|

More leasing activities are reported as the office market starts to pick up post-COVID-19. However, tenants are also very specific in their office space requirements. By Khalil Adis In May 2022, I secured my very first corporate leasing deal. Although I was elated to finally secure a tenant for the landlord, it was not an easy process especially since the office market was affected by Covid-19. I was faced with a challenging period when marketing the office space in late 2021 as Singapore was battling the delta variant then. While interest in office space at first increased, the Omricon variant threw the wrench for potential tenants looking for office space in November 2021. As a result, enquiries started to decrease until the early part of 2022. Fast forward, a year ahead, the office leasing market appears to pick up steam as more employees returned to work. Data from CBRE confirmed this showing strong positive office net absorption in the third quarter of 2022, bringing the year-to-date take-up to 0.56 million sq ft and surpassing the total take-up of 0.32 million sq ft for the whole of 2021. “Key demand drivers are expansions by tech firms, flexible workspace operators and non-banking financial companies, which took up significant secondary office space in the Core CBD (Grade A). Fresh pre-commitments to upcoming new projects such as Guoco Midtown and Central Boulevard Towers were also inked during the quarter,” its research notes. Broad-based demand in all micro markets In addition to the growth sectors, CBRE notes that tenant displacement from planned redevelopments such as Clifford Centre and Robinson Point has also contributed to a broad-based recovery. According to the firm, islandwide vacancy declined further to 4.9 per cent in the third quarter of 2022 from the previous high of 6.8 per cent from the same period last year. “Despite hybrid working arrangements likely to stay, total leasing volume from renewals, new setups and expansion over the past three quarters has been resilient, a testament that physical office still plays an integral role in the workplace ecosystem,” CBRE’s research cites. With more leasing activities reported in the third quarter, here are the five things corporate tenants look for in an office space. #1: A prestigious address From my experience, certain tenants, particularly those in the banking, real estate, energy, legal and tech sectors, would only look for a prestigious office address right in the CBD. This is because their corporate image is important especially since they mostly deal with multinational companies and government agencies. Some are also particular about the look and feel of the building’s main lobby as they may sometime hold meetings with important clients in their office. Others cite improving their staff’s morale and confidence in the company when having a prestigious Grade A CBD address. #2: Accessibility Accessibility is also a key consideration for corporate tenants as most of their staff rely on public transportation while some drive to work. Therefore, being connected within walking distance to the MRT stations and expressways are important. As the office unit that I was marketing is located within the CBD, accessibility is not an issue as it well-served by various train stations such as Tanjong Pagar and Raffles Place MRT stations on the East-West and North-South Line, Chinatown, Telok Ayer MRT stations and Downtown on the Downtown Line as well as newly opened Maxwell and Shenton Way MRT stations on the Thomson-East Coast Line. The office building is also easily accessible via the Ayer Rajah Expressway (AYE), Marina Coastal Expressway (MCE), Central Expressway (CTE) and East Coast Parkway (ECP) for those who drive. #3: Amenities Amenities or the lack of them can either make or break an office leasing requirements for a corporate tenant. Some of the important amenities they look for include banking, dining, hawker centres, clinics and car parking facilities. I recall one particular tenant who insisted on having several car parking lots. Unfortunately, due to the limited car parking space for season parking holders, this proved to be difficult. If you require ample car parking space, then make sure you ask the agent in advance to check with the building management before asking for a viewing. #4: A column-free space A column-free space ranks highly as it enables the potential tenant to use the entire space efficiently. This is from my experience when conducting viewings on the ground. This is because such space offers them flexibility in how they would like to utilise the space just like drawing from a blank canvas. You can ask the agent for a copy of the floor plan so you can plan the office planning with your interior designer. #5: Facilities With an increased emphasis on staff’s mental health and wellness, I noticed that corporate tenants now prefer office buildings that offer recreational facilities such as green, open spaces, gyms or swimming pools where their staff can feel relaxed.

As one potential tenant puts it, “when an office feels like home, our staff are more likely to be comfortable and productive at their workplace.

0 Comments

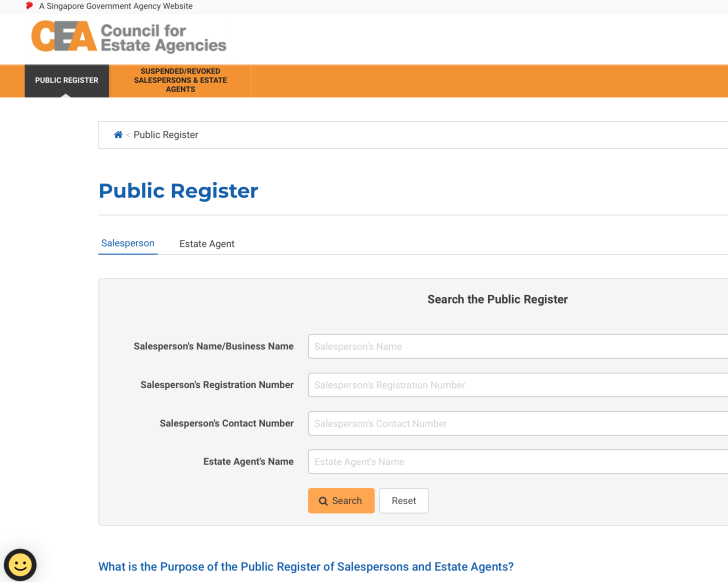

With many rental scams out there, here are the checks to protect yourself as a tenant. By Khalil Adis The September 2022 cooling measures will translate to a red-hot property market as ex-private property owners will now have to wait out a 15 months period before they can buy a resale HDB flat. This means demand in the rental market for both both private properties and HDB flats will pick up in the coming months ahead. Unfortunately, rental scams appear to also be on the rise. According to the Singapore Police Force (SPF), there were at least 144 victims of such scams who had lost around S$190,000 since January 2022. Modus operandi As the rental market heats up, scammers are taking advantage of the situation by posting fake listings on social media to lure unsuspecting tenants. Such listings are often too good to be true, depicting beautiful apartments at bargain prices. However, there is one catch. In order to secure viewings, the bogus property agents will often ask potential tenants to transfer money. This is where potential tenants may lose their monies. They will also ask you to send a copy of your identification card to confirm your viewing. Such requests are in fact dubious and not in line with market practice. They may also open you to identity thefts. 4 due diligence checks that you must do as a tenant To prevent yourself from being scammed, here are the four thing you must do: #1: Do not transfer any monies for viewings Instead, you should request for a physical viewing to verify that the property does indeed exist. #2: Verify the agent is registered with Council for Estate Agencies (CEA) If you are dealing with an agent, ask for the agent’s registration number. You can also check the agent’s details via CEA’s Public Register here. #3: Ask for proof of ownership Whether you are dealing with the agent or landlord, you should ask for proof of ownership of the rightful owner before transferring the earnest deposit. The earnest deposit is usually transferred directly to the landlord’s bank account along with the Letter of Intent (for a private property rental). For HDB flats and private properties, this can be done via INLIS here. For HDB flats only, you can request for the proof of ownership via MY HDBPage. If you are renting a property that is owned by a company, you should ask for their business profile or purchase it via BizFile here. The address of the directors of the company must match the address as reflected in INLIS or MY HDBPage. #4: Do not transfer monies to the agent Under CEA’s guidelines, for rental of HDB flats, agents are not allowed to hold any monies.

The deposit is typically equivalent to one or two months rent for a 1- or 2-year lease respectively. Upon signing the Tenancy Agreement, tenants will then have to transfer the one month’s advance rental. Property prices are expected to correct in the months ahead which may favour buyers. Meanwhile, the rental market is expected to heat up further. By Khalil Adis On 30 September 2022, the Singapore government announced various property cooling measures that are aimed at ensuring prudent borrowing and moderating demand. Indeed, the HDB Resale Price Index (RPI) and Private Property Index (PPI) as of the third quarter of 2022 are now at record highs at 168.1 and 187.8 points respectively. This means that first-time homebuyers are finding both HDB flats and private properties to be severely unaffordable. Meanwhile, potential sellers see this as an opportune time to profit from the red-hot property market. With this in mind, the government has had to intervene to ensure property prices remain affordable and are in tandem with wages. The measures include the following four-pronged approach:

How they may impact you as a consumer: For point 1, you will have to have a higher monthly combined income and pay a higher monthly mortgage and combined income . However, the actual interest rates charged will be determined by the private financial institutions. For point 2, the stress test has been increased to 3 per cent when calculating your monthly mortgage but with a reduced Loan-to-Value (LTV) limit at 80 per cent. This is to ensure your monthly mortgage remains affordable and within the 30 per cent Mortgage Servicing Ratio (MSR). On the overall, with a higher downpayment of 20 per cent, it will result in a lower mortgage payment when compared to an LTV limit of 85 per cent. However, this will not affect the actual HDB concessionary interest rate, which will remain unchanged at 2.6 per cent per annum. For point 3, buyers will need to come up with a higher cash and/or CPF amount (an increase of 5 per cent) to make up the 20 per cent downpayment. For example, for an $500,000 HDB flat, you will need to come up with $100,000 (80 per cent LTV) as opposed to $75,000 (85 per cent LTV). This means an additional cash and/or CPF outlay of $25,000. For point 4, this will mean sellers will have to rent either an HDB flat or private property during the interim period. This will result in increased demand in the rental market which will push asking prices further. According to data from the Urban Redevelopment Authority (URA), rentals of private residential properties had increased by 8.6 per cent in the third quarter to reach 137.9 points from 127.0 points in the second quarter of 2022. Meanwhile, HDB rentals have increased by around 30 per cent. Looking ahead, the rental market is expected to strengthen further which will favour landlords. Summary For buyers who are looking to buy a resale HDB flat or private property, you might want to wait out until their prices correct.

For sellers, you only have a small window period to take advantage of the exuberant market before it cools in the coming months. For landlords, the market will favour you due to increasing demand from existing tenants and ex-private property owners who have already sold their homes. For tenants, you will have to set aside more budget as rentals have now increased by around 30 per cent. |

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed