|

8/16/2023 Consider upgrading to a condo? Mass market condominiums in the Outside Central Region (OCR) may be your perfect choiceRead NowData from the Urban Redevelopment Authority (URA) suggests that it is the best-performing sector. By Khalil Adis If you are contemplating a move to a condo, the next few months present a promising window of opportunity, government statistics showed. The second quarter of 2023 data from the Urban Redevelopment Authority (URA) suggests that HDB upgraders and investors seeking condominiums in the Outside Central Region (OCR) should take note of the best-performing sectors. Let’s delve into the latest URA findings, explore the reasons behind the success of mass market condos, and showcase notable condo launches and resales that have caught the attention of potential buyers. Private Property Index (PPI) and Resale Price Index (RPI). The second quarter of 2023 data from URA reveals intriguing insights. The Private Property Index (PPI) saw a marginal decline of 0.2 per cent, reaching 194.4 points. This marks the first dip since the first quarter of 2020 for the index, which tracks price movements in the private property market. Concurrently, the Housing & Development Board's (HDB) Resale Price Index (RPI) showed a 1.5 per cent uptick in the second quarter of 2023 compared to the previous quarter, reaching 176.2 points. This trend indicates a narrowing price gap between resale HDB flats and private properties, favouring HDB upgraders. Mass market condominiums: The leading performers Why are mass market condominiums in the OCR stealing the spotlight? These condos have proven to be the best-performing sector, outpacing their counterparts in the Rest of Central Region (RCR) and Core Central Region (CCR). Mass market condos, strategically situated in the Outside Central Region (OCR), boast affordability and local buyer appeal. Notably, their PPI surged to 225.0 points, surpassing those in RCR and CCR. The upward index signifies robust demand for these condos, driven by their strategic locations and reasonable pricing. Key drivers of mass market condo success The popularity of mass market condos can be attributed to several factors. These condos, situated in the suburbs, have captured the interest of local buyers, including first-time buyers and HDB upgraders. In contrast to prime condos, which attract speculators and foreigners, mass market condos remain unaffected by the higher Additional Buyer's Stamp Duty (ABSD) implemented in April 2023. This distinction has contributed to sustained demand among Singaporean buyers, rendering these condos resilient to market cooling measures. Highlighting top condo launches in Q3 2023 According to data from Propnex, these are the three most popular mass market condo launches ranked by volume in the third quarter of 2023: 1. Lentor Hill Residences Nestled in District 20 (Mandai / Upper Thomson), this 99-year leasehold development offers 598 units ranging from one- to four-bedroom layouts. With prices starting at $2,028 per sq ft for a one-bedroom unit, a significant 88.5 per cent of buyers are Singaporean residents. Nearby amenities include Lentor Hill MRT station, Anderson Primary School, CHIJ St Nicholas Girls’ School, Mayflower Primary School, Mayflower Secondary School, Anderson Serangoon Junior College, Nanyang Polytechnic, AMK Hub and Thomson Plaza. 2. The Myst Crafted by City Developments Limited (CDL), The Myst features 408 units across two 24-storey blocks. Priced at an average of $2,070 per sq ft, The Myst showcases one-bedroom study to five-bedroom units, spanning around 517 sq ft to 2,034 sq ft. Conveniently located MRT stations and reputable schools further enhance its appeal. Nearby MRT stations include Cashew MRT station and the upcoming Cross Island Line. There are also several good schools located within a 1km radius of the development such as CHIJ Our Lady Queen of Peace, Bukit Panjang Primary School and Zhenghua Primary School. Other nearby amenities include Bukit Panjang Integrated Transport Hub, Hillion Mall, Bukit Panjang Plaza and Junction 10. Nature lovers will be thrilled to know that The Myst is located at the doorstep of The Rail Corridor and Bukit Timah Nature Reserve. 3. Lentor Modern Found in District 23 (Upper Thomson and Springleaf), Lentor Modern stands as the inaugural integrated mixed-use development in the Lentor precinct, directly linked to Lentor MRT station. Comprising three 25-storey towers, this 99-year leasehold development offers 605 residential units, ranging from 1- to 4-bedroom apartments, with extensive facilities and sky terraces in each tower. Priced at an average of $2,087 per sq ft, the majority (91.1 per cent) of buyers are Singaporean residents. Noteworthy mass market resale condos in Q3 2023 Data from Propnex, showed that these are the five most popular mass market condo launches ranked by volume in the third quarter of 2023: 1. Kingsford Waterbay Situated in District 19 (Serangoon), Kingsford Waterbay features 1 to 5-bedroom penthouses and cluster homes. With 11 transactions in the third quarter of 2023 at an average price of $1,399 per sq ft, its proximity to reputable schools contributes to its popularity. These schools include CHIJ Our Lady of the Nativity, Holy Innocents’ Primary School, Montfort Junior School, Holy Innocents’ High School, Montfort Secondary School and CHIJ St. Joseph’s Convent. 2. High Park Residences Positioned in District 28 (Sengkang), High Park Residences offers 1,390 units spanning 1- to 5-bedroom layouts, recording eight transactions with a median price of $1,523 per sq ft. Conveniently sited next to Thanggam LRT and four stops to Sengkang MRT stations, High Park Residences is within close proximity to Seletar Aerospace Park, food & beverage joints at Jalan Kayu, Seletar Mall, Compass Point Shopping Centre and Greenwich V. This 99-year leasehold development is popular among Singaporeans which make up 80.7 per cent of its buyers. 3. Parc Botannia In District 28 (Sengkang), Parc Botannia secured third place with seven transactions at a median price of $1,603 per sq ft. Its prime location and lush surroundings attract buyers seeking a serene living environment. There are many reputable local and international schools located near Park Botannia such as Lycee Francais De Singapour, Gems World Academy (Singapore), Hillside World Academy, Fernvale Primary School, Anchor Green Primary School and Nan Chiau Primary School. All the above factors could perhaps explain why this condominium is the third most popular mass market development. 4. The Glades Located in District 16 (Bedok), The Glades recorded seven transactions at a median price of $1,646 per sq ft. This 99-year leasehold development appeals to both Singaporeans and Permanent Residents. Located next to Tanah Merah MRT station and one stop away from the Expo, The Glades comprises 726 units ranging from 1 to 5-bedroom penthouses. The Glades is especially popular among Singaporeans and Permanent Residents who make up 69.3 per cent and 22 per cent of its buyers respectively. Nearby amenities include Bedok Mall, Bedok Point, Eastpoint Mall and Changi City Point. Popular schools located nearby include Temasek Primary School, Temasek Secondary School, Anglican High School, Temasek Junior College and Temasek Polytechnic. 5. Treasure at Tampines In District 18 (Tampines), Treasure at Tampines emerges as the fifth best-selling mass market condominium development, with six units sold at a median price of $1,605 per sq ft.

Treasure at Tampines is a high-density development with 29 twelve-storey residential blocks. Units range from 1 to 5 bedrooms starting from 463 square feet to 1,345 square feet with full condominium facilities. Treasure at Tampines is located close to several good schools such as Temasek Polytechnic, Singapore University of Technology, Angsana Primary School and Tampines Junior College. Nearby shopping malls include Tampines Mall, Century Square, Tampines One and Eastpoint Mall. Conclusion For HDB upgraders and investors exploring condo options, mass market condominiums within the Outside Central Region (OCR) offer a promising avenue. URA's second quarter of 2023 data underscores their resilience and growth, positioning them favourably against prime condos. With various developments available, such as Lentor Hill Residences, The Myst, and more, now is a prime time to evaluate these opportunities and capitalise on their potential benefits.

0 Comments

5/27/2023 From public rental flat to HDB part 2: How another family upgraded to a resale flat with my helpRead NowFinding a home within their means: Navigating the record high HDB resale market By Khalil Adis Imagine spending four long years in a cramped public rental flat, yearning for a bigger and better space to raise your child. That was the reality for Andy and Ruby (not their real names), a young couple determined to improve their living environment. With their aspirations set on a 4-room HDB flat, they sought my assistance in their quest. After three weeks of house hunting, we finally secured a resale flat in Sengkang without any cash-over-valuation (COV). Let me take you through the steps we followed. Step 1: Ensuring the basics: Intent to Buy and HDB Loan Eligibility (HLE) Our first priority was to ensure Andy and Ruby had registered their Intent to Buy and obtained the HDB Loan Eligibility (HLE) document. These two crucial documents were necessary for financial calculations and obtaining the Option to Purchase (OTP) from the seller's agent. Step 2: Crunching the numbers: Cash, CPF, and HDB loan We then worked together to determine the couple's available funds, including cash, CPF savings and the HDB loan. Their combined resources amounted to $58,000 in CPF, $2,000 in cash and a $364,000 HDB loan. Step 3: Exploring eligible grants To maximise their budget, we identified three grants they qualified for - the Family Grant ($80,000), Enhanced Housing Grant ($35,000), and Proximity Housing Grant ($20,000). These grants added up to an impressive $135,000 in CPF grants, providing a significant boost to their budget. Step 4: Determining the total housing budget Combining their available funds with the CPF Housing Grants, Andy and Ruby's total housing budget came to $557,000. This amount was more than enough to afford the 4-room HDB flats they had set their sights on in Hougang and Sengkang. Step 5: House hunting challenges and adaptation During the initial two weeks of viewings in Hougang, we faced fierce competition from other buyers. The units Andy and Ruby had selected were beautifully renovated, driving up the price with a cash-over-valuation (COV) of around $20,000—a cost they were not willing to bear. Step 6: A change in strategy and finding the perfect fit To overcome the challenges, I advised them to consider slightly older flats that may require some renovation but would not attract as much competition. We eventually found a 4-room flat in Sengkang with approximately 78 years of remaining lease. Based on recent transactions in the area, we made an offer of around $485,000. I also suggested increasing the deposit from $1,500 to $2,000 to secure the unit. Fortunately, this flat did not come with any COV, leading to substantial savings compared to their initial budget. Conclusion In conclusion, the resale HDB market still offers affordable flats, even in the face of record-high prices.

By leveraging CPF Housing Grants, low to middle-income families can significantly reduce their purchase costs. It takes a change in strategy, research, and negotiation skills, but upgrading from a public rental flat to owning your first home is within reach. If Andy and Ruby can do it, so can you. A step-by-step guide to finding affordable housing for low-income families By Khalil Adis Finding a suitable home in Singapore can be a daunting task, especially for low-income families. As an experienced real estate agent, I recently helped a family of five upgrade from a public rental flat to a 3-room HDB flat in Jurong West. Here's how I did it. Step 1: Work out their total cash, CPF, and HDB loan Firstly, I sat down with them to find out their available CPF, cash, and HDB loan. We established a total of $30,000 in CPF, $2,000 in cash, and $180,000 in HDB loan. Step 2: Identify grants they are eligible for We identified three grants that they qualified for: Family Grant ($80,000), Enhanced Housing Grant ($65,000), and Proximity Housing Grant ($20,000), totalling $165,000 in CPF Grants. Step 3: Work out their total housing budget After combining their available funds with the CPF Housing Grants, their total housing budget amounted to $377,000. With 3-room HDB flats in most estates transacting above $400,000, we had to search for older resale flats. Step 4: Narrow down to HDB estates close to their parents The family's parents live in Jurong West, and we found an older 3-room HDB flat in the same estate that fell within their budget. I managed to negotiate the deposit down from $5,000 to $1,500. Conclusion In conclusion, while the HDB resale market is at a record high, there are still affordable flats available, and there are various CPF Housing Grants that you may be eligible for.

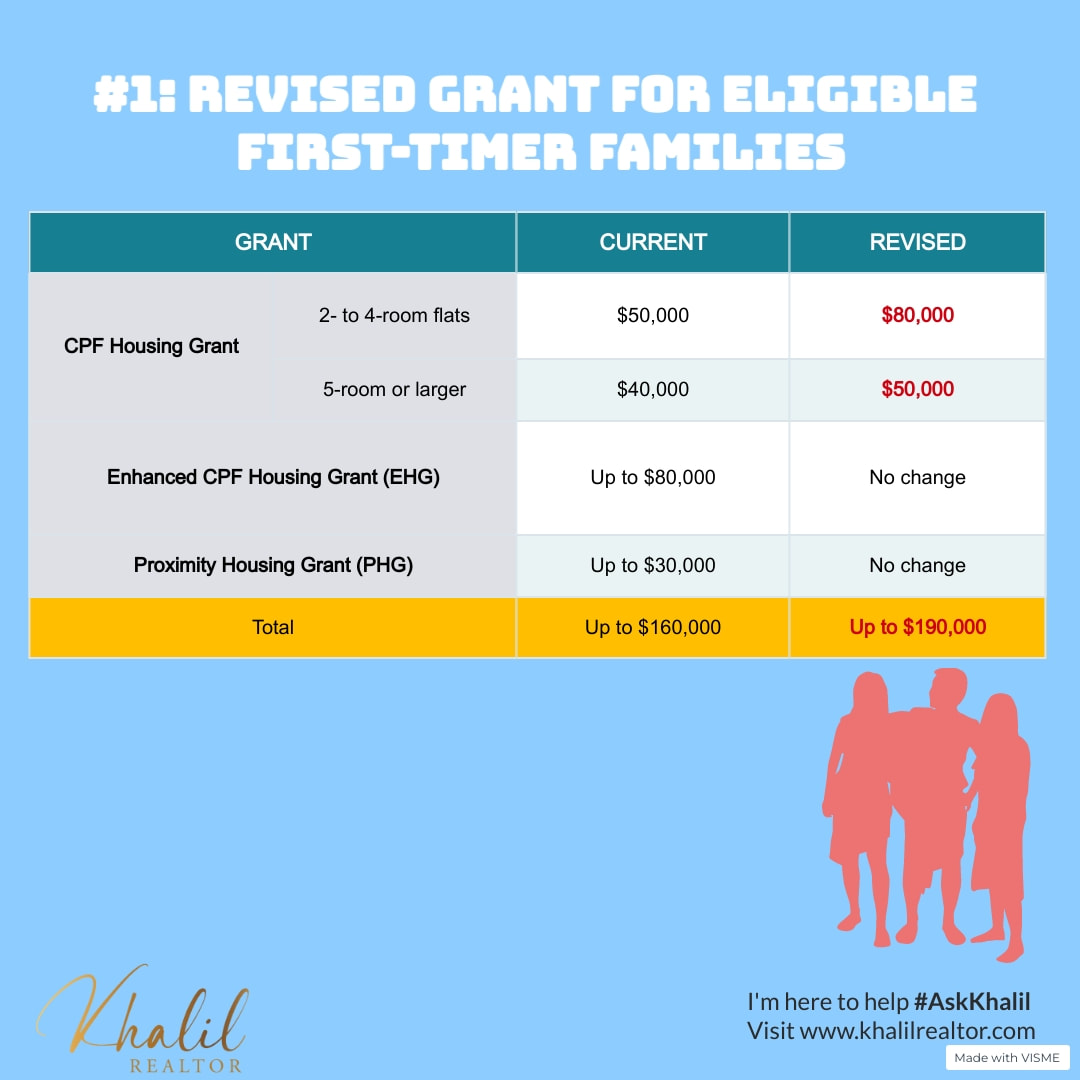

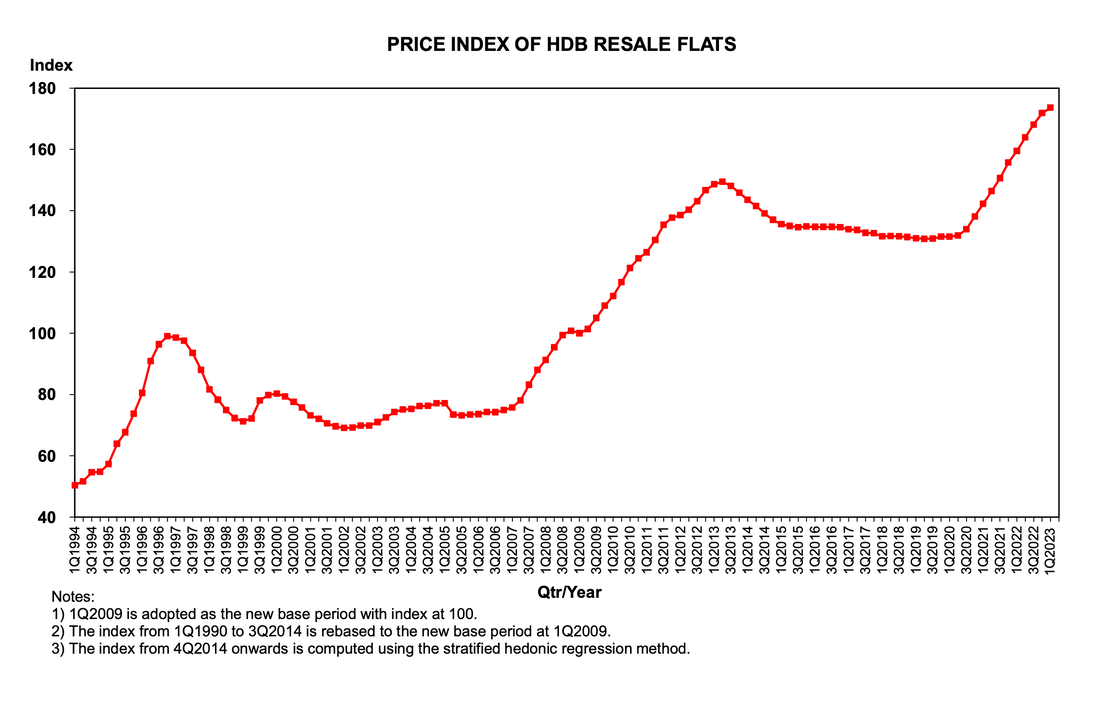

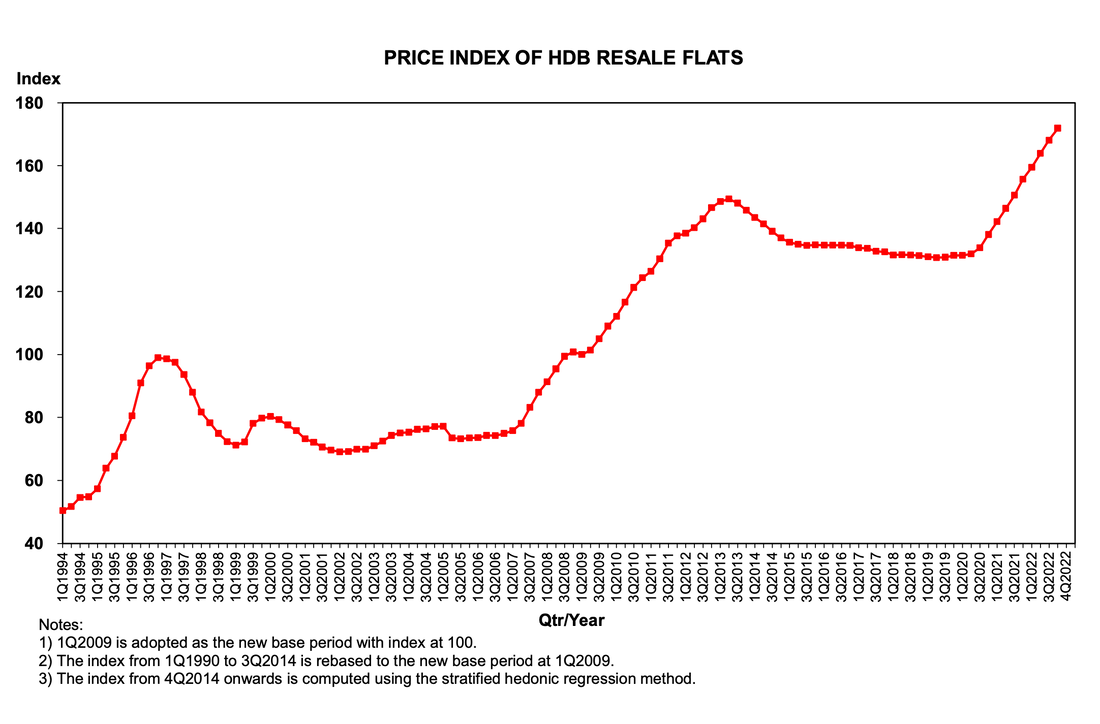

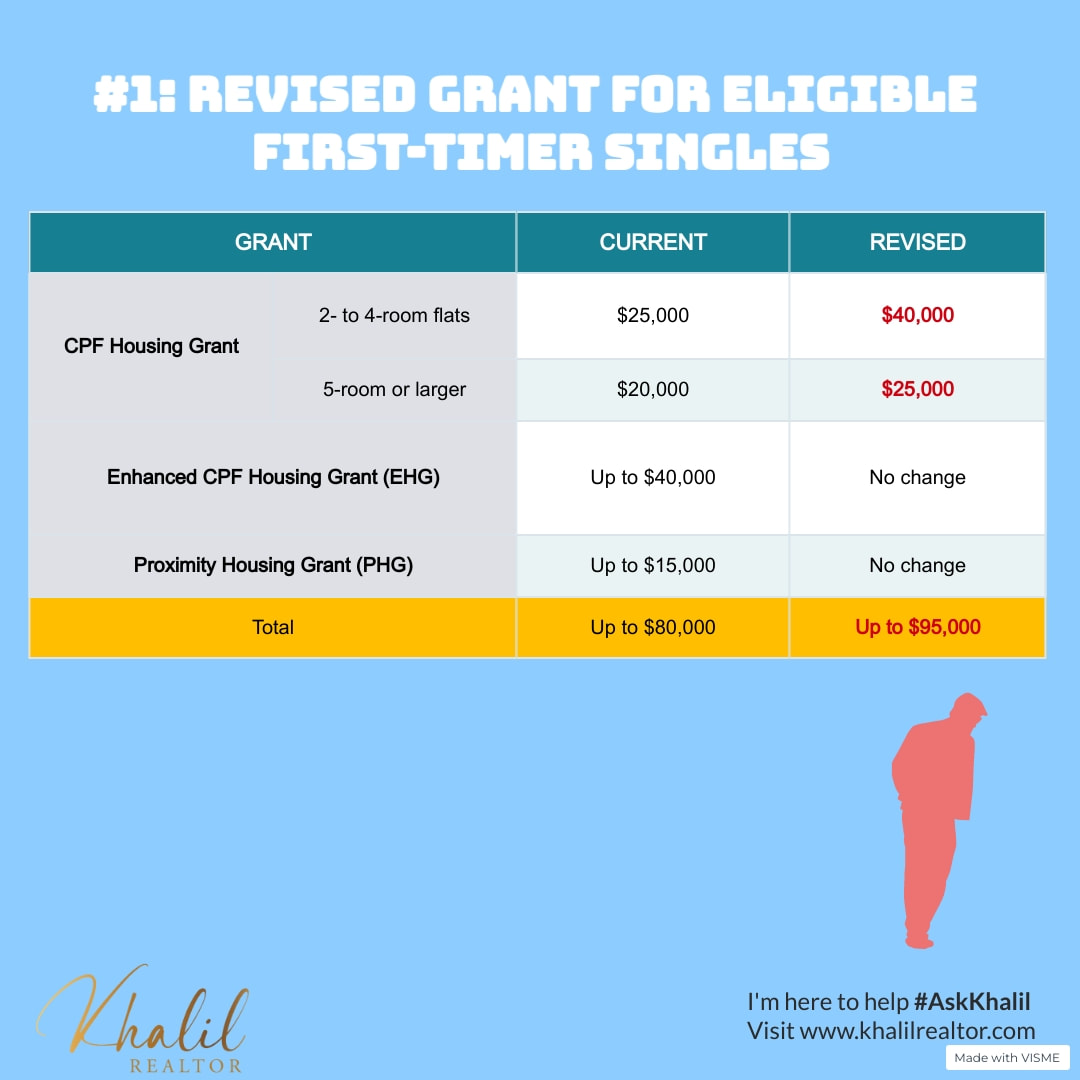

The recent Budget 2023 announcement to increase the Family Grant for 4-room and below HDB flats from $50,000 to $80,000 is a welcome move to reduce the cost of purchase. With a little research and negotiation skills, low-income families can also upgrade their homes and enjoy better living conditions. First-timers households and singles can get up to $190,000 and $95,000 in CPF Housing Grants respectively. Khalil Adis If you are looking to buy a resale HDB flat but are concerned about whether you can afford it, fret not. Announced as part of Budget 2023 on 14 February 2023, more help is on the way for first-time homebuyers be they singles or families. In the face of inflation and rising property prices in Singapore, the government has allocated more housing subsidies to make public housing more affordable and accessible for young families buying their first homes “Against the backdrop of the broad-based increase in demand for housing in recent years, these measures will help more families with children and young married couples own their first home,” said the Ministry for National Development and Housing & Development Board in a joint statement. Here are three things first-time homebuyers can look forward to: #1: Increased CPF Housing Grant for first-timers households First-timers households buying resale 2- to 4-room flats will receive up to $80,000 up from $50,000. Meanwhile, those buying 5-room or larger flats will receive up to $50,000 up from $40,000. When including the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG), families can enjoy up to $190,000 in CPF Housing Grants. #2: Increased CPF Housing Grant for first-timers singles First-timers singles buying resale 2- to 4-room flats will receive up to $40,000 up from $25,000. while those buying 5-room or larger flats will receive up to $25,000 up from $20,000. When including the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG), singles can enjoy up to $95,000 in housing subsidies. #3: Greater priority for first-timers families First-timers families with children and young married couples aged 40 years and below who are buying their first home will be given greater priority during their Built-To-Order (BTO) applications. According to HDB and MND, this will be implemented later this year. This category of first-timers will receive additional support in securing their flats via an additional ballot chance for their BTO applications. “More details of the scheme as well as eligibility criteria will be shared at the Ministry of National Development Committee of Supply debate,” said the MND and HDB in their joint statement. Rising property prices Property prices in the Lion City have been on the uptrend figures from the HDB showed. According to HDB’s fourth quarter of 2022 data, the Resale Price Index (RPI) is at 171.9 points which is an increase of 2.3 per cent over that in the third quarter of 2022. While the RPI has been rising, HDB notes that this is a slower increase than the 2.6 per cent increase in the third quarter of 2022. It is worth noting that this is the slowest increase in the past year. Meanwhile, the median price for 4-room HDB flats in Queenstown is the most expensive at $870,000 while those in Jurong East are the cheapest at $465,000. While prices have been rising, resale transactions fell by 12.6 per cent, from 7,546 cases transacted in the third quarter of 2022 to 6,597 cases in the fourth quarter of 2022. No impact on the price of resale HDB market While the budget is generous, it will not have a significant impact on the price of resale HDB flats.

This is because the price is determined by demand and supply. Rather, the slew of new measures aims to reduce the cost of public housing ownership via the various subsidies, if applicable. Nevertheless, with HDB committed to launching up to a total of 100,000 flats from 2021 to 2025, we could see resale flat prices correcting this year onwards. More leasing activities are reported as the office market starts to pick up post-COVID-19. However, tenants are also very specific in their office space requirements. By Khalil Adis In May 2022, I secured my very first corporate leasing deal. Although I was elated to finally secure a tenant for the landlord, it was not an easy process especially since the office market was affected by Covid-19. I was faced with a challenging period when marketing the office space in late 2021 as Singapore was battling the delta variant then. While interest in office space at first increased, the Omricon variant threw the wrench for potential tenants looking for office space in November 2021. As a result, enquiries started to decrease until the early part of 2022. Fast forward, a year ahead, the office leasing market appears to pick up steam as more employees returned to work. Data from CBRE confirmed this showing strong positive office net absorption in the third quarter of 2022, bringing the year-to-date take-up to 0.56 million sq ft and surpassing the total take-up of 0.32 million sq ft for the whole of 2021. “Key demand drivers are expansions by tech firms, flexible workspace operators and non-banking financial companies, which took up significant secondary office space in the Core CBD (Grade A). Fresh pre-commitments to upcoming new projects such as Guoco Midtown and Central Boulevard Towers were also inked during the quarter,” its research notes. Broad-based demand in all micro markets In addition to the growth sectors, CBRE notes that tenant displacement from planned redevelopments such as Clifford Centre and Robinson Point has also contributed to a broad-based recovery. According to the firm, islandwide vacancy declined further to 4.9 per cent in the third quarter of 2022 from the previous high of 6.8 per cent from the same period last year. “Despite hybrid working arrangements likely to stay, total leasing volume from renewals, new setups and expansion over the past three quarters has been resilient, a testament that physical office still plays an integral role in the workplace ecosystem,” CBRE’s research cites. With more leasing activities reported in the third quarter, here are the five things corporate tenants look for in an office space. #1: A prestigious address From my experience, certain tenants, particularly those in the banking, real estate, energy, legal and tech sectors, would only look for a prestigious office address right in the CBD. This is because their corporate image is important especially since they mostly deal with multinational companies and government agencies. Some are also particular about the look and feel of the building’s main lobby as they may sometime hold meetings with important clients in their office. Others cite improving their staff’s morale and confidence in the company when having a prestigious Grade A CBD address. #2: Accessibility Accessibility is also a key consideration for corporate tenants as most of their staff rely on public transportation while some drive to work. Therefore, being connected within walking distance to the MRT stations and expressways are important. As the office unit that I was marketing is located within the CBD, accessibility is not an issue as it well-served by various train stations such as Tanjong Pagar and Raffles Place MRT stations on the East-West and North-South Line, Chinatown, Telok Ayer MRT stations and Downtown on the Downtown Line as well as newly opened Maxwell and Shenton Way MRT stations on the Thomson-East Coast Line. The office building is also easily accessible via the Ayer Rajah Expressway (AYE), Marina Coastal Expressway (MCE), Central Expressway (CTE) and East Coast Parkway (ECP) for those who drive. #3: Amenities Amenities or the lack of them can either make or break an office leasing requirements for a corporate tenant. Some of the important amenities they look for include banking, dining, hawker centres, clinics and car parking facilities. I recall one particular tenant who insisted on having several car parking lots. Unfortunately, due to the limited car parking space for season parking holders, this proved to be difficult. If you require ample car parking space, then make sure you ask the agent in advance to check with the building management before asking for a viewing. #4: A column-free space A column-free space ranks highly as it enables the potential tenant to use the entire space efficiently. This is from my experience when conducting viewings on the ground. This is because such space offers them flexibility in how they would like to utilise the space just like drawing from a blank canvas. You can ask the agent for a copy of the floor plan so you can plan the office planning with your interior designer. #5: Facilities With an increased emphasis on staff’s mental health and wellness, I noticed that corporate tenants now prefer office buildings that offer recreational facilities such as green, open spaces, gyms or swimming pools where their staff can feel relaxed.

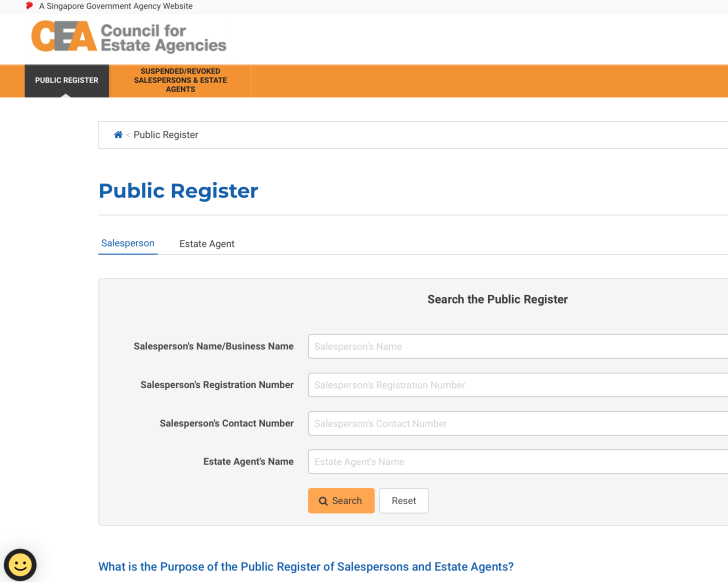

As one potential tenant puts it, “when an office feels like home, our staff are more likely to be comfortable and productive at their workplace. With many rental scams out there, here are the checks to protect yourself as a tenant. By Khalil Adis The September 2022 cooling measures will translate to a red-hot property market as ex-private property owners will now have to wait out a 15 months period before they can buy a resale HDB flat. This means demand in the rental market for both both private properties and HDB flats will pick up in the coming months ahead. Unfortunately, rental scams appear to also be on the rise. According to the Singapore Police Force (SPF), there were at least 144 victims of such scams who had lost around S$190,000 since January 2022. Modus operandi As the rental market heats up, scammers are taking advantage of the situation by posting fake listings on social media to lure unsuspecting tenants. Such listings are often too good to be true, depicting beautiful apartments at bargain prices. However, there is one catch. In order to secure viewings, the bogus property agents will often ask potential tenants to transfer money. This is where potential tenants may lose their monies. They will also ask you to send a copy of your identification card to confirm your viewing. Such requests are in fact dubious and not in line with market practice. They may also open you to identity thefts. 4 due diligence checks that you must do as a tenant To prevent yourself from being scammed, here are the four thing you must do: #1: Do not transfer any monies for viewings Instead, you should request for a physical viewing to verify that the property does indeed exist. #2: Verify the agent is registered with Council for Estate Agencies (CEA) If you are dealing with an agent, ask for the agent’s registration number. You can also check the agent’s details via CEA’s Public Register here. #3: Ask for proof of ownership Whether you are dealing with the agent or landlord, you should ask for proof of ownership of the rightful owner before transferring the earnest deposit. The earnest deposit is usually transferred directly to the landlord’s bank account along with the Letter of Intent (for a private property rental). For HDB flats and private properties, this can be done via INLIS here. For HDB flats only, you can request for the proof of ownership via MY HDBPage. If you are renting a property that is owned by a company, you should ask for their business profile or purchase it via BizFile here. The address of the directors of the company must match the address as reflected in INLIS or MY HDBPage. #4: Do not transfer monies to the agent Under CEA’s guidelines, for rental of HDB flats, agents are not allowed to hold any monies.

The deposit is typically equivalent to one or two months rent for a 1- or 2-year lease respectively. Upon signing the Tenancy Agreement, tenants will then have to transfer the one month’s advance rental. Property prices are expected to correct in the months ahead which may favour buyers. Meanwhile, the rental market is expected to heat up further. By Khalil Adis On 30 September 2022, the Singapore government announced various property cooling measures that are aimed at ensuring prudent borrowing and moderating demand. Indeed, the HDB Resale Price Index (RPI) and Private Property Index (PPI) as of the third quarter of 2022 are now at record highs at 168.1 and 187.8 points respectively. This means that first-time homebuyers are finding both HDB flats and private properties to be severely unaffordable. Meanwhile, potential sellers see this as an opportune time to profit from the red-hot property market. With this in mind, the government has had to intervene to ensure property prices remain affordable and are in tandem with wages. The measures include the following four-pronged approach:

How they may impact you as a consumer: For point 1, you will have to have a higher monthly combined income and pay a higher monthly mortgage and combined income . However, the actual interest rates charged will be determined by the private financial institutions. For point 2, the stress test has been increased to 3 per cent when calculating your monthly mortgage but with a reduced Loan-to-Value (LTV) limit at 80 per cent. This is to ensure your monthly mortgage remains affordable and within the 30 per cent Mortgage Servicing Ratio (MSR). On the overall, with a higher downpayment of 20 per cent, it will result in a lower mortgage payment when compared to an LTV limit of 85 per cent. However, this will not affect the actual HDB concessionary interest rate, which will remain unchanged at 2.6 per cent per annum. For point 3, buyers will need to come up with a higher cash and/or CPF amount (an increase of 5 per cent) to make up the 20 per cent downpayment. For example, for an $500,000 HDB flat, you will need to come up with $100,000 (80 per cent LTV) as opposed to $75,000 (85 per cent LTV). This means an additional cash and/or CPF outlay of $25,000. For point 4, this will mean sellers will have to rent either an HDB flat or private property during the interim period. This will result in increased demand in the rental market which will push asking prices further. According to data from the Urban Redevelopment Authority (URA), rentals of private residential properties had increased by 8.6 per cent in the third quarter to reach 137.9 points from 127.0 points in the second quarter of 2022. Meanwhile, HDB rentals have increased by around 30 per cent. Looking ahead, the rental market is expected to strengthen further which will favour landlords. Summary For buyers who are looking to buy a resale HDB flat or private property, you might want to wait out until their prices correct.

For sellers, you only have a small window period to take advantage of the exuberant market before it cools in the coming months. For landlords, the market will favour you due to increasing demand from existing tenants and ex-private property owners who have already sold their homes. For tenants, you will have to set aside more budget as rentals have now increased by around 30 per cent. The unit received several offers signifying a robust rental market. By Khalil Adis A 2-bedroom unit at The Paterson Edge has been successfully tenanted at an above average median price when compared to similar sized units.

Data from the Urban Redevelopment Authority (URA) showed that 17 2-bedroom units at The Paterson Edge were transacted at an average price of $4,501 per month from January to June 2022. The highest transacted price was $6,151 per month in March 2022 followed by $6,000 per month in May 2022. Measuring 990 sq ft, the unit received several offers signifying a robust rental market. Situated within walking distance to the shopping belt of Orchard Road and right opposite the upcoming Orchard MRT station via the Thomson East Coast Line (TEL), The Paterson Edge is located in a prestigious neighbourhood. A low-density development that has often been described as a "doll house”, The Paterson Edge offers discerning families or individuals a quiet, private retreat while being a stone throw's away to luxury boutiques, high-end stores, shopping malls, supermarkets and top-notch medical centres. This mid-floor unit is located at the corner to ensure the utmost privacy. The unit comes with Miele refrigerator & freezer, Miele cooker hood/hob, built in refrigerator & freezer, built in conventional oven, built in wardrobe, curtains and blackouts, roller blinds and energy saving lighting features. The unit has been property maintained and is in good condition. Facilities at The Paterson Edge include a swimming pool, gym, covered carpark and 24-hour security 7/18/2022 SBF Center office units successfully leased out at $8 per sq ft per month in May 2022Read NowData from Squarefoot showed that the transacted price is the highest so far for SBF Center and along Robinson Road. By Khalil Adis Two office units at SBF Center were transacted for $8 per sq ft per month in May 2022 or at $16,500 per month. According to data from Squarefoot, the median rental for SBF Center is $7.18 per sq ft per month while the historical rental along Robinson Road ranges from $6.5 per sq ft per month in January 2022 to $7.18 per sq ft per month in May 2022. This means the office units were the highest price transacted so far for SBF Center and along Robinson Road. The units face Cecil Street with an awe-inspiring view of the conserved shophouses of Tanjong Pagar, office buildings and the nearby Raffles Place CBD. Grade A office rents in the CBD projected to grow by 4.6 per cent With the government now mandating that starting from 1 January 2022, fully vaccinated employees can return to work, demand for Grade A office space is now slowly returning to pre-pandemic level.

A report released in February 2022 by Cushman and Wakefield predicts that Grade A office rents in the Central Business District (CBD) will grow. “The Singapore office market bottomed out in 2021 as demand continues to recover amidst a flight to quality. Looking ahead, Singapore’s CBD Grade A office rents are projected to grow by 4.6 per cent year-on-year with vacancy rates tightening to below 4 per cent by end-2022, against a backdrop of projected sustained demand of 0.9 million sq ft (msf) and limited supply of 0.8 msf this year,” said Wong Xian Yang, head of research, Singapore at Cushman & Wakefield. Data from Cushman and Wakefield also showed that Grade A and B office spaces are seeing growths after six consecutive quarters of decline since the first quarter of 2020, although this was still lower than the growth that was recorded before the pandemic began. “CBD Grade A office rents rose by 1.7 per cent quarter-to-quarter in the fourth quarter of 2021, marking three consecutive quarters of growth. For the whole of 2021, CBD Grade A rents grew 2.3 per cent year-on-year to reach $9.81 per sq ft per month, although this remains about 8.0 per cent below pre-pandemic (fourth quarter of 2019) levels,” its report cites. The latest mixed-use property launch that is located in the Rest of Central Region (RCR), Piccadilly Grand offers the benefits of living close to the city but at the Outside Central Region's (OCR) entry price. By Khalil Realtor Piccadilly Grand is the latest launch for 2022 that is located in the Rest of Central Region (RCR) in District 8 with direct access to Farrer Park MRT station via the North East Line (NEL). Located at the doorstep of the vibrant Little India district, this 99-year leasehold mixed-use development will comprise 407 residential units ranging from one- to five-bedrooms with commercial units on the first storey. According to URA Space, Piccadilly Grand sits on site area of 8,732.9 sq m with a maximum gross floor area (GFA) of 36,679 sq m with a gross plot ratio of 4.2. How Piccadilly Grand compares with similar properties in the vicinity As a fair comparison, we will compare Piccadilly Grand with SOHO 188 as it is the closest private residential property located within the vicinity. Data from the Urban Redevelopment Authority (URA), showed that the average transacted price per sq ft for SOHO 188 was $1,626 in August 2021. With an estimated indicative price starting from around $1,950 per sq ft, Piccadilly Grand is priced at around 20 per cent higher when compared to SOHO 188. When compared to the average price entry price for a two-bedroom unit at Pasir Ris 8 at $2.050 per sq ft, Piccadilly Grand appears to offer an attractive OCR price for an RCR project. Data from URA also showed the indicative average rental range for SOHO 188 is around $4.49 per sq ft per month. For a one-bedroom (484 sq ft) unit priced at $1,950 per sq ft, the unit quantum price translates to $943,800. Based on a rental of $4.49 per sq ft per month, the expected rental is around $2,173.16. Based on our calculation, the estimated rental yield will work out to the following: $2,173.16 x 12 / $943,800 x 100 = 2.76 per cent Here are eight compelling reasons to invest in Piccadilly Grand: #1: Established developer with a good track record When it comes to buying a property, the track record of the developer can make or break a project. However, that is not the case for Piccadilly Grand as it will be developed jointly by City Developments Limited (CDL) and MCL Land. CDL is one of Singapore’s leading global real estate companies with projects spanning from residential to commercial. Listed on the Singapore Exchange, CDL is considered one of the largest companies by market capitalisation. CDL prides itself as an income-stable with a geographically-diverse portfolio that comprises residences, offices, hotels, serviced apartments, shopping malls and integrated developments. Their latest residential project that was launched last year is Canninghill Piers. Meanwhile, MCL Land is a leading residential developer whose notable developments include The Estuary, UBER 388, Este Villa, Terrasse, Palms @ Sixth Avenue, Hallmark Residences, Ripple Bay, J Gateway, LakeVille, Sol Acres, Lake Grande, Margaret Ville, Parc Esta and Leedon Green. MCL Land prides itself on establishing a legacy of building quality homes in both Singapore and Malaysia over the past 50 years. #2: Integrated development Data from URA Space showed that Piccadilly Grand is zoned for residential use with commercial units on the first storey. With a gross plot ratio of 4.2, Piccadilly Grand will span three blocks of 23-storey where investors and residents can look forward to a plethora of lifestyle options such as retail, food & beverage and childcare centre all under one roof. Connected directly to Farrer Park MRT station, residents can enjoy seamless connectivity to the rest of the island. We will discuss this in detail in the next paragraph. #3: Connected to Farrer Park MRT station URA’s master plan shows that Piccadilly Grand will be directly connected to Farrer Park MRT station via Exit E. Whether you are working in the Central Business District, Changi Region, Greater Southern Waterfront, Jurong Lake District, Punggol Digital District or Woodlands Regional Centre, Piccadilly Grand connects you to these major economic hubs. From here, residents can hop onto the NEL and then transfer to the Downtown Line (DTL) one stop away at Little India MRT station, the North-South Line (NSL) two stops away at Dhoby Ghaut MRT station, the Circle Line (CRL) four stops away at Serangoon MRT station, the East West Line (EWL) and the Thomson-East Coast Line (TEL) five stops away at Outram Park MRT station. Such ease of commute will make the property highly desirable and convenient for owner-occupiers and prospective tenants. #4: Near several good schools Distance requirements are dictated by the Ministry of Education (MOE) and these will affect your children’s priority admission to nearby schools. According to the MOE, priority is given to Singapore Citizens and Permanent Residents who live closer to the preferred school when balloting. You may check the full requirements here. Parents with school-going children will be pleased to know that several notable good schools are located within 2 km from Piccadilly Grand. Here are the full lists of primary and secondary schools:

#5: At the doorstep of the Little India Arts Belt Steeped in local culture and tradition, Singapore’s Little India is an ethnic enclave that exudes a hip, bohemian vibe while preserving its authentic Indian identity. Home to many trendy cafes and traditional Indian restaurants, Little India boasts street-style shops selling flowers, garlands, spices and fresh produce. Lined with rows and rows of colourful shophouses and murals, the area comes alive on weekends and during Deepavali when crowds will throng the area for festive shopping. Little India also boasts an arts belt on Kerbau Road where several local performing arts companies call these vibrant shophouses home. For a truly authentic Indian cultural and dining experience, Little India offers a plethora of Indian restaurants serving curry on banana leaves topped with crispy naan bread or rice with a glass of refreshing lime juice or lassi. #6: Various amenities nearby Speaking of Little India, the Tekka Market, located within Tekka Centre, is conveniently sited next to Little India MRT station where you can find the freshest produce and ingredients for your wet market shopping. For delicious local cuisines, head to the Tekka Food Centre located at the back of the building where you can find a variety of affordable hawker fares to suit your taste buds. Meanwhile, at the other end of Little India is Mustafa Centre, located on Syed Alwi Road, which is popular among the bargain-hunting crowd. A favourite haunt among locals and tourists alike, Mustafa Centre is where you can find anything and everything under one roof. Known for its chaotic atmosphere, Mustafa Centre boasts a selection of luxury goods, jewellery, perfumes, clothing and even a supermarket spanning two buildings at extremely competitive pricing. Best of all, it is open 24 hours a day. Recently, one of the buildings for Mustafa Centre (facing Farrer Park MRT station) has been newly refurbished and renamed Centrium Square offering consumers even more shopping options. For a family-friendly experience, pop over to City Square Mall located just across Mustafa Centre. Owned and managed by CDL, City Square Mall enjoys direct access to Farrer Park MRT station and features over 450,000 sq ft of net lettable area, spread over five retail levels, two basements and four levels of lifestyle services. Some of its key anchor tenants include NTUC Fairprice, Mc Donald’s and Challenger Mini. #7: Healthcare Top-notch healthcare is available right opposite Piccadilly Grand at Farrer Park Hospital. This private hospital integrates current developments in medical technology and treatments in its hospital design and architecture to better serve patients. Offering a myriad of services from Anesthesiology to Sports Medicine, the hospital comes with a medical centre attached to it. This is part of a lifestyle concept that combines healthcare and hospitality. Like Piccadilly Grand, the hospital enjoys direct access to Farrer Park MRT station via Exit C. Meanwhile, the KK Women’s and Children’s Hospital is within 5 minutes drive from Piccadilly Grand. Founded in 1858, the hospital has since then evolved into a leader in Obstetrics, Gynaecology, Paediatrics and Neonatology. Offering 830 beds, the hospital is also a referral centre providing tertiary services to manage high-risk conditions in women and children. Equipped with a team of about 500 specialists, they adopt a compassionate, multi-disciplinary and holistic approach to treatment, and harness the latest medical innovations and technology to deliver the best medical care possible. #8: URA Master Plan The URA has made a concerted effort to preserve the unique culture and heritage of Little India. According to its latest master plan, certain pockets and spaces within the historic area have been earmarked to preserve the local arts, culture and heritage. For instance, URA's Project Oasis Little India (POLI) has transformed the vacant state land into public spaces where the community can come together for activities organised by Little India Shopkeepers and Heritage Association (LISHA). Meanwhile, the charming heritage buildings at Chitty/ Veerasamy Road and Hindoo Road have been earmarked for refurbishment and repurposement with innovative uses, that activate public spaces and plug gaps in pedestrian experience along Kampong Kapor Road. As such, investors can anticipate such regenerative project led by the government to have a potentially positive impact for the capital appreciation for Piccadilly Grand. |

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed