|

A step-by-step guide to finding affordable housing for low-income families By Khalil Adis Finding a suitable home in Singapore can be a daunting task, especially for low-income families. As an experienced real estate agent, I recently helped a family of five upgrade from a public rental flat to a 3-room HDB flat in Jurong West. Here's how I did it. Step 1: Work out their total cash, CPF, and HDB loan Firstly, I sat down with them to find out their available CPF, cash, and HDB loan. We established a total of $30,000 in CPF, $2,000 in cash, and $180,000 in HDB loan. Step 2: Identify grants they are eligible for We identified three grants that they qualified for: Family Grant ($80,000), Enhanced Housing Grant ($65,000), and Proximity Housing Grant ($20,000), totalling $165,000 in CPF Grants. Step 3: Work out their total housing budget After combining their available funds with the CPF Housing Grants, their total housing budget amounted to $377,000. With 3-room HDB flats in most estates transacting above $400,000, we had to search for older resale flats. Step 4: Narrow down to HDB estates close to their parents The family's parents live in Jurong West, and we found an older 3-room HDB flat in the same estate that fell within their budget. I managed to negotiate the deposit down from $5,000 to $1,500. Conclusion In conclusion, while the HDB resale market is at a record high, there are still affordable flats available, and there are various CPF Housing Grants that you may be eligible for.

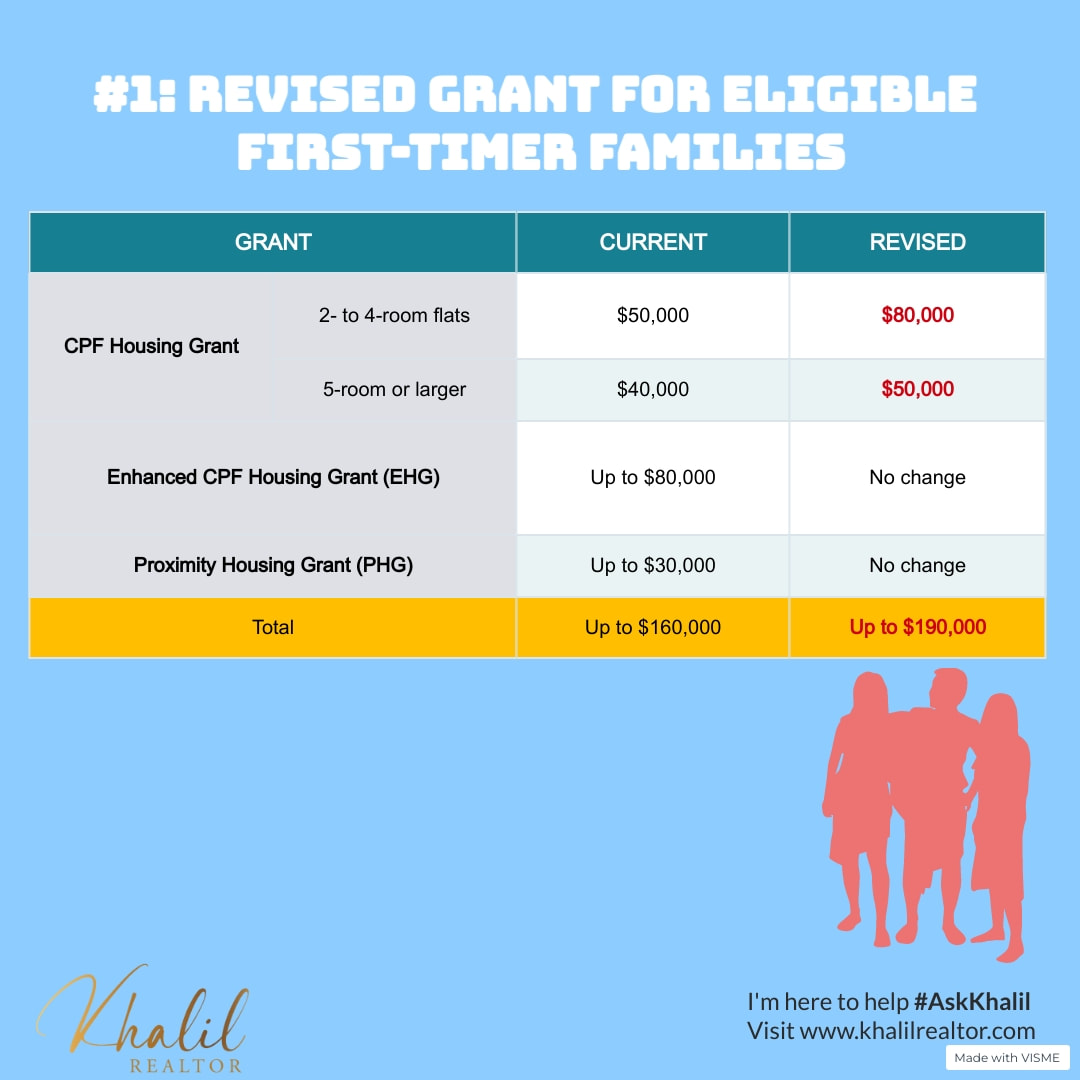

The recent Budget 2023 announcement to increase the Family Grant for 4-room and below HDB flats from $50,000 to $80,000 is a welcome move to reduce the cost of purchase. With a little research and negotiation skills, low-income families can also upgrade their homes and enjoy better living conditions.

0 Comments

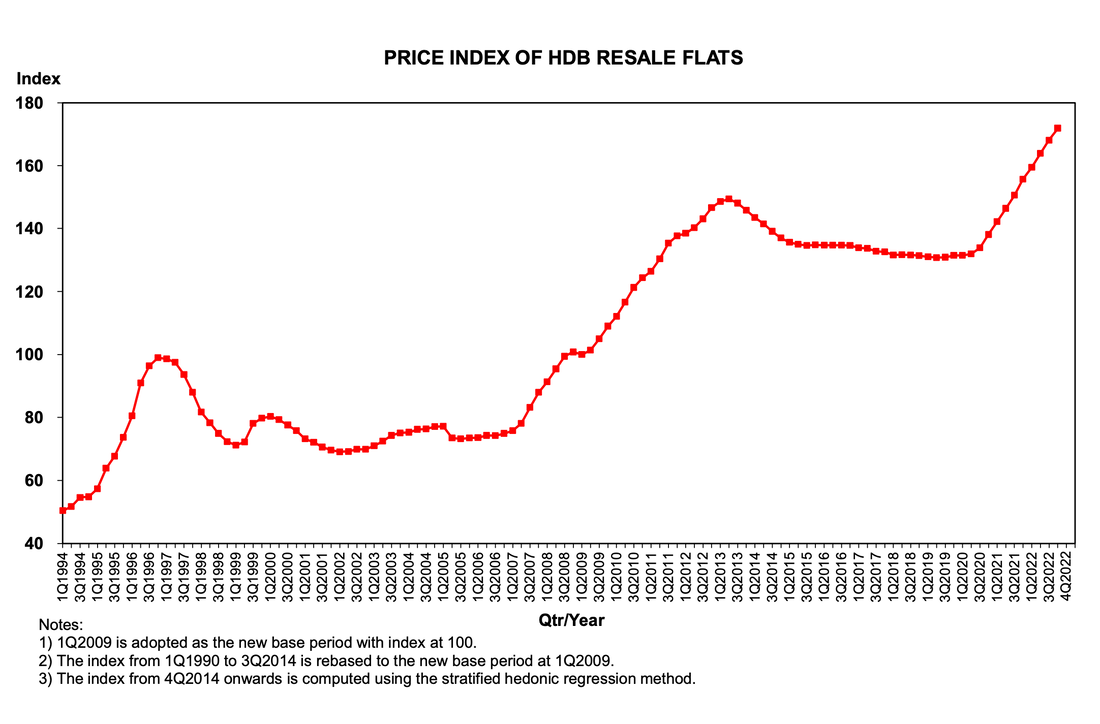

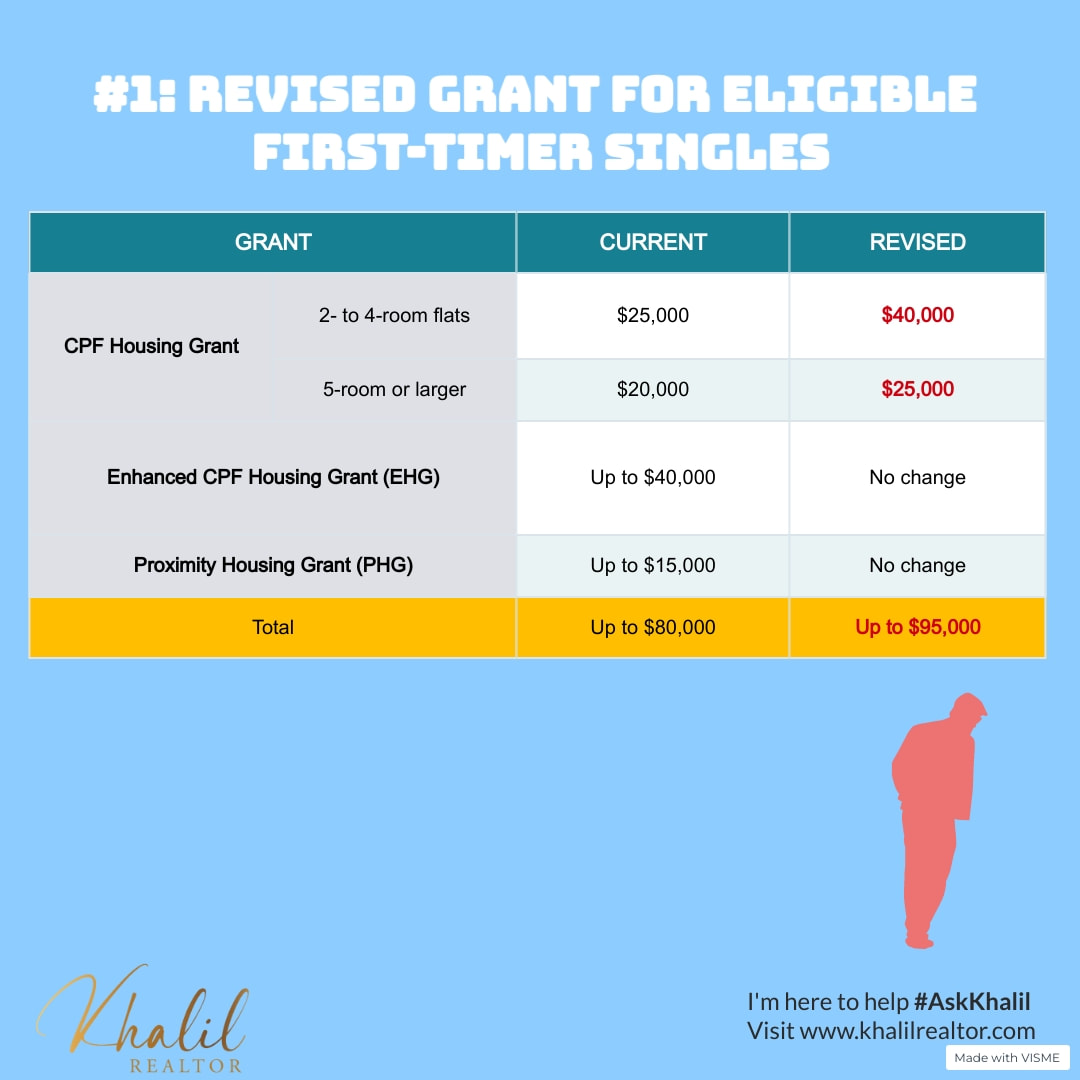

First-timers households and singles can get up to $190,000 and $95,000 in CPF Housing Grants respectively. Khalil Adis If you are looking to buy a resale HDB flat but are concerned about whether you can afford it, fret not. Announced as part of Budget 2023 on 14 February 2023, more help is on the way for first-time homebuyers be they singles or families. In the face of inflation and rising property prices in Singapore, the government has allocated more housing subsidies to make public housing more affordable and accessible for young families buying their first homes “Against the backdrop of the broad-based increase in demand for housing in recent years, these measures will help more families with children and young married couples own their first home,” said the Ministry for National Development and Housing & Development Board in a joint statement. Here are three things first-time homebuyers can look forward to: #1: Increased CPF Housing Grant for first-timers households First-timers households buying resale 2- to 4-room flats will receive up to $80,000 up from $50,000. Meanwhile, those buying 5-room or larger flats will receive up to $50,000 up from $40,000. When including the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG), families can enjoy up to $190,000 in CPF Housing Grants. #2: Increased CPF Housing Grant for first-timers singles First-timers singles buying resale 2- to 4-room flats will receive up to $40,000 up from $25,000. while those buying 5-room or larger flats will receive up to $25,000 up from $20,000. When including the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG), singles can enjoy up to $95,000 in housing subsidies. #3: Greater priority for first-timers families First-timers families with children and young married couples aged 40 years and below who are buying their first home will be given greater priority during their Built-To-Order (BTO) applications. According to HDB and MND, this will be implemented later this year. This category of first-timers will receive additional support in securing their flats via an additional ballot chance for their BTO applications. “More details of the scheme as well as eligibility criteria will be shared at the Ministry of National Development Committee of Supply debate,” said the MND and HDB in their joint statement. Rising property prices Property prices in the Lion City have been on the uptrend figures from the HDB showed. According to HDB’s fourth quarter of 2022 data, the Resale Price Index (RPI) is at 171.9 points which is an increase of 2.3 per cent over that in the third quarter of 2022. While the RPI has been rising, HDB notes that this is a slower increase than the 2.6 per cent increase in the third quarter of 2022. It is worth noting that this is the slowest increase in the past year. Meanwhile, the median price for 4-room HDB flats in Queenstown is the most expensive at $870,000 while those in Jurong East are the cheapest at $465,000. While prices have been rising, resale transactions fell by 12.6 per cent, from 7,546 cases transacted in the third quarter of 2022 to 6,597 cases in the fourth quarter of 2022. No impact on the price of resale HDB market While the budget is generous, it will not have a significant impact on the price of resale HDB flats.

This is because the price is determined by demand and supply. Rather, the slew of new measures aims to reduce the cost of public housing ownership via the various subsidies, if applicable. Nevertheless, with HDB committed to launching up to a total of 100,000 flats from 2021 to 2025, we could see resale flat prices correcting this year onwards. More leasing activities are reported as the office market starts to pick up post-COVID-19. However, tenants are also very specific in their office space requirements. By Khalil Adis In May 2022, I secured my very first corporate leasing deal. Although I was elated to finally secure a tenant for the landlord, it was not an easy process especially since the office market was affected by Covid-19. I was faced with a challenging period when marketing the office space in late 2021 as Singapore was battling the delta variant then. While interest in office space at first increased, the Omricon variant threw the wrench for potential tenants looking for office space in November 2021. As a result, enquiries started to decrease until the early part of 2022. Fast forward, a year ahead, the office leasing market appears to pick up steam as more employees returned to work. Data from CBRE confirmed this showing strong positive office net absorption in the third quarter of 2022, bringing the year-to-date take-up to 0.56 million sq ft and surpassing the total take-up of 0.32 million sq ft for the whole of 2021. “Key demand drivers are expansions by tech firms, flexible workspace operators and non-banking financial companies, which took up significant secondary office space in the Core CBD (Grade A). Fresh pre-commitments to upcoming new projects such as Guoco Midtown and Central Boulevard Towers were also inked during the quarter,” its research notes. Broad-based demand in all micro markets In addition to the growth sectors, CBRE notes that tenant displacement from planned redevelopments such as Clifford Centre and Robinson Point has also contributed to a broad-based recovery. According to the firm, islandwide vacancy declined further to 4.9 per cent in the third quarter of 2022 from the previous high of 6.8 per cent from the same period last year. “Despite hybrid working arrangements likely to stay, total leasing volume from renewals, new setups and expansion over the past three quarters has been resilient, a testament that physical office still plays an integral role in the workplace ecosystem,” CBRE’s research cites. With more leasing activities reported in the third quarter, here are the five things corporate tenants look for in an office space. #1: A prestigious address From my experience, certain tenants, particularly those in the banking, real estate, energy, legal and tech sectors, would only look for a prestigious office address right in the CBD. This is because their corporate image is important especially since they mostly deal with multinational companies and government agencies. Some are also particular about the look and feel of the building’s main lobby as they may sometime hold meetings with important clients in their office. Others cite improving their staff’s morale and confidence in the company when having a prestigious Grade A CBD address. #2: Accessibility Accessibility is also a key consideration for corporate tenants as most of their staff rely on public transportation while some drive to work. Therefore, being connected within walking distance to the MRT stations and expressways are important. As the office unit that I was marketing is located within the CBD, accessibility is not an issue as it well-served by various train stations such as Tanjong Pagar and Raffles Place MRT stations on the East-West and North-South Line, Chinatown, Telok Ayer MRT stations and Downtown on the Downtown Line as well as newly opened Maxwell and Shenton Way MRT stations on the Thomson-East Coast Line. The office building is also easily accessible via the Ayer Rajah Expressway (AYE), Marina Coastal Expressway (MCE), Central Expressway (CTE) and East Coast Parkway (ECP) for those who drive. #3: Amenities Amenities or the lack of them can either make or break an office leasing requirements for a corporate tenant. Some of the important amenities they look for include banking, dining, hawker centres, clinics and car parking facilities. I recall one particular tenant who insisted on having several car parking lots. Unfortunately, due to the limited car parking space for season parking holders, this proved to be difficult. If you require ample car parking space, then make sure you ask the agent in advance to check with the building management before asking for a viewing. #4: A column-free space A column-free space ranks highly as it enables the potential tenant to use the entire space efficiently. This is from my experience when conducting viewings on the ground. This is because such space offers them flexibility in how they would like to utilise the space just like drawing from a blank canvas. You can ask the agent for a copy of the floor plan so you can plan the office planning with your interior designer. #5: Facilities With an increased emphasis on staff’s mental health and wellness, I noticed that corporate tenants now prefer office buildings that offer recreational facilities such as green, open spaces, gyms or swimming pools where their staff can feel relaxed.

As one potential tenant puts it, “when an office feels like home, our staff are more likely to be comfortable and productive at their workplace. The unit received several offers signifying a robust rental market. By Khalil Adis A 2-bedroom unit at The Paterson Edge has been successfully tenanted at an above average median price when compared to similar sized units.

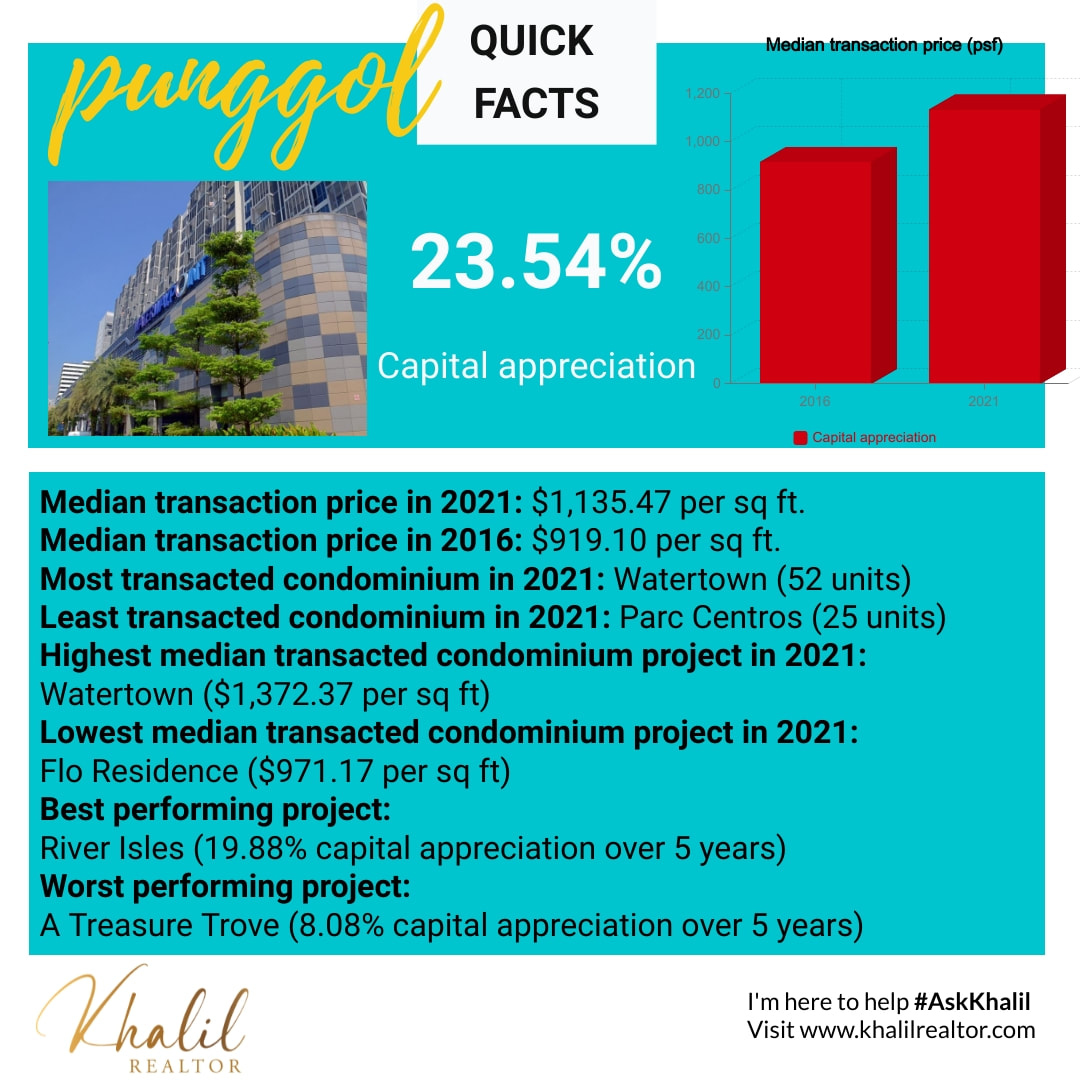

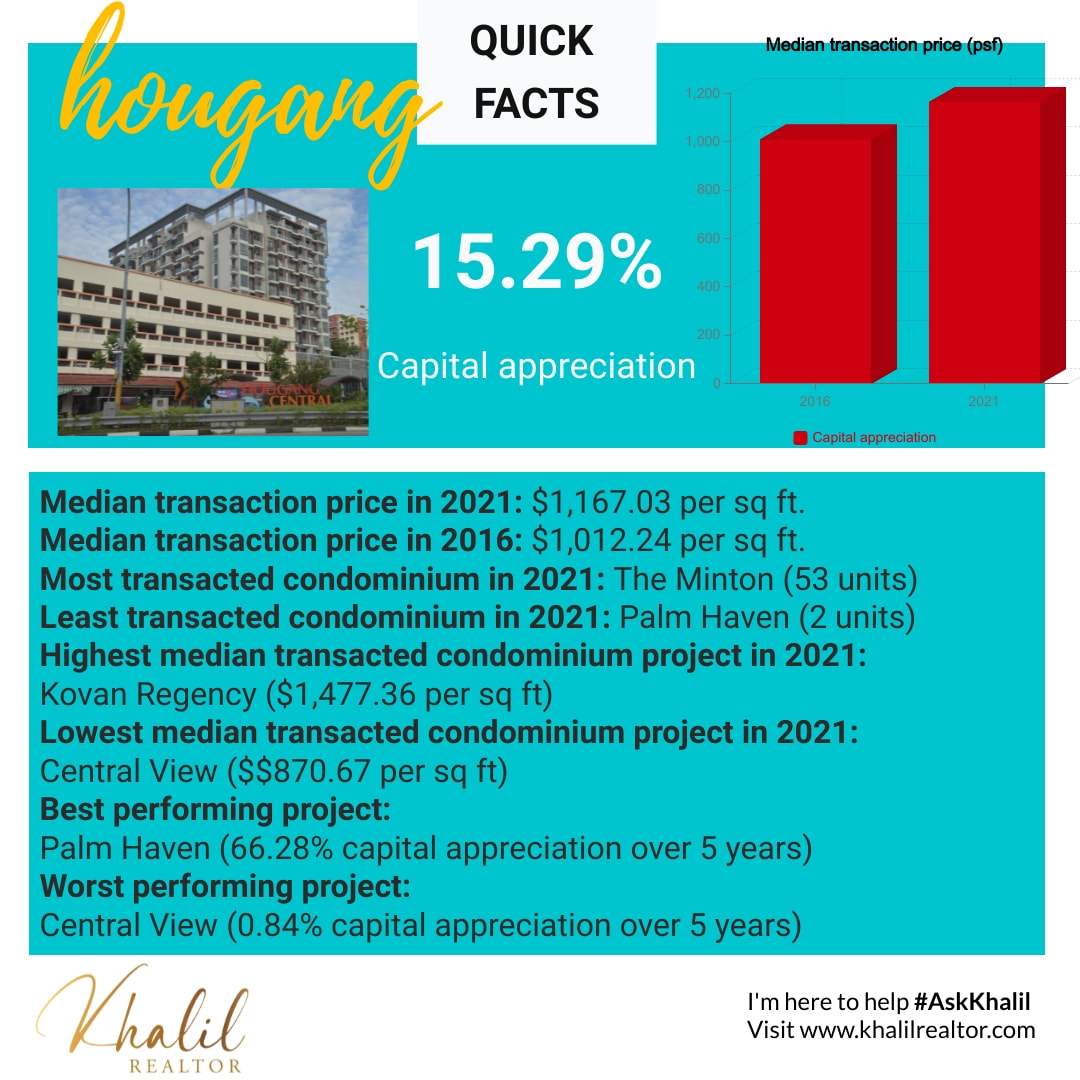

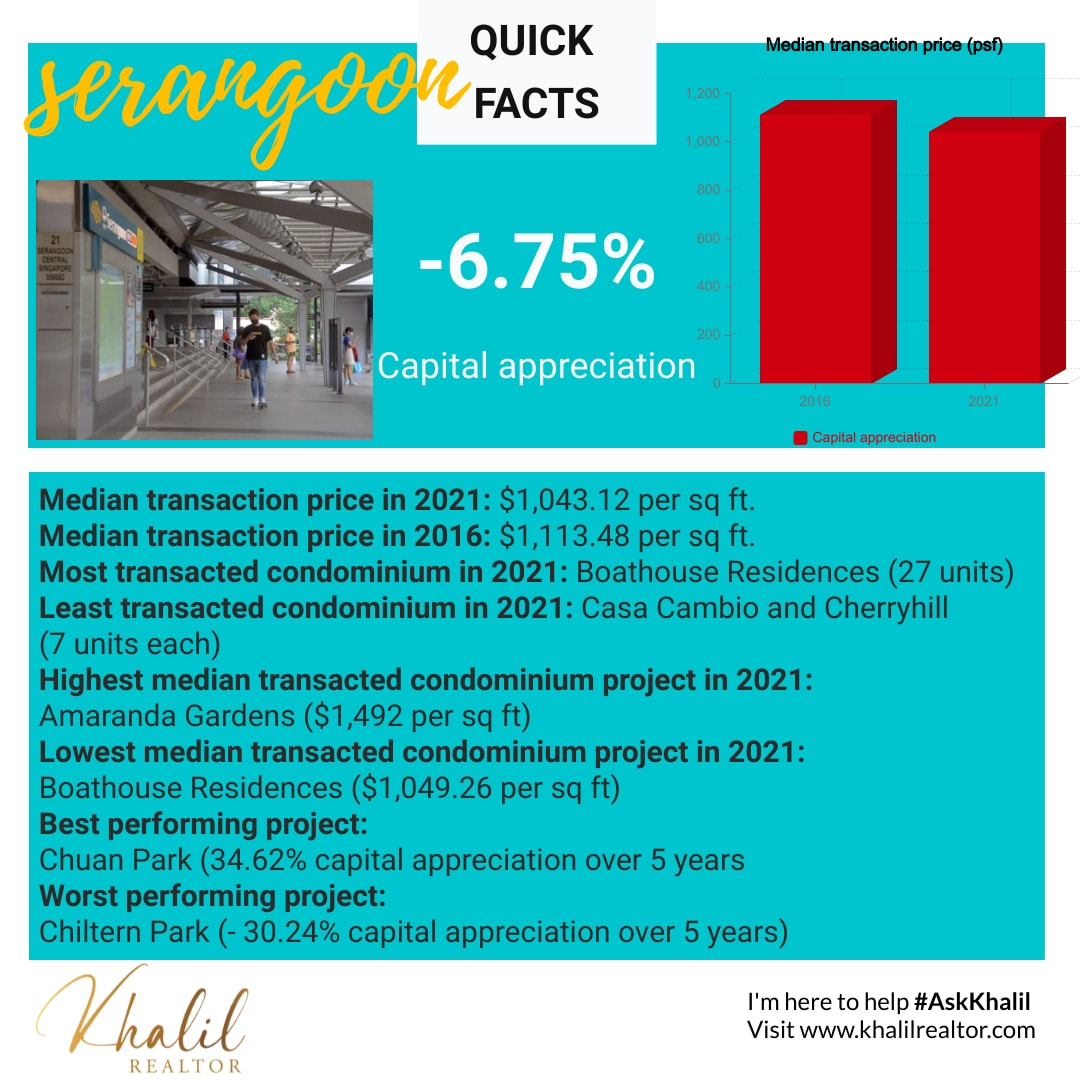

Data from the Urban Redevelopment Authority (URA) showed that 17 2-bedroom units at The Paterson Edge were transacted at an average price of $4,501 per month from January to June 2022. The highest transacted price was $6,151 per month in March 2022 followed by $6,000 per month in May 2022. Measuring 990 sq ft, the unit received several offers signifying a robust rental market. Situated within walking distance to the shopping belt of Orchard Road and right opposite the upcoming Orchard MRT station via the Thomson East Coast Line (TEL), The Paterson Edge is located in a prestigious neighbourhood. A low-density development that has often been described as a "doll house”, The Paterson Edge offers discerning families or individuals a quiet, private retreat while being a stone throw's away to luxury boutiques, high-end stores, shopping malls, supermarkets and top-notch medical centres. This mid-floor unit is located at the corner to ensure the utmost privacy. The unit comes with Miele refrigerator & freezer, Miele cooker hood/hob, built in refrigerator & freezer, built in conventional oven, built in wardrobe, curtains and blackouts, roller blinds and energy saving lighting features. The unit has been property maintained and is in good condition. Facilities at The Paterson Edge include a swimming pool, gym, covered carpark and 24-hour security 10/6/2021 How have condominiums in Punggol fared in 2021 and what should you do as a seller?Read NowAccording to data from the Urban Redevelopment Authority (URA), condominiums in Punggol experienced the most capital appreciation over 5 years in District 19 while Serangoon is the worst faring neighbourhood. Read on to find out more. By Khalil Realtor If you are a condominium owner in Punggol, this may be the right time to sell your property. This is because condominiums in Punggol enjoyed the highest capital appreciation in District 19, data from the Urban Redevelopment Authority (URA) showed. According to resale transactions that we had analysed based from 2016 and up to 15 September 2021, condominiums in Punggol enjoyed the highest capital appreciation at 23.54 per cent. This is higher than the average growth that was recorded in the entire District 19. Coming second place are condominiums that are located in Hougang which saw a capital appreciation of 15.29 per cent followed by Sengkang at 10.88 per cent. The worst faring area is Serangoon which recorded a depreciation of 6.75 per cent over the same period. On the overall, District 19 saw 1,146 resale transactions at a median transacted price of $1,174.50 per sq ft in 2021. This represents a capital appreciation of 19.14 per cent over five years when compared to the 168 resale transactions recorded in 2016 at a median transacted price of $985.82 per sq ft. Let’s take a look in detail how each area have performed so far. #1: Punggol Despite its far-flung location, Punggol is the top performer in District 19. In 2016, 14 condominium units had changed hands. This comprises four units at River Isles and 10 units at A Treasure Trove that were transacted at a median price of $843 per sq ft and $995.20 per sq ft respectively. For the entire Punggol, the median transaction price recorded in 2016 was $919.10 per sq ft. Meanwhile, in 2021, a total of 189 condominiums were sold at a median price of $1,135.47 per sq ft. Watertown is the most popular condominium and where the highest median price was recorded with 52 units sold at a median price of $1,372.37 per sq ft. This was followed by A Treasure Trove with 47 units transacted at a median price of $1,075.62 per sq ft, representing a capital appreciation of 8.08 per cent over five years. Third in place is Flo Residence with 36 units changing hands at a median price of $971.17 per sq ft - the lowest recorded in Punggol. The fourth most popular condominium project is River Isles which saw 29 units sold at a median price of $1,010.64 per sq ft. When compared to 2016’s transaction data, this represents an increase of 19.88 per cent. Lastly, 25 units at Parc Centros were transacted at a median price of $1,2471.56 per sq ft. With the upcoming Punggol Coast MRT station, 7.3 kilometre Cross Island Line (CRL) – Punggol Extension and the Punggol Digital District, we can expect demand for condominiums to remain robust in Punggol. #2: Hougang Hougang is a mature township with plenty of good schools, amenities and delicious local hawker food located within the neighbourhood. Thus, it is no wonder it is one of the most sought after townships in District 19 ranking second in place in terms of capital appreciation. In 2016, a total of 39 units were sold at a median price of $1,012.24 per sq ft. The Minton leads the way with 11 units sold at a median price of $1,091 per sq ft, followed by Kovan Residences (six units sold at a median price of $1,114.17 per sq ft), Kovan Regency and Kovan Melody (five units each sold at a median price of $1,304 per sq ft and $1,017 per sq ft respectively), Terrasse (four units sold at a median price of $1,006 per sq ft), Parc Vera (two units sold at a median price of $956 per sq ft), Central View (two units sold at a median price of $878 per sq ft), Bliss @ Kovan (one unit sold at a median price of $1,386 per sq ft), Palm Haven (one unit sold at a median price of $654 per sq ft) and The Waterline (one unit sold at a median price of $654 per sq ft). Meanwhile, in 2021, a total of 169 condominiums were sold at a median price of $1,167.03 per sq ft. Again, The Minton is the most popular condominium with 53 units sold at a median price of $1,115.13 per sq ft. This represents a price appreciation of 2.21 per cent over five years. Second in place is Kovan Residences (22 units sold at a median price of $1,477.36 per sq ft), representing a price appreciation of 32.60 per cent over the same period. Tied in third place are Kovan Melody and Kovan Regency (21 units each sold at a median price of $1,186.86 and $1,448.67 per sq ft respectively) with a capital appreciation of 16.70 per cent and 11.09 per cent respectively when compared to 2016. The fourth bestselling project was Parc Vera with 15 units sold at a median price of $1,028.47 per sq ft, representing a price appreciation of 7.58 per cent over the same period. This was followed Terrasse where 12 units were transacted at a median price of $1,084 per sq ft in 2021 - a capital appreciation of 7.75 per cent over the same period. When compared to the median transacted price of $1,012.24 per sq ft in 2016, Hougang witnessed price appreciation of 15.29 per cent ($1,167.03 per sq ft in 2021) over five years, earning it second place. By 2030, this could go higher as Hougang MRT station will be upgraded to an interchange station with the CRL. The Land Transport Authority (LTA) anticipates more than 100,000 households will benefit from this new line which will make Hougang even more attractive for investors. #3: Sengkang Just across the Tampines Expressway (TPE) from Punggol is Sengkang. Served by two MRT stations (Buangkok and Sengkang) and a network of LRT stations, Sengkang is considered the most populous planning area in the North-East Region. In 2016, a total of 12 units had changed hands at a median transacted price of $965.79 per sq ft. Leading the pack is The Quartz (seven units sold at a median price of $877.86 per sq ft), followed by The Luxurie (four units sold at a median price of $1,123.50 per sq ft) and Riversound Residence (one unit sold at a median price of $962 per sq ft). Meanwhile, in 2021, a total of 169 condominiums were sold at a median price of $1,135.47 per sq ft. La Fiesta is the most popular condominium with 55 units sold at a median price of $1,263.53 per sq ft followed by Flo Residence with 36 units changing hands at a median price of $971.17 per sq ft. Third in place is The Luxurie (34 units sold at a median price of $1,167.88 per sq ft). When compared to 2016, it saw a capital appreciation of 3.95 per cent. This was followed by Riversound Residence where 28 units were transacted at a median price of $1,001.11 per sq ft (a capital appreciation of 4.07 per cent), and Jewel @ Buangkok (27 units at a median price of $1,326.11 per sq ft). Fifth in place is The Quartz and Rivervale Crest where 24 units each were transacted at a median price of $1,026.71 and $753.88 per sq ft in 2021. For The Quartz, this represents a price appreciation of 16.97 per cent over five years. For the entire Sengkang area, the median transacted price in 2021 is $1,070.91 per sq ft, representing a price appreciation of 10.88 per cent since 2016. By 2040, a new MRT station may be added to Sengkang which will improve its connectivity further to the rest of the island. According to Land Transport Master Plan 2040, there is a possibility that an eighth MRT line will run from Woodlands to the Greater Southern Waterfront with a station passing through Sengkang. Estimated to be about 30 km long, the line will potentially benefit 400,000 households, if the plan were to materialise. This could uplift property prices further. #4: Serangoon Though Serangoon is located closer to the city and is served by Serangoon MRT interchange station that connects to the Circle Line and North East Line, the private property sector lags behind those of Punggol, Sengkang and Hougang. In fact, it is the only area in District 19 that recorded negative growth. In 2016, a total of 20 units were sold at a median price of $1,113.48 per sq ft. Chiltern Park is the most popular project (seven units sold at a median price of $989 per sq ft), followed by Cardiff Residence (four units sold at a median price of $1,308.2 per sq ft), Casia Cambio and Chuan Park (three units each sold at a median price of $1,420.66 and $752.67 per sq ft respectively) and Casa Rosa (one unit sold at a median price of $837 per sq ft). In 2021, a total of 73 units were sold, comprising 27 units at Boathouse Residences (at a median price of $1,049.26 per sq ft), 12 units at Cardiff Residence (at a median price of $1,301.33 per sq ft), nine units at Chiltern Park (at a median price of $1,054.44 per sq ft), seven units each at Casa Cambio and Cherryhill (at a median price of $1,366.42 and $1,105.86 per sq ft respectively), five units at Amaranda Gardens (at a median price of $1,492 per sq ft), four units at Chuan Park (at a median price of $1,013.25 per sq ft) and two units at Casa Rosa (at a median price of $1,005.50 per sq ft). When compared to 2016, Cardiff Residence, Chiltern Park and Casa Cambio witnessed a price depreciation of 0.53, 30.24 and 3.97 per cent respectively. Meanwhile, Casa Rosa, Cherryhill and Chuan Park saw a price appreciation of 20.13, 11.82 and 34.62 per cent respectively. For the entire Serangoon area, the median transaction price in 2021 was $1,043.12 per sq ft, representing a capital depreciation of 6.75 per cent over 5 years. Under the URA Master Plan 2019, the URA envisages Serangoon Central to be “the heart of the North East region with excellent connectivity via the North-East Line, Circle Line, and Serangoon Bus Interchange.” However, there are no plans so far for Serangoon’s rejuvenation nor any new infrastructure developments under the master plan. This could be a dealbreaker for property investors looking for potential upsides. Summary Based on our analysis, it may be an opportune time to either sell your condominium or invest in one in Punggol. This is because there are potentially new upsides arising from the completion of the Punggol Digital District, Punggol Coast MRT station and the upgraded Punggol MRT interchange station to the CRL. The URA Draft Master Plan 2019 anticipates Punggol Digital District to be a new smart city by 2023 that will create around 28,000 jobs. The innovation hub is expected to house technology firms involved in key growth fields as well as the new Singapore Institute of Technology Campus. That’s not all. The LTA expects the new Punggol Coast MRT station to provide enhanced connectivity to the rest of the island via the CRL which will link Punggol Digital District to Jurong Lake District and Changi by around 2030. Collectively, all these infrastructure projects are expected to have a positive spillover impact for Punggol. Interested to sell your condominium or buy one in Punggol? I’m here to help. Contact me for a non-obligatory chat. |

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed