|

A step-by-step guide to finding affordable housing for low-income families By Khalil Adis Finding a suitable home in Singapore can be a daunting task, especially for low-income families. As an experienced real estate agent, I recently helped a family of five upgrade from a public rental flat to a 3-room HDB flat in Jurong West. Here's how I did it. Step 1: Work out their total cash, CPF, and HDB loan Firstly, I sat down with them to find out their available CPF, cash, and HDB loan. We established a total of $30,000 in CPF, $2,000 in cash, and $180,000 in HDB loan. Step 2: Identify grants they are eligible for We identified three grants that they qualified for: Family Grant ($80,000), Enhanced Housing Grant ($65,000), and Proximity Housing Grant ($20,000), totalling $165,000 in CPF Grants. Step 3: Work out their total housing budget After combining their available funds with the CPF Housing Grants, their total housing budget amounted to $377,000. With 3-room HDB flats in most estates transacting above $400,000, we had to search for older resale flats. Step 4: Narrow down to HDB estates close to their parents The family's parents live in Jurong West, and we found an older 3-room HDB flat in the same estate that fell within their budget. I managed to negotiate the deposit down from $5,000 to $1,500. Conclusion In conclusion, while the HDB resale market is at a record high, there are still affordable flats available, and there are various CPF Housing Grants that you may be eligible for.

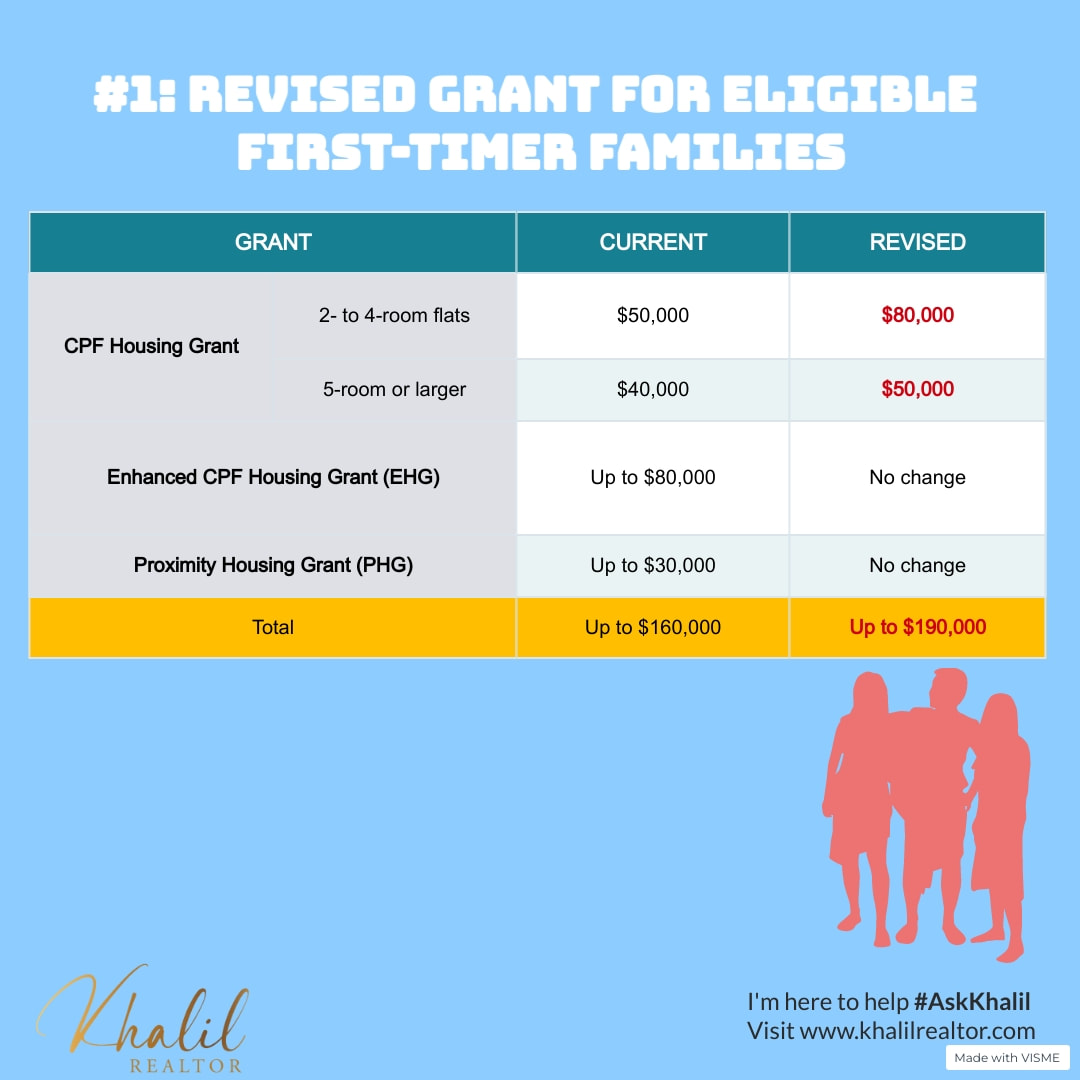

The recent Budget 2023 announcement to increase the Family Grant for 4-room and below HDB flats from $50,000 to $80,000 is a welcome move to reduce the cost of purchase. With a little research and negotiation skills, low-income families can also upgrade their homes and enjoy better living conditions.

0 Comments

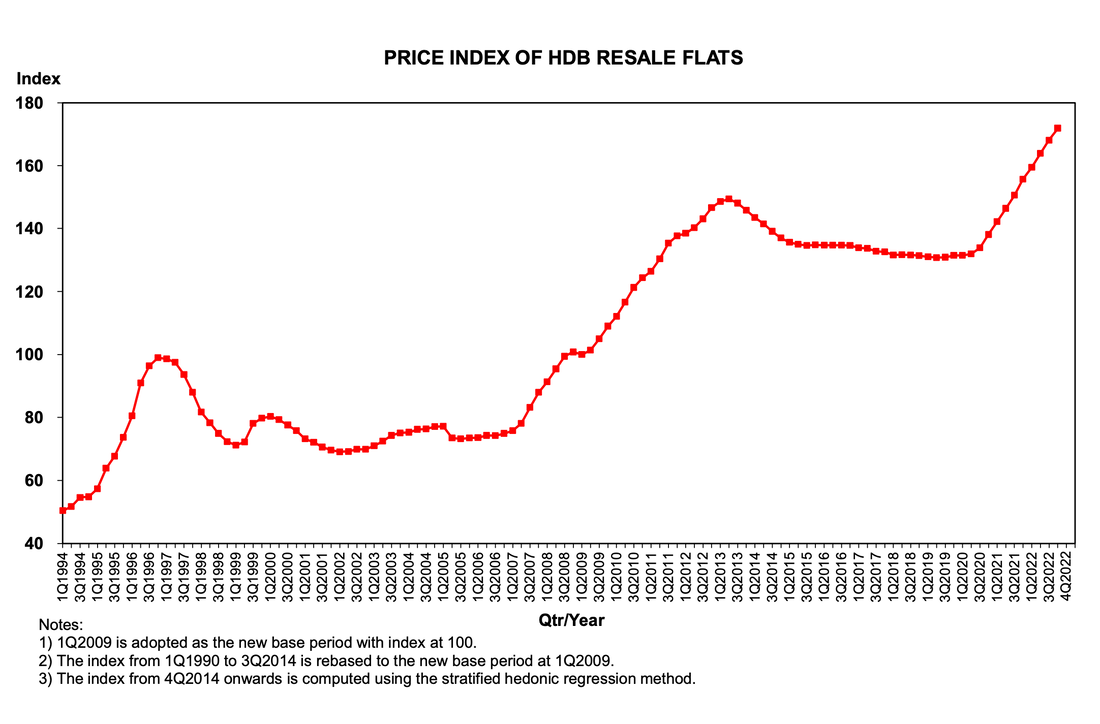

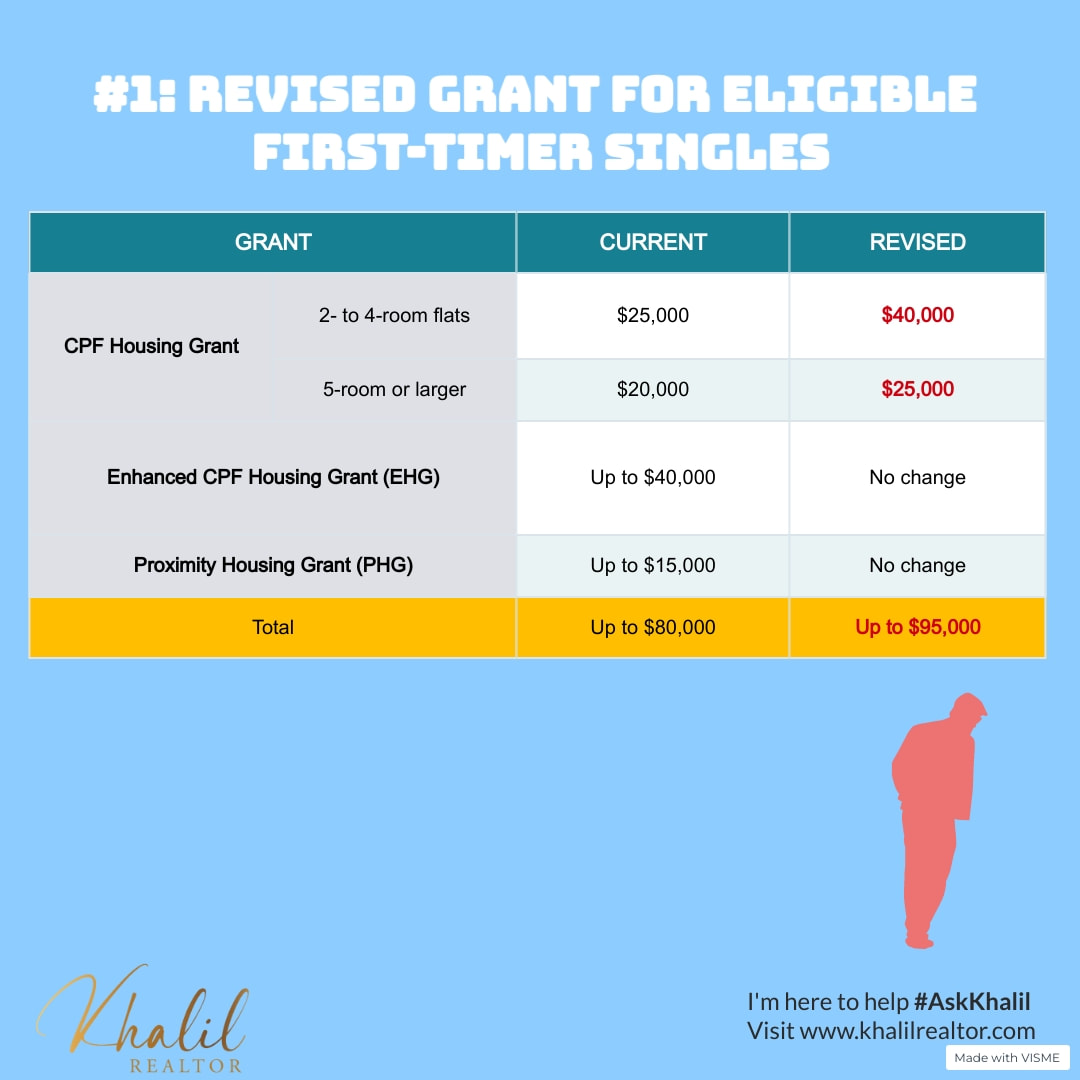

First-timers households and singles can get up to $190,000 and $95,000 in CPF Housing Grants respectively. Khalil Adis If you are looking to buy a resale HDB flat but are concerned about whether you can afford it, fret not. Announced as part of Budget 2023 on 14 February 2023, more help is on the way for first-time homebuyers be they singles or families. In the face of inflation and rising property prices in Singapore, the government has allocated more housing subsidies to make public housing more affordable and accessible for young families buying their first homes “Against the backdrop of the broad-based increase in demand for housing in recent years, these measures will help more families with children and young married couples own their first home,” said the Ministry for National Development and Housing & Development Board in a joint statement. Here are three things first-time homebuyers can look forward to: #1: Increased CPF Housing Grant for first-timers households First-timers households buying resale 2- to 4-room flats will receive up to $80,000 up from $50,000. Meanwhile, those buying 5-room or larger flats will receive up to $50,000 up from $40,000. When including the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG), families can enjoy up to $190,000 in CPF Housing Grants. #2: Increased CPF Housing Grant for first-timers singles First-timers singles buying resale 2- to 4-room flats will receive up to $40,000 up from $25,000. while those buying 5-room or larger flats will receive up to $25,000 up from $20,000. When including the Enhanced Housing Grant (EHG) and Proximity Housing Grant (PHG), singles can enjoy up to $95,000 in housing subsidies. #3: Greater priority for first-timers families First-timers families with children and young married couples aged 40 years and below who are buying their first home will be given greater priority during their Built-To-Order (BTO) applications. According to HDB and MND, this will be implemented later this year. This category of first-timers will receive additional support in securing their flats via an additional ballot chance for their BTO applications. “More details of the scheme as well as eligibility criteria will be shared at the Ministry of National Development Committee of Supply debate,” said the MND and HDB in their joint statement. Rising property prices Property prices in the Lion City have been on the uptrend figures from the HDB showed. According to HDB’s fourth quarter of 2022 data, the Resale Price Index (RPI) is at 171.9 points which is an increase of 2.3 per cent over that in the third quarter of 2022. While the RPI has been rising, HDB notes that this is a slower increase than the 2.6 per cent increase in the third quarter of 2022. It is worth noting that this is the slowest increase in the past year. Meanwhile, the median price for 4-room HDB flats in Queenstown is the most expensive at $870,000 while those in Jurong East are the cheapest at $465,000. While prices have been rising, resale transactions fell by 12.6 per cent, from 7,546 cases transacted in the third quarter of 2022 to 6,597 cases in the fourth quarter of 2022. No impact on the price of resale HDB market While the budget is generous, it will not have a significant impact on the price of resale HDB flats.

This is because the price is determined by demand and supply. Rather, the slew of new measures aims to reduce the cost of public housing ownership via the various subsidies, if applicable. Nevertheless, with HDB committed to launching up to a total of 100,000 flats from 2021 to 2025, we could see resale flat prices correcting this year onwards. More leasing activities are reported as the office market starts to pick up post-COVID-19. However, tenants are also very specific in their office space requirements. By Khalil Adis In May 2022, I secured my very first corporate leasing deal. Although I was elated to finally secure a tenant for the landlord, it was not an easy process especially since the office market was affected by Covid-19. I was faced with a challenging period when marketing the office space in late 2021 as Singapore was battling the delta variant then. While interest in office space at first increased, the Omricon variant threw the wrench for potential tenants looking for office space in November 2021. As a result, enquiries started to decrease until the early part of 2022. Fast forward, a year ahead, the office leasing market appears to pick up steam as more employees returned to work. Data from CBRE confirmed this showing strong positive office net absorption in the third quarter of 2022, bringing the year-to-date take-up to 0.56 million sq ft and surpassing the total take-up of 0.32 million sq ft for the whole of 2021. “Key demand drivers are expansions by tech firms, flexible workspace operators and non-banking financial companies, which took up significant secondary office space in the Core CBD (Grade A). Fresh pre-commitments to upcoming new projects such as Guoco Midtown and Central Boulevard Towers were also inked during the quarter,” its research notes. Broad-based demand in all micro markets In addition to the growth sectors, CBRE notes that tenant displacement from planned redevelopments such as Clifford Centre and Robinson Point has also contributed to a broad-based recovery. According to the firm, islandwide vacancy declined further to 4.9 per cent in the third quarter of 2022 from the previous high of 6.8 per cent from the same period last year. “Despite hybrid working arrangements likely to stay, total leasing volume from renewals, new setups and expansion over the past three quarters has been resilient, a testament that physical office still plays an integral role in the workplace ecosystem,” CBRE’s research cites. With more leasing activities reported in the third quarter, here are the five things corporate tenants look for in an office space. #1: A prestigious address From my experience, certain tenants, particularly those in the banking, real estate, energy, legal and tech sectors, would only look for a prestigious office address right in the CBD. This is because their corporate image is important especially since they mostly deal with multinational companies and government agencies. Some are also particular about the look and feel of the building’s main lobby as they may sometime hold meetings with important clients in their office. Others cite improving their staff’s morale and confidence in the company when having a prestigious Grade A CBD address. #2: Accessibility Accessibility is also a key consideration for corporate tenants as most of their staff rely on public transportation while some drive to work. Therefore, being connected within walking distance to the MRT stations and expressways are important. As the office unit that I was marketing is located within the CBD, accessibility is not an issue as it well-served by various train stations such as Tanjong Pagar and Raffles Place MRT stations on the East-West and North-South Line, Chinatown, Telok Ayer MRT stations and Downtown on the Downtown Line as well as newly opened Maxwell and Shenton Way MRT stations on the Thomson-East Coast Line. The office building is also easily accessible via the Ayer Rajah Expressway (AYE), Marina Coastal Expressway (MCE), Central Expressway (CTE) and East Coast Parkway (ECP) for those who drive. #3: Amenities Amenities or the lack of them can either make or break an office leasing requirements for a corporate tenant. Some of the important amenities they look for include banking, dining, hawker centres, clinics and car parking facilities. I recall one particular tenant who insisted on having several car parking lots. Unfortunately, due to the limited car parking space for season parking holders, this proved to be difficult. If you require ample car parking space, then make sure you ask the agent in advance to check with the building management before asking for a viewing. #4: A column-free space A column-free space ranks highly as it enables the potential tenant to use the entire space efficiently. This is from my experience when conducting viewings on the ground. This is because such space offers them flexibility in how they would like to utilise the space just like drawing from a blank canvas. You can ask the agent for a copy of the floor plan so you can plan the office planning with your interior designer. #5: Facilities With an increased emphasis on staff’s mental health and wellness, I noticed that corporate tenants now prefer office buildings that offer recreational facilities such as green, open spaces, gyms or swimming pools where their staff can feel relaxed.

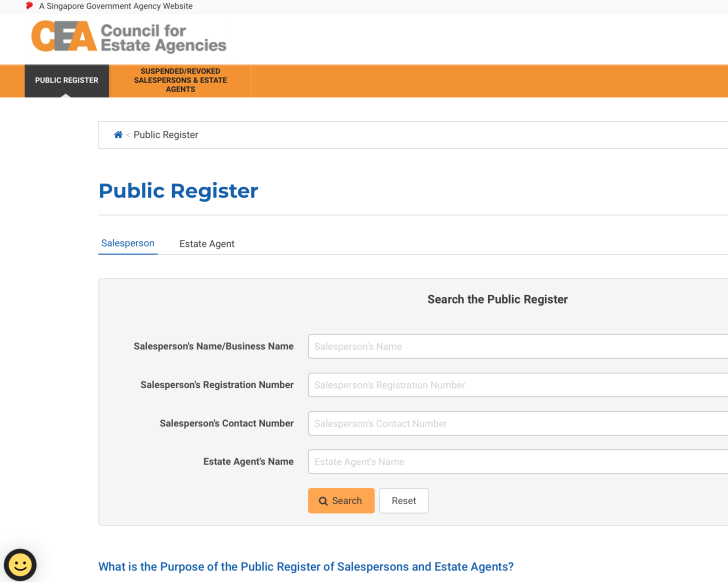

As one potential tenant puts it, “when an office feels like home, our staff are more likely to be comfortable and productive at their workplace. With many rental scams out there, here are the checks to protect yourself as a tenant. By Khalil Adis The September 2022 cooling measures will translate to a red-hot property market as ex-private property owners will now have to wait out a 15 months period before they can buy a resale HDB flat. This means demand in the rental market for both both private properties and HDB flats will pick up in the coming months ahead. Unfortunately, rental scams appear to also be on the rise. According to the Singapore Police Force (SPF), there were at least 144 victims of such scams who had lost around S$190,000 since January 2022. Modus operandi As the rental market heats up, scammers are taking advantage of the situation by posting fake listings on social media to lure unsuspecting tenants. Such listings are often too good to be true, depicting beautiful apartments at bargain prices. However, there is one catch. In order to secure viewings, the bogus property agents will often ask potential tenants to transfer money. This is where potential tenants may lose their monies. They will also ask you to send a copy of your identification card to confirm your viewing. Such requests are in fact dubious and not in line with market practice. They may also open you to identity thefts. 4 due diligence checks that you must do as a tenant To prevent yourself from being scammed, here are the four thing you must do: #1: Do not transfer any monies for viewings Instead, you should request for a physical viewing to verify that the property does indeed exist. #2: Verify the agent is registered with Council for Estate Agencies (CEA) If you are dealing with an agent, ask for the agent’s registration number. You can also check the agent’s details via CEA’s Public Register here. #3: Ask for proof of ownership Whether you are dealing with the agent or landlord, you should ask for proof of ownership of the rightful owner before transferring the earnest deposit. The earnest deposit is usually transferred directly to the landlord’s bank account along with the Letter of Intent (for a private property rental). For HDB flats and private properties, this can be done via INLIS here. For HDB flats only, you can request for the proof of ownership via MY HDBPage. If you are renting a property that is owned by a company, you should ask for their business profile or purchase it via BizFile here. The address of the directors of the company must match the address as reflected in INLIS or MY HDBPage. #4: Do not transfer monies to the agent Under CEA’s guidelines, for rental of HDB flats, agents are not allowed to hold any monies.

The deposit is typically equivalent to one or two months rent for a 1- or 2-year lease respectively. Upon signing the Tenancy Agreement, tenants will then have to transfer the one month’s advance rental. Property prices are expected to correct in the months ahead which may favour buyers. Meanwhile, the rental market is expected to heat up further. By Khalil Adis On 30 September 2022, the Singapore government announced various property cooling measures that are aimed at ensuring prudent borrowing and moderating demand. Indeed, the HDB Resale Price Index (RPI) and Private Property Index (PPI) as of the third quarter of 2022 are now at record highs at 168.1 and 187.8 points respectively. This means that first-time homebuyers are finding both HDB flats and private properties to be severely unaffordable. Meanwhile, potential sellers see this as an opportune time to profit from the red-hot property market. With this in mind, the government has had to intervene to ensure property prices remain affordable and are in tandem with wages. The measures include the following four-pronged approach:

How they may impact you as a consumer: For point 1, you will have to have a higher monthly combined income and pay a higher monthly mortgage and combined income . However, the actual interest rates charged will be determined by the private financial institutions. For point 2, the stress test has been increased to 3 per cent when calculating your monthly mortgage but with a reduced Loan-to-Value (LTV) limit at 80 per cent. This is to ensure your monthly mortgage remains affordable and within the 30 per cent Mortgage Servicing Ratio (MSR). On the overall, with a higher downpayment of 20 per cent, it will result in a lower mortgage payment when compared to an LTV limit of 85 per cent. However, this will not affect the actual HDB concessionary interest rate, which will remain unchanged at 2.6 per cent per annum. For point 3, buyers will need to come up with a higher cash and/or CPF amount (an increase of 5 per cent) to make up the 20 per cent downpayment. For example, for an $500,000 HDB flat, you will need to come up with $100,000 (80 per cent LTV) as opposed to $75,000 (85 per cent LTV). This means an additional cash and/or CPF outlay of $25,000. For point 4, this will mean sellers will have to rent either an HDB flat or private property during the interim period. This will result in increased demand in the rental market which will push asking prices further. According to data from the Urban Redevelopment Authority (URA), rentals of private residential properties had increased by 8.6 per cent in the third quarter to reach 137.9 points from 127.0 points in the second quarter of 2022. Meanwhile, HDB rentals have increased by around 30 per cent. Looking ahead, the rental market is expected to strengthen further which will favour landlords. Summary For buyers who are looking to buy a resale HDB flat or private property, you might want to wait out until their prices correct.

For sellers, you only have a small window period to take advantage of the exuberant market before it cools in the coming months. For landlords, the market will favour you due to increasing demand from existing tenants and ex-private property owners who have already sold their homes. For tenants, you will have to set aside more budget as rentals have now increased by around 30 per cent. The unit received several offers signifying a robust rental market. By Khalil Adis A 2-bedroom unit at The Paterson Edge has been successfully tenanted at an above average median price when compared to similar sized units.

Data from the Urban Redevelopment Authority (URA) showed that 17 2-bedroom units at The Paterson Edge were transacted at an average price of $4,501 per month from January to June 2022. The highest transacted price was $6,151 per month in March 2022 followed by $6,000 per month in May 2022. Measuring 990 sq ft, the unit received several offers signifying a robust rental market. Situated within walking distance to the shopping belt of Orchard Road and right opposite the upcoming Orchard MRT station via the Thomson East Coast Line (TEL), The Paterson Edge is located in a prestigious neighbourhood. A low-density development that has often been described as a "doll house”, The Paterson Edge offers discerning families or individuals a quiet, private retreat while being a stone throw's away to luxury boutiques, high-end stores, shopping malls, supermarkets and top-notch medical centres. This mid-floor unit is located at the corner to ensure the utmost privacy. The unit comes with Miele refrigerator & freezer, Miele cooker hood/hob, built in refrigerator & freezer, built in conventional oven, built in wardrobe, curtains and blackouts, roller blinds and energy saving lighting features. The unit has been property maintained and is in good condition. Facilities at The Paterson Edge include a swimming pool, gym, covered carpark and 24-hour security |

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed