|

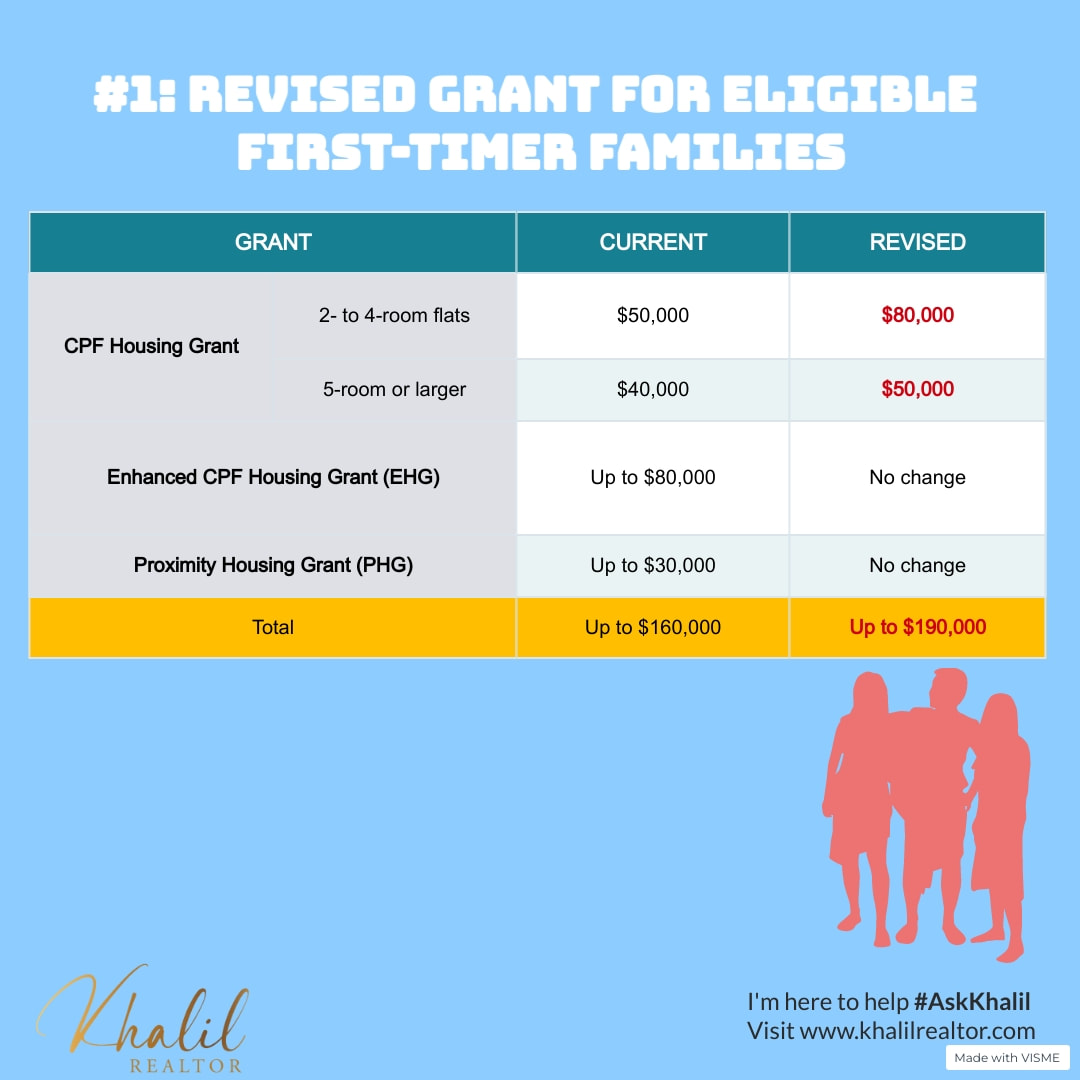

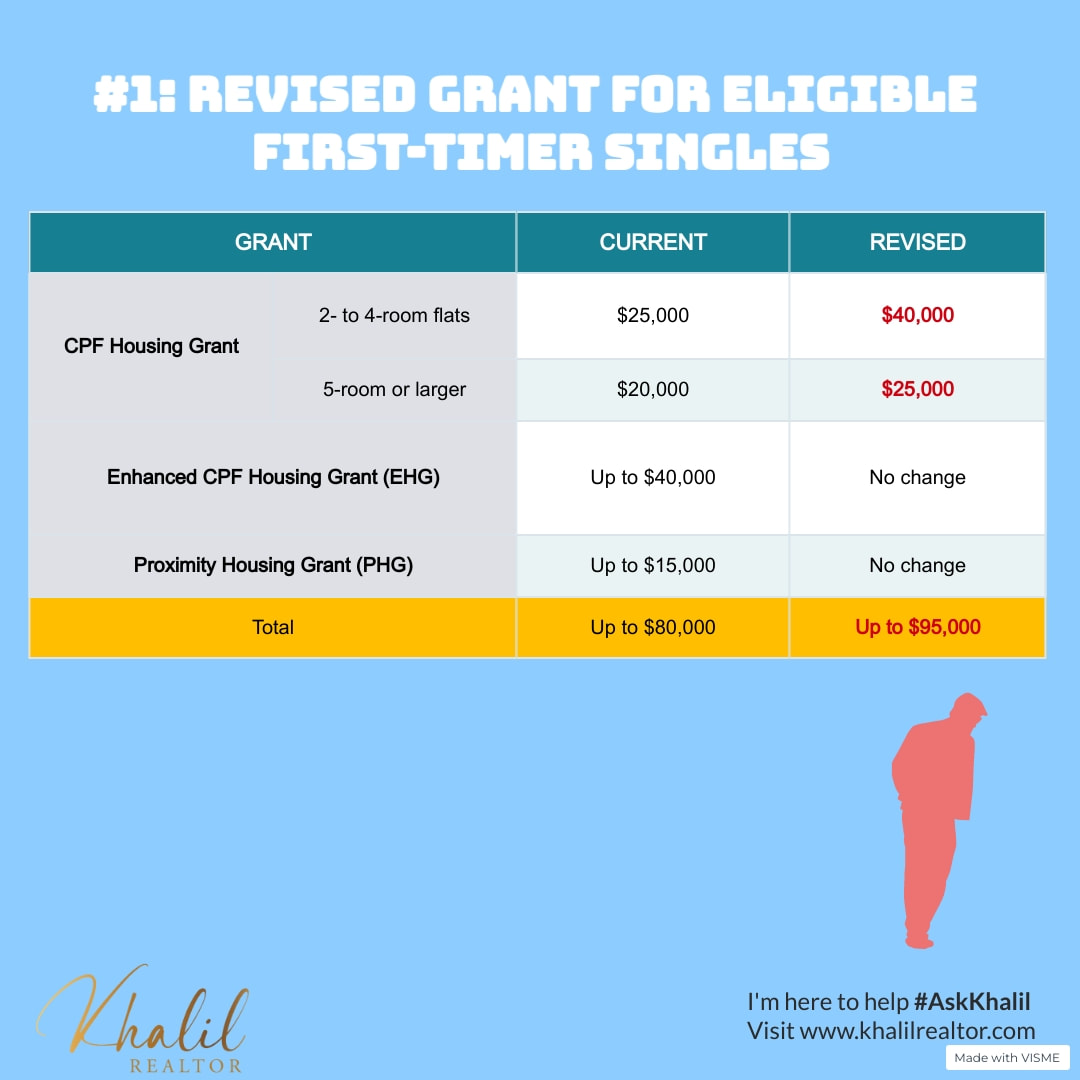

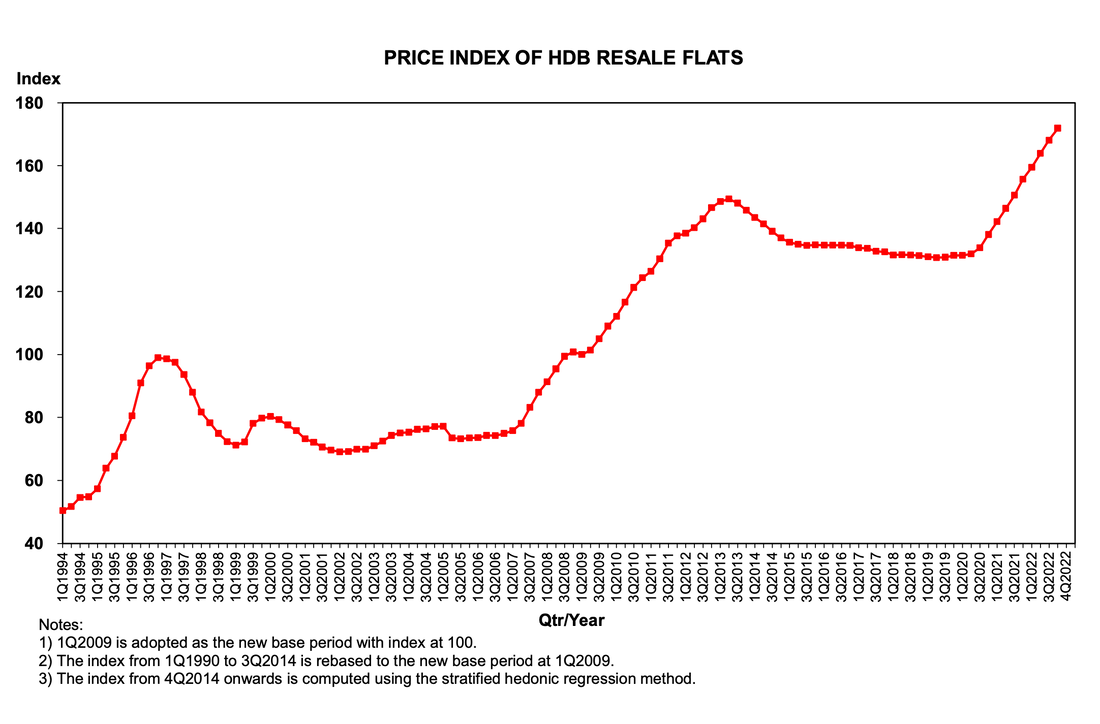

First-timers households and singles can get up to $190,000 and $95,000 in CPF Housing Grants respectively. Khalil Adis If you are looking to buy a resale HDB flat but are concerned about whether you can afford it, fret not. Announced as part of Budget 2023 on 14 February 2023, more help is on the way for first-time homebuyers be they singles or families. In the face of inflation and rising property prices in Singapore, the government has allocated more housing subsidies to make public housing more affordable and accessible for young families buying their first homes “Against the backdrop of the broad-based increase in demand for housing in recent years, these measures will help more families with children and young married couples own their first home,” said the Ministry for National Development and Housing & Development Board in a joint statement. Here are three things first-time homebuyers can look forward to: #1: Increased CPF Housing Grant for first-timers households First-timers households buying resale 2- to 4-room flats will receive up to $80,000 up from $50,000. Meanwhile, those buying 5-room or larger flats will receive up to $50,000 up from $40,000. When including the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG), families can enjoy up to $190,000 in CPF Housing Grants. #2: Increased CPF Housing Grant for first-timers singles First-timers singles buying resale 2- to 4-room flats will receive up to $40,000 up from $25,000. while those buying 5-room or larger flats will receive up to $25,000 up from $20,000. When including the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG), singles can enjoy up to $95,000 in housing subsidies. #3: Greater priority for first-timers families First-timers families with children and young married couples aged 40 years and below who are buying their first home will be given greater priority during their Built-To-Order (BTO) applications. According to HDB and MND, this will be implemented later this year. This category of first-timers will receive additional support in securing their flats via an additional ballot chance for their BTO applications. “More details of the scheme as well as eligibility criteria will be shared at the Ministry of National Development Committee of Supply debate,” said the MND and HDB in their joint statement. Rising property prices Property prices in the Lion City have been on the uptrend figures from the HDB showed. According to HDB’s fourth quarter of 2022 data, the Resale Price Index (RPI) is at 171.9 points which is an increase of 2.3 per cent over that in the third quarter of 2022. While the RPI has been rising, HDB notes that this is a slower increase than the 2.6 per cent increase in the third quarter of 2022. It is worth noting that this is the slowest increase in the past year. Meanwhile, the median price for 4-room HDB flats in Queenstown is the most expensive at $870,000 while those in Jurong East are the cheapest at $465,000. While prices have been rising, resale transactions fell by 12.6 per cent, from 7,546 cases transacted in the third quarter of 2022 to 6,597 cases in the fourth quarter of 2022. No impact on the price of resale HDB market While the budget is generous, it will not have a significant impact on the price of resale HDB flats.

This is because the price is determined by demand and supply. Rather, the slew of new measures aims to reduce the cost of public housing ownership via the various subsidies, if applicable. Nevertheless, with HDB committed to launching up to a total of 100,000 flats from 2021 to 2025, we could see resale flat prices correcting this year onwards.

0 Comments

|

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed