|

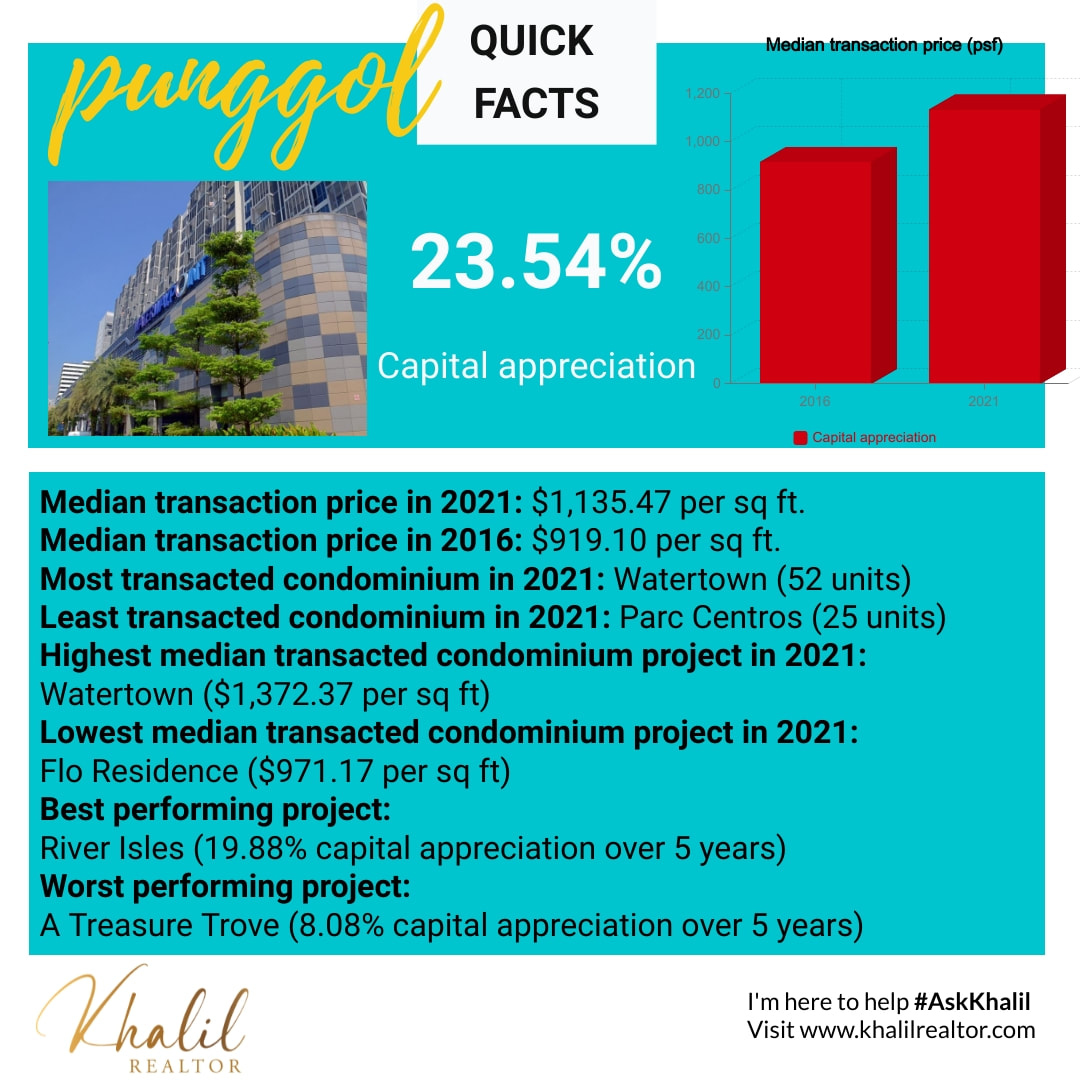

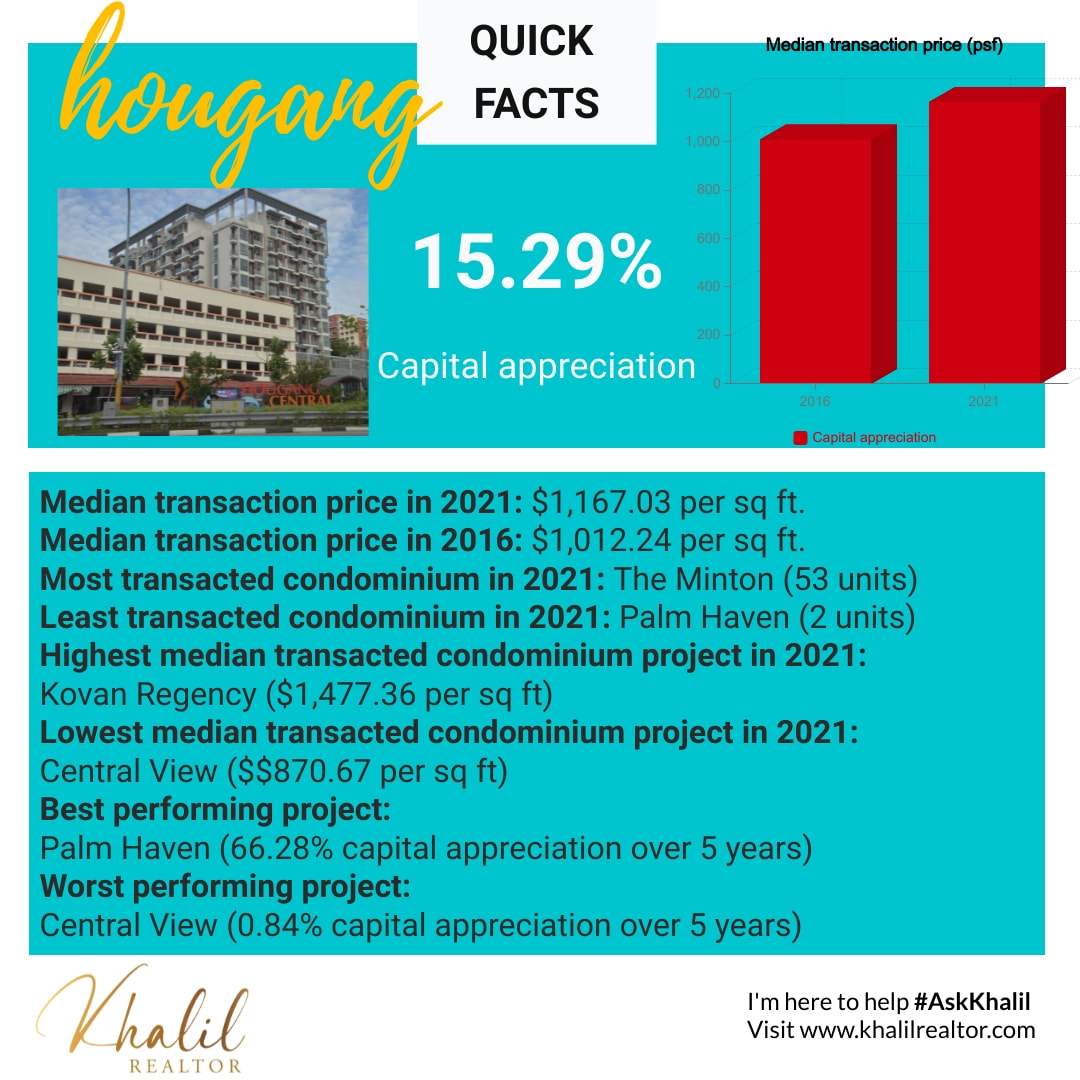

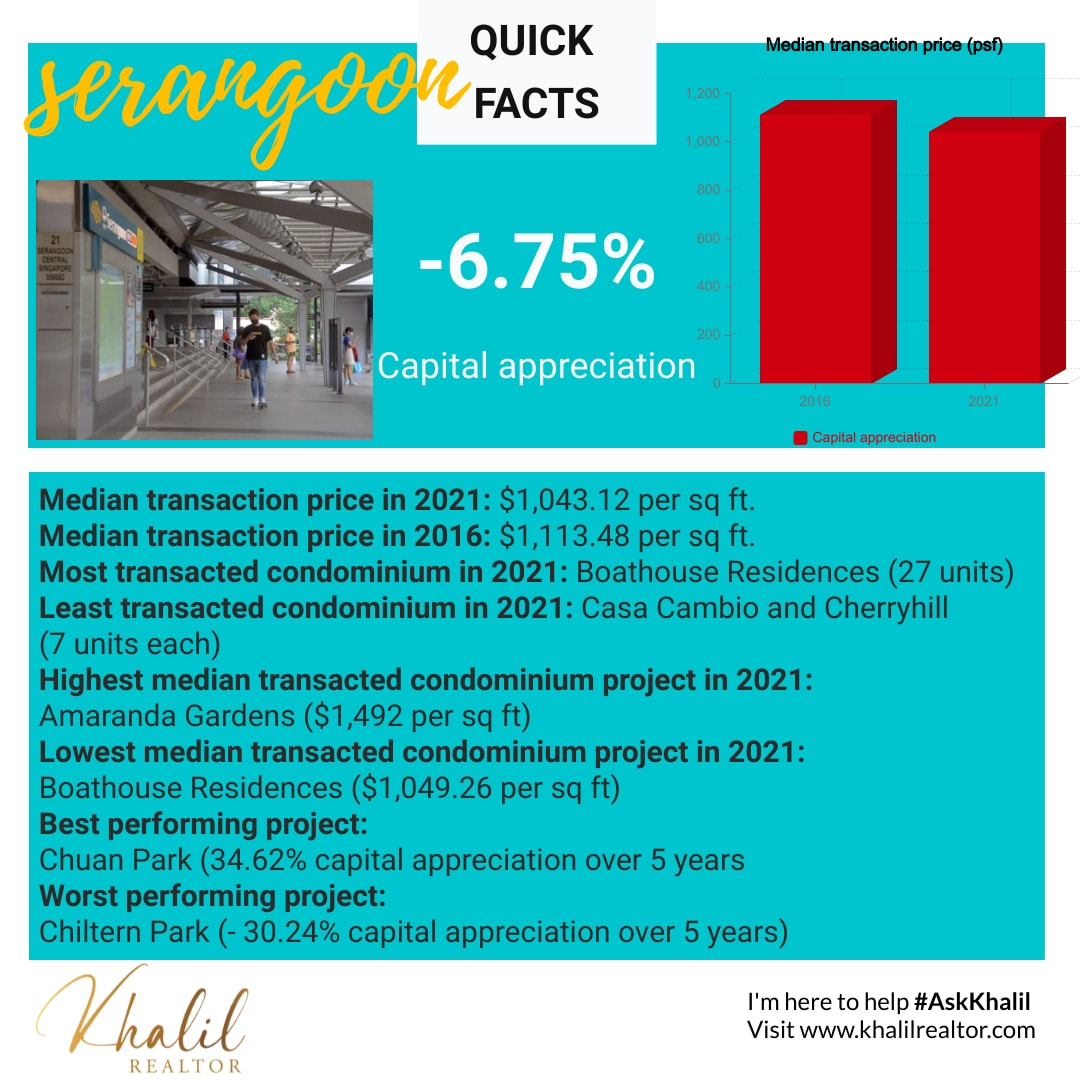

10/6/2021 How have condominiums in Punggol fared in 2021 and what should you do as a seller?Read NowAccording to data from the Urban Redevelopment Authority (URA), condominiums in Punggol experienced the most capital appreciation over 5 years in District 19 while Serangoon is the worst faring neighbourhood. Read on to find out more. By Khalil Realtor If you are a condominium owner in Punggol, this may be the right time to sell your property. This is because condominiums in Punggol enjoyed the highest capital appreciation in District 19, data from the Urban Redevelopment Authority (URA) showed. According to resale transactions that we had analysed based from 2016 and up to 15 September 2021, condominiums in Punggol enjoyed the highest capital appreciation at 23.54 per cent. This is higher than the average growth that was recorded in the entire District 19. Coming second place are condominiums that are located in Hougang which saw a capital appreciation of 15.29 per cent followed by Sengkang at 10.88 per cent. The worst faring area is Serangoon which recorded a depreciation of 6.75 per cent over the same period. On the overall, District 19 saw 1,146 resale transactions at a median transacted price of $1,174.50 per sq ft in 2021. This represents a capital appreciation of 19.14 per cent over five years when compared to the 168 resale transactions recorded in 2016 at a median transacted price of $985.82 per sq ft. Let’s take a look in detail how each area have performed so far. #1: Punggol Despite its far-flung location, Punggol is the top performer in District 19. In 2016, 14 condominium units had changed hands. This comprises four units at River Isles and 10 units at A Treasure Trove that were transacted at a median price of $843 per sq ft and $995.20 per sq ft respectively. For the entire Punggol, the median transaction price recorded in 2016 was $919.10 per sq ft. Meanwhile, in 2021, a total of 189 condominiums were sold at a median price of $1,135.47 per sq ft. Watertown is the most popular condominium and where the highest median price was recorded with 52 units sold at a median price of $1,372.37 per sq ft. This was followed by A Treasure Trove with 47 units transacted at a median price of $1,075.62 per sq ft, representing a capital appreciation of 8.08 per cent over five years. Third in place is Flo Residence with 36 units changing hands at a median price of $971.17 per sq ft - the lowest recorded in Punggol. The fourth most popular condominium project is River Isles which saw 29 units sold at a median price of $1,010.64 per sq ft. When compared to 2016’s transaction data, this represents an increase of 19.88 per cent. Lastly, 25 units at Parc Centros were transacted at a median price of $1,2471.56 per sq ft. With the upcoming Punggol Coast MRT station, 7.3 kilometre Cross Island Line (CRL) – Punggol Extension and the Punggol Digital District, we can expect demand for condominiums to remain robust in Punggol. #2: Hougang Hougang is a mature township with plenty of good schools, amenities and delicious local hawker food located within the neighbourhood. Thus, it is no wonder it is one of the most sought after townships in District 19 ranking second in place in terms of capital appreciation. In 2016, a total of 39 units were sold at a median price of $1,012.24 per sq ft. The Minton leads the way with 11 units sold at a median price of $1,091 per sq ft, followed by Kovan Residences (six units sold at a median price of $1,114.17 per sq ft), Kovan Regency and Kovan Melody (five units each sold at a median price of $1,304 per sq ft and $1,017 per sq ft respectively), Terrasse (four units sold at a median price of $1,006 per sq ft), Parc Vera (two units sold at a median price of $956 per sq ft), Central View (two units sold at a median price of $878 per sq ft), Bliss @ Kovan (one unit sold at a median price of $1,386 per sq ft), Palm Haven (one unit sold at a median price of $654 per sq ft) and The Waterline (one unit sold at a median price of $654 per sq ft). Meanwhile, in 2021, a total of 169 condominiums were sold at a median price of $1,167.03 per sq ft. Again, The Minton is the most popular condominium with 53 units sold at a median price of $1,115.13 per sq ft. This represents a price appreciation of 2.21 per cent over five years. Second in place is Kovan Residences (22 units sold at a median price of $1,477.36 per sq ft), representing a price appreciation of 32.60 per cent over the same period. Tied in third place are Kovan Melody and Kovan Regency (21 units each sold at a median price of $1,186.86 and $1,448.67 per sq ft respectively) with a capital appreciation of 16.70 per cent and 11.09 per cent respectively when compared to 2016. The fourth bestselling project was Parc Vera with 15 units sold at a median price of $1,028.47 per sq ft, representing a price appreciation of 7.58 per cent over the same period. This was followed Terrasse where 12 units were transacted at a median price of $1,084 per sq ft in 2021 - a capital appreciation of 7.75 per cent over the same period. When compared to the median transacted price of $1,012.24 per sq ft in 2016, Hougang witnessed price appreciation of 15.29 per cent ($1,167.03 per sq ft in 2021) over five years, earning it second place. By 2030, this could go higher as Hougang MRT station will be upgraded to an interchange station with the CRL. The Land Transport Authority (LTA) anticipates more than 100,000 households will benefit from this new line which will make Hougang even more attractive for investors. #3: Sengkang Just across the Tampines Expressway (TPE) from Punggol is Sengkang. Served by two MRT stations (Buangkok and Sengkang) and a network of LRT stations, Sengkang is considered the most populous planning area in the North-East Region. In 2016, a total of 12 units had changed hands at a median transacted price of $965.79 per sq ft. Leading the pack is The Quartz (seven units sold at a median price of $877.86 per sq ft), followed by The Luxurie (four units sold at a median price of $1,123.50 per sq ft) and Riversound Residence (one unit sold at a median price of $962 per sq ft). Meanwhile, in 2021, a total of 169 condominiums were sold at a median price of $1,135.47 per sq ft. La Fiesta is the most popular condominium with 55 units sold at a median price of $1,263.53 per sq ft followed by Flo Residence with 36 units changing hands at a median price of $971.17 per sq ft. Third in place is The Luxurie (34 units sold at a median price of $1,167.88 per sq ft). When compared to 2016, it saw a capital appreciation of 3.95 per cent. This was followed by Riversound Residence where 28 units were transacted at a median price of $1,001.11 per sq ft (a capital appreciation of 4.07 per cent), and Jewel @ Buangkok (27 units at a median price of $1,326.11 per sq ft). Fifth in place is The Quartz and Rivervale Crest where 24 units each were transacted at a median price of $1,026.71 and $753.88 per sq ft in 2021. For The Quartz, this represents a price appreciation of 16.97 per cent over five years. For the entire Sengkang area, the median transacted price in 2021 is $1,070.91 per sq ft, representing a price appreciation of 10.88 per cent since 2016. By 2040, a new MRT station may be added to Sengkang which will improve its connectivity further to the rest of the island. According to Land Transport Master Plan 2040, there is a possibility that an eighth MRT line will run from Woodlands to the Greater Southern Waterfront with a station passing through Sengkang. Estimated to be about 30 km long, the line will potentially benefit 400,000 households, if the plan were to materialise. This could uplift property prices further. #4: Serangoon Though Serangoon is located closer to the city and is served by Serangoon MRT interchange station that connects to the Circle Line and North East Line, the private property sector lags behind those of Punggol, Sengkang and Hougang. In fact, it is the only area in District 19 that recorded negative growth. In 2016, a total of 20 units were sold at a median price of $1,113.48 per sq ft. Chiltern Park is the most popular project (seven units sold at a median price of $989 per sq ft), followed by Cardiff Residence (four units sold at a median price of $1,308.2 per sq ft), Casia Cambio and Chuan Park (three units each sold at a median price of $1,420.66 and $752.67 per sq ft respectively) and Casa Rosa (one unit sold at a median price of $837 per sq ft). In 2021, a total of 73 units were sold, comprising 27 units at Boathouse Residences (at a median price of $1,049.26 per sq ft), 12 units at Cardiff Residence (at a median price of $1,301.33 per sq ft), nine units at Chiltern Park (at a median price of $1,054.44 per sq ft), seven units each at Casa Cambio and Cherryhill (at a median price of $1,366.42 and $1,105.86 per sq ft respectively), five units at Amaranda Gardens (at a median price of $1,492 per sq ft), four units at Chuan Park (at a median price of $1,013.25 per sq ft) and two units at Casa Rosa (at a median price of $1,005.50 per sq ft). When compared to 2016, Cardiff Residence, Chiltern Park and Casa Cambio witnessed a price depreciation of 0.53, 30.24 and 3.97 per cent respectively. Meanwhile, Casa Rosa, Cherryhill and Chuan Park saw a price appreciation of 20.13, 11.82 and 34.62 per cent respectively. For the entire Serangoon area, the median transaction price in 2021 was $1,043.12 per sq ft, representing a capital depreciation of 6.75 per cent over 5 years. Under the URA Master Plan 2019, the URA envisages Serangoon Central to be “the heart of the North East region with excellent connectivity via the North-East Line, Circle Line, and Serangoon Bus Interchange.” However, there are no plans so far for Serangoon’s rejuvenation nor any new infrastructure developments under the master plan. This could be a dealbreaker for property investors looking for potential upsides. Summary Based on our analysis, it may be an opportune time to either sell your condominium or invest in one in Punggol. This is because there are potentially new upsides arising from the completion of the Punggol Digital District, Punggol Coast MRT station and the upgraded Punggol MRT interchange station to the CRL. The URA Draft Master Plan 2019 anticipates Punggol Digital District to be a new smart city by 2023 that will create around 28,000 jobs. The innovation hub is expected to house technology firms involved in key growth fields as well as the new Singapore Institute of Technology Campus. That’s not all. The LTA expects the new Punggol Coast MRT station to provide enhanced connectivity to the rest of the island via the CRL which will link Punggol Digital District to Jurong Lake District and Changi by around 2030. Collectively, all these infrastructure projects are expected to have a positive spillover impact for Punggol. Interested to sell your condominium or buy one in Punggol? I’m here to help. Contact me for a non-obligatory chat.

0 Comments

9/20/2021 Is your HDB flat hitting its Minimum Occupation Period (MOP) in 2022? Here are 3 things you can doRead NowFreshly MOP-ed HDB resale flats are in hot demand especially in growth areas like Punggol. By Khalil Realtor QUICK FACTS In case you don’t already know, HDB flats with a fresh lease are in high demand especially in growth areas like Punggol. This is because they are not subjected to a pro-rated CPF usage unlike in older estates like Toa Payoh. This means you can use 100 per cent of your CPF up to the Valuation Limit and 120 per cent of the Withdrawal Limit if you are taking a bank loan to finance your purchase. If you are taking an HDB loan, you can use 100 per cent of your CPF up to the Valuation Limit. It also means should you wish to sell your resale HDB flat, the pool of buyers are not restricted to a pro-rated CPF usage as long as your flat has a remaining lease of more than 60 years. With a number of HDB flats reaching their Minimum Occupation Period (MOP) in 2022, here are three things you can do: #1: Rent it out You will be eligible to rent out your entire HDB flat upon reaching your MOP. In fact, HDB flats offer a good rental yield of more than 5 per cent per annum when compared to a private property. When looking at rental yield, we are looking at the difference between the cost of purchasing the property (including monthly mortgage, maintenance fee, property tax etc) and the income you receive when renting out your property, A good rental yield in Singapore would be anything above 5 per cent. You can calculate your rental yield by calculating your annual rent and divide it with your purchase price times 100. For a property that was purchased at $143,000 with an annual rental income of $21,000, your rental yield would be 14.68 per cent. Do note, you must rent out your HDB flat for at least 6 months. If your tenants are all Singaporeans or Malaysians, you can apply to rent out your flat for a maximum period of 3 years per application. For an application involving non-Malaysian non-citizens, the maximum rental period per approval is 2 years. Your tenant must be any of the following to rent a flat or bedroom as a tenant: - Singapore Citizen - Singapore Permanent Resident - Non-citizen legally residing in Singapore who holds an Employment Pass, S Pass, Work Permit, Student Pass, Dependant Pass, or Long-Term Social Visit Pass. The pass must have a validity period of at least 6 months as at the date of application by the flat owners: - Work Permit holders from the construction, marine, and process sectors must be Malaysians. Work Permit holders from the manufacturing sector must also be Malaysians if they are renting a whole HDB flat If your tenant is a non-Malaysian non-citizen (Singapore Permanent Resident or foreigner) renting the HDB flat, they will be subject to the Non-Citizen Quota for Renting Out of Flat. The quota is to help maintain a good ethnic mix in HDB estates. Malaysians are not subject to this quota in view of their close cultural and historical similarities with Singaporeans. The quota is set at 8 per cent at the neighbourhood level and 11 per cent at the block level, and applicable if any of your tenant renting your flat is a non-Malaysian non-citizen. If the quota is reached, only Singaporeans and Malaysians can rent a flat in your neighbourhood/ block. This quota does not apply to the renting out of bedrooms. Do note the maximum number of tenants allowed for 1-room and 2-room and 3-room and bigger flats is 4 and 6 respectively. As a landlord, you are required to check original NRIC or FINS of your tenants and occupiers for forgery and make copies, check photographs on NRICs or FINS against the actual persons to confirm identity and verify the validity of the passes with MOM database and/or ICA database. As an added due diligence, you may also ask for letter of employment from employer. This is to deter illegal immigrants or vice activities. This is required by the Council of Estate Agencies for compliance with the Immigration and Women's Charter. You will be required to apply for the subletting approval from HDB should you wish to rent out your whole flat. A processing fee of $20 is applicable. #2: Sell it in the open market To protect their assets, some HDB flat owners prefer to sell their newly MOP-ed flat. This is because as HDB flats come to the tail end of their lease, their value drops significantly. This can already be seen in the transacted price of older HDB resale flats in Toa Payoh, especially those with a remaining lease of less than 60 years. When selling your flat in the open market, you will first need to apply for an Intent To Sell via HDB's Resale Portal here: The buyer will first need to pay an option fee of an amount not exceeding $1,000. Your agent can then issue an Option to Purchase (OTP) form after 7 days from the date of the Intent to Sell. Your agent can then submit the OTP to HDB to request for a valuation. An assigned valuer will then inspect your HDB flat to determine its valuation. The buyer will be given 21 days to think over the intended purchase and to check his/her eligibility, financing aspects and other issues such as whether your flat is affected by redevelopment or upgrading, the liability to pay for upgrading costs, levy and so on and then to exercise their option. To exercise the option, the buyer must sign the 'Acceptance' portion on the OTP by ensuring that the date of issue of the HDB Loan Eligibility or bank's Letter of Offer is before the date of acceptance. The buyer must then deliver the OTP to your agent and pay the Option Exercise Fee (which is a sum not exceeding $5,000 - less the deposit already paid) to you. All this must be done within the 21-day option period. Upon exercising the Option, a binding contract is formed between the seller and buyer for the sale and purchase of your flat. The next information is crucial as many sellers are not aware of it. If you plan to buy another HDB flat and apply for a second HDB concessionary rate loan, your housing loan will be reduced by the CPF monies refunded and up to 50 per cent of the cash proceeds from the disposal of your existing or previously owned HDB flat. This is to ensure financial prudence. You can keep the greater of $25,000 or half of the cash proceeds. The HDB will take into account the remaining part of the cash proceeds when determining the amount of the second loan to be granted to you. #3: Invest in a private property Now that you have met your MOP, you are free to invest in a private property without any restrictions. This is also a popular option among HDB upgraders as a private property is considered an investment whereas an HDB flat is for long-term occupation. If you have an outstanding HDB loan, your loan-to-value (LTV) limit will be reduced to 45 per cent with a minimum 25 per cent cash downpayment. The remaining 30 per cent will be via your cash and/or CPF Ordinary Account. If you do not have any outstanding loan, your loan-to-value (LTV) limit will be 75 per cent with a minimum 5 per cent cash downpayment. The remaining 20 per cent will be via your cash and/or CPF Ordinary Account. When purchasing a private property, you will be subjected to the Total Debt Service Ratio (TDSR), Valuation Limit and Withdrawal Limit. Your TDSR should be less than or equal to 60 per cent. The TDSR formula is as follows: (Borrower's total monthly debt obligations / Borrower's gross monthly income) x 100% Assuming you have a total monthly debt of $1,000, this is your TDSR: $1,000/$10,000 x 100% = 10% Your monthly mortgage will be included in this TDSR calculation and cannot exceed the 60 per cent threshold. You will be subjected to Valuation Limit. Valuation Limit is the lower of the purchase price or valuation at the time of purchase. Assuming the valuation and purchase price is $1 million, your Valuation Limit is $1 million. For a bank loan, you will be subjected to Withdrawal Limit: 120% of the Valuation Limit. 120% x $1,000,000 = $1,200,000 $1.2 million is your Withdrawal Limit. Do note, you will also need to set aside a Basic Retirement Sum (BRS) of $93,000 in 2021 if you are reaching 55-years-old. You can use the remaining amount in your CPF Ordinary Account after setting aside your BRS. Also, a Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) of 12 per cent will be applicable for your second property purchase. As you can see from the examples above, renting, buying and selling a property requires extensive knowledge and financial calculations. Interested to sell your HDB flat or buy a private property? I’m here to help. Contact me for a non-obligatory chat. |

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed