|

8/16/2023 Consider upgrading to a condo? Mass market condominiums in the Outside Central Region (OCR) may be your perfect choiceRead NowData from the Urban Redevelopment Authority (URA) suggests that it is the best-performing sector. By Khalil Adis If you are contemplating a move to a condo, the next few months present a promising window of opportunity, government statistics showed. The second quarter of 2023 data from the Urban Redevelopment Authority (URA) suggests that HDB upgraders and investors seeking condominiums in the Outside Central Region (OCR) should take note of the best-performing sectors. Let’s delve into the latest URA findings, explore the reasons behind the success of mass market condos, and showcase notable condo launches and resales that have caught the attention of potential buyers. Private Property Index (PPI) and Resale Price Index (RPI). The second quarter of 2023 data from URA reveals intriguing insights. The Private Property Index (PPI) saw a marginal decline of 0.2 per cent, reaching 194.4 points. This marks the first dip since the first quarter of 2020 for the index, which tracks price movements in the private property market. Concurrently, the Housing & Development Board's (HDB) Resale Price Index (RPI) showed a 1.5 per cent uptick in the second quarter of 2023 compared to the previous quarter, reaching 176.2 points. This trend indicates a narrowing price gap between resale HDB flats and private properties, favouring HDB upgraders. Mass market condominiums: The leading performers Why are mass market condominiums in the OCR stealing the spotlight? These condos have proven to be the best-performing sector, outpacing their counterparts in the Rest of Central Region (RCR) and Core Central Region (CCR). Mass market condos, strategically situated in the Outside Central Region (OCR), boast affordability and local buyer appeal. Notably, their PPI surged to 225.0 points, surpassing those in RCR and CCR. The upward index signifies robust demand for these condos, driven by their strategic locations and reasonable pricing. Key drivers of mass market condo success The popularity of mass market condos can be attributed to several factors. These condos, situated in the suburbs, have captured the interest of local buyers, including first-time buyers and HDB upgraders. In contrast to prime condos, which attract speculators and foreigners, mass market condos remain unaffected by the higher Additional Buyer's Stamp Duty (ABSD) implemented in April 2023. This distinction has contributed to sustained demand among Singaporean buyers, rendering these condos resilient to market cooling measures. Highlighting top condo launches in Q3 2023 According to data from Propnex, these are the three most popular mass market condo launches ranked by volume in the third quarter of 2023: 1. Lentor Hill Residences Nestled in District 20 (Mandai / Upper Thomson), this 99-year leasehold development offers 598 units ranging from one- to four-bedroom layouts. With prices starting at $2,028 per sq ft for a one-bedroom unit, a significant 88.5 per cent of buyers are Singaporean residents. Nearby amenities include Lentor Hill MRT station, Anderson Primary School, CHIJ St Nicholas Girls’ School, Mayflower Primary School, Mayflower Secondary School, Anderson Serangoon Junior College, Nanyang Polytechnic, AMK Hub and Thomson Plaza. 2. The Myst Crafted by City Developments Limited (CDL), The Myst features 408 units across two 24-storey blocks. Priced at an average of $2,070 per sq ft, The Myst showcases one-bedroom study to five-bedroom units, spanning around 517 sq ft to 2,034 sq ft. Conveniently located MRT stations and reputable schools further enhance its appeal. Nearby MRT stations include Cashew MRT station and the upcoming Cross Island Line. There are also several good schools located within a 1km radius of the development such as CHIJ Our Lady Queen of Peace, Bukit Panjang Primary School and Zhenghua Primary School. Other nearby amenities include Bukit Panjang Integrated Transport Hub, Hillion Mall, Bukit Panjang Plaza and Junction 10. Nature lovers will be thrilled to know that The Myst is located at the doorstep of The Rail Corridor and Bukit Timah Nature Reserve. 3. Lentor Modern Found in District 23 (Upper Thomson and Springleaf), Lentor Modern stands as the inaugural integrated mixed-use development in the Lentor precinct, directly linked to Lentor MRT station. Comprising three 25-storey towers, this 99-year leasehold development offers 605 residential units, ranging from 1- to 4-bedroom apartments, with extensive facilities and sky terraces in each tower. Priced at an average of $2,087 per sq ft, the majority (91.1 per cent) of buyers are Singaporean residents. Noteworthy mass market resale condos in Q3 2023 Data from Propnex, showed that these are the five most popular mass market condo launches ranked by volume in the third quarter of 2023: 1. Kingsford Waterbay Situated in District 19 (Serangoon), Kingsford Waterbay features 1 to 5-bedroom penthouses and cluster homes. With 11 transactions in the third quarter of 2023 at an average price of $1,399 per sq ft, its proximity to reputable schools contributes to its popularity. These schools include CHIJ Our Lady of the Nativity, Holy Innocents’ Primary School, Montfort Junior School, Holy Innocents’ High School, Montfort Secondary School and CHIJ St. Joseph’s Convent. 2. High Park Residences Positioned in District 28 (Sengkang), High Park Residences offers 1,390 units spanning 1- to 5-bedroom layouts, recording eight transactions with a median price of $1,523 per sq ft. Conveniently sited next to Thanggam LRT and four stops to Sengkang MRT stations, High Park Residences is within close proximity to Seletar Aerospace Park, food & beverage joints at Jalan Kayu, Seletar Mall, Compass Point Shopping Centre and Greenwich V. This 99-year leasehold development is popular among Singaporeans which make up 80.7 per cent of its buyers. 3. Parc Botannia In District 28 (Sengkang), Parc Botannia secured third place with seven transactions at a median price of $1,603 per sq ft. Its prime location and lush surroundings attract buyers seeking a serene living environment. There are many reputable local and international schools located near Park Botannia such as Lycee Francais De Singapour, Gems World Academy (Singapore), Hillside World Academy, Fernvale Primary School, Anchor Green Primary School and Nan Chiau Primary School. All the above factors could perhaps explain why this condominium is the third most popular mass market development. 4. The Glades Located in District 16 (Bedok), The Glades recorded seven transactions at a median price of $1,646 per sq ft. This 99-year leasehold development appeals to both Singaporeans and Permanent Residents. Located next to Tanah Merah MRT station and one stop away from the Expo, The Glades comprises 726 units ranging from 1 to 5-bedroom penthouses. The Glades is especially popular among Singaporeans and Permanent Residents who make up 69.3 per cent and 22 per cent of its buyers respectively. Nearby amenities include Bedok Mall, Bedok Point, Eastpoint Mall and Changi City Point. Popular schools located nearby include Temasek Primary School, Temasek Secondary School, Anglican High School, Temasek Junior College and Temasek Polytechnic. 5. Treasure at Tampines In District 18 (Tampines), Treasure at Tampines emerges as the fifth best-selling mass market condominium development, with six units sold at a median price of $1,605 per sq ft.

Treasure at Tampines is a high-density development with 29 twelve-storey residential blocks. Units range from 1 to 5 bedrooms starting from 463 square feet to 1,345 square feet with full condominium facilities. Treasure at Tampines is located close to several good schools such as Temasek Polytechnic, Singapore University of Technology, Angsana Primary School and Tampines Junior College. Nearby shopping malls include Tampines Mall, Century Square, Tampines One and Eastpoint Mall. Conclusion For HDB upgraders and investors exploring condo options, mass market condominiums within the Outside Central Region (OCR) offer a promising avenue. URA's second quarter of 2023 data underscores their resilience and growth, positioning them favourably against prime condos. With various developments available, such as Lentor Hill Residences, The Myst, and more, now is a prime time to evaluate these opportunities and capitalise on their potential benefits.

0 Comments

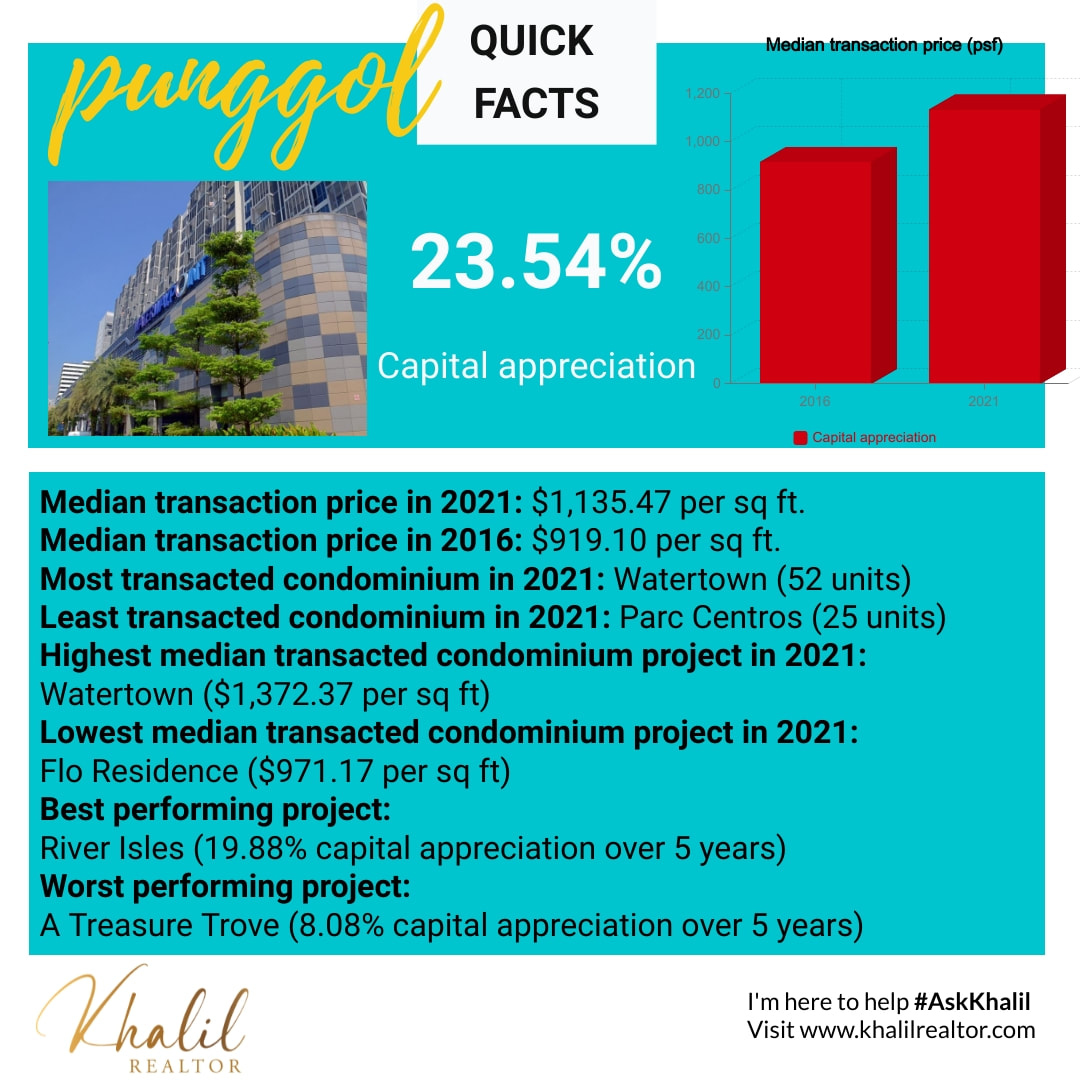

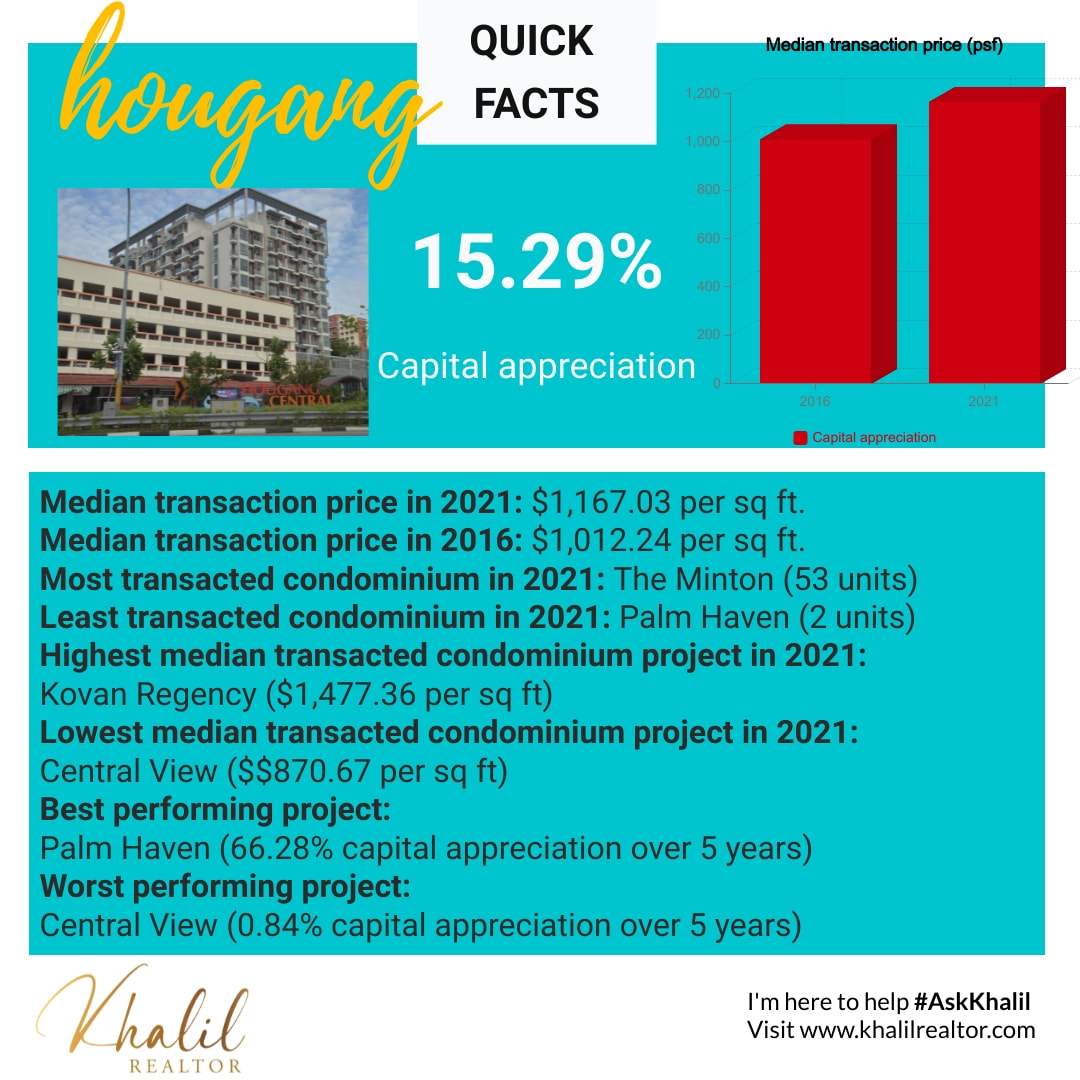

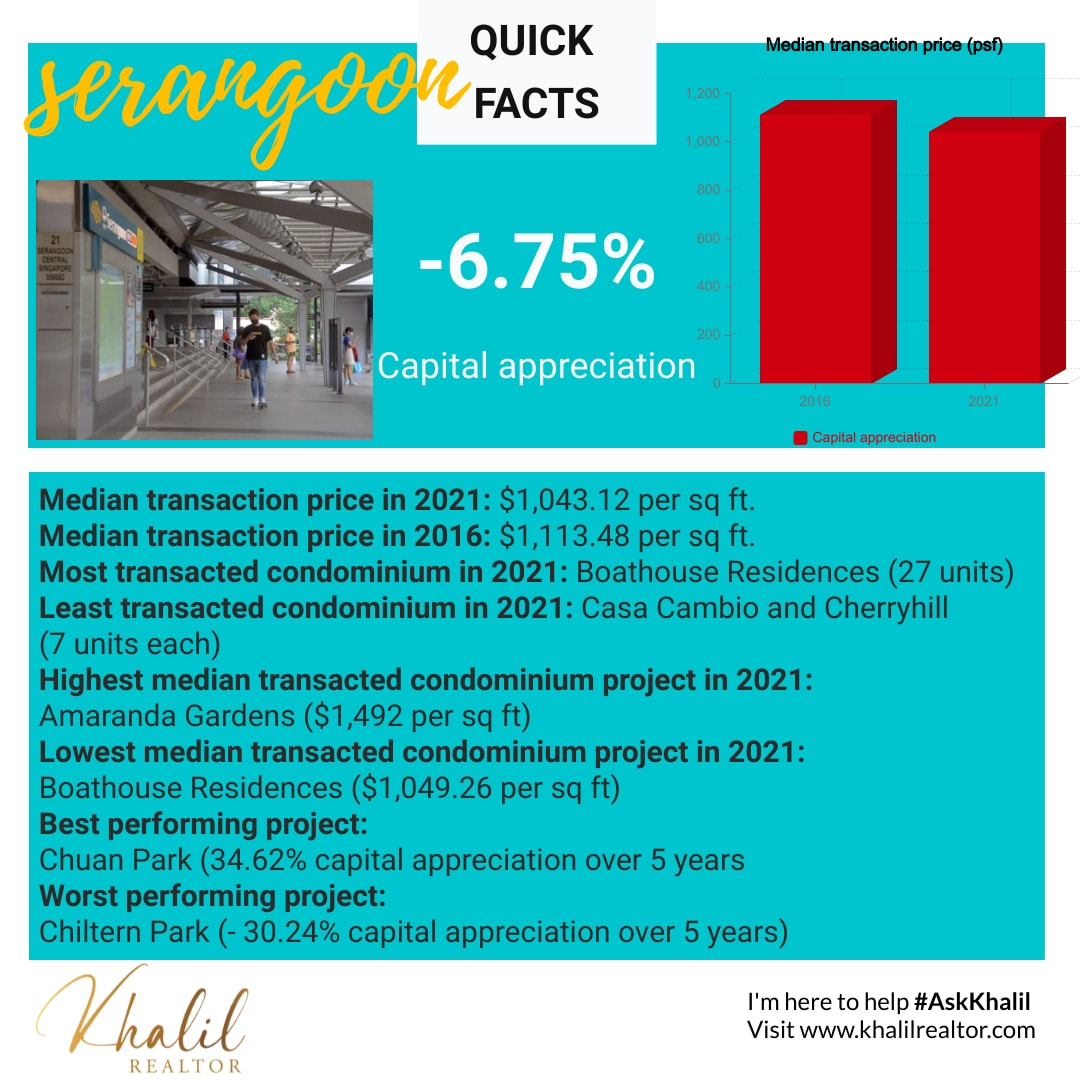

10/6/2021 How have condominiums in Punggol fared in 2021 and what should you do as a seller?Read NowAccording to data from the Urban Redevelopment Authority (URA), condominiums in Punggol experienced the most capital appreciation over 5 years in District 19 while Serangoon is the worst faring neighbourhood. Read on to find out more. By Khalil Realtor If you are a condominium owner in Punggol, this may be the right time to sell your property. This is because condominiums in Punggol enjoyed the highest capital appreciation in District 19, data from the Urban Redevelopment Authority (URA) showed. According to resale transactions that we had analysed based from 2016 and up to 15 September 2021, condominiums in Punggol enjoyed the highest capital appreciation at 23.54 per cent. This is higher than the average growth that was recorded in the entire District 19. Coming second place are condominiums that are located in Hougang which saw a capital appreciation of 15.29 per cent followed by Sengkang at 10.88 per cent. The worst faring area is Serangoon which recorded a depreciation of 6.75 per cent over the same period. On the overall, District 19 saw 1,146 resale transactions at a median transacted price of $1,174.50 per sq ft in 2021. This represents a capital appreciation of 19.14 per cent over five years when compared to the 168 resale transactions recorded in 2016 at a median transacted price of $985.82 per sq ft. Let’s take a look in detail how each area have performed so far. #1: Punggol Despite its far-flung location, Punggol is the top performer in District 19. In 2016, 14 condominium units had changed hands. This comprises four units at River Isles and 10 units at A Treasure Trove that were transacted at a median price of $843 per sq ft and $995.20 per sq ft respectively. For the entire Punggol, the median transaction price recorded in 2016 was $919.10 per sq ft. Meanwhile, in 2021, a total of 189 condominiums were sold at a median price of $1,135.47 per sq ft. Watertown is the most popular condominium and where the highest median price was recorded with 52 units sold at a median price of $1,372.37 per sq ft. This was followed by A Treasure Trove with 47 units transacted at a median price of $1,075.62 per sq ft, representing a capital appreciation of 8.08 per cent over five years. Third in place is Flo Residence with 36 units changing hands at a median price of $971.17 per sq ft - the lowest recorded in Punggol. The fourth most popular condominium project is River Isles which saw 29 units sold at a median price of $1,010.64 per sq ft. When compared to 2016’s transaction data, this represents an increase of 19.88 per cent. Lastly, 25 units at Parc Centros were transacted at a median price of $1,2471.56 per sq ft. With the upcoming Punggol Coast MRT station, 7.3 kilometre Cross Island Line (CRL) – Punggol Extension and the Punggol Digital District, we can expect demand for condominiums to remain robust in Punggol. #2: Hougang Hougang is a mature township with plenty of good schools, amenities and delicious local hawker food located within the neighbourhood. Thus, it is no wonder it is one of the most sought after townships in District 19 ranking second in place in terms of capital appreciation. In 2016, a total of 39 units were sold at a median price of $1,012.24 per sq ft. The Minton leads the way with 11 units sold at a median price of $1,091 per sq ft, followed by Kovan Residences (six units sold at a median price of $1,114.17 per sq ft), Kovan Regency and Kovan Melody (five units each sold at a median price of $1,304 per sq ft and $1,017 per sq ft respectively), Terrasse (four units sold at a median price of $1,006 per sq ft), Parc Vera (two units sold at a median price of $956 per sq ft), Central View (two units sold at a median price of $878 per sq ft), Bliss @ Kovan (one unit sold at a median price of $1,386 per sq ft), Palm Haven (one unit sold at a median price of $654 per sq ft) and The Waterline (one unit sold at a median price of $654 per sq ft). Meanwhile, in 2021, a total of 169 condominiums were sold at a median price of $1,167.03 per sq ft. Again, The Minton is the most popular condominium with 53 units sold at a median price of $1,115.13 per sq ft. This represents a price appreciation of 2.21 per cent over five years. Second in place is Kovan Residences (22 units sold at a median price of $1,477.36 per sq ft), representing a price appreciation of 32.60 per cent over the same period. Tied in third place are Kovan Melody and Kovan Regency (21 units each sold at a median price of $1,186.86 and $1,448.67 per sq ft respectively) with a capital appreciation of 16.70 per cent and 11.09 per cent respectively when compared to 2016. The fourth bestselling project was Parc Vera with 15 units sold at a median price of $1,028.47 per sq ft, representing a price appreciation of 7.58 per cent over the same period. This was followed Terrasse where 12 units were transacted at a median price of $1,084 per sq ft in 2021 - a capital appreciation of 7.75 per cent over the same period. When compared to the median transacted price of $1,012.24 per sq ft in 2016, Hougang witnessed price appreciation of 15.29 per cent ($1,167.03 per sq ft in 2021) over five years, earning it second place. By 2030, this could go higher as Hougang MRT station will be upgraded to an interchange station with the CRL. The Land Transport Authority (LTA) anticipates more than 100,000 households will benefit from this new line which will make Hougang even more attractive for investors. #3: Sengkang Just across the Tampines Expressway (TPE) from Punggol is Sengkang. Served by two MRT stations (Buangkok and Sengkang) and a network of LRT stations, Sengkang is considered the most populous planning area in the North-East Region. In 2016, a total of 12 units had changed hands at a median transacted price of $965.79 per sq ft. Leading the pack is The Quartz (seven units sold at a median price of $877.86 per sq ft), followed by The Luxurie (four units sold at a median price of $1,123.50 per sq ft) and Riversound Residence (one unit sold at a median price of $962 per sq ft). Meanwhile, in 2021, a total of 169 condominiums were sold at a median price of $1,135.47 per sq ft. La Fiesta is the most popular condominium with 55 units sold at a median price of $1,263.53 per sq ft followed by Flo Residence with 36 units changing hands at a median price of $971.17 per sq ft. Third in place is The Luxurie (34 units sold at a median price of $1,167.88 per sq ft). When compared to 2016, it saw a capital appreciation of 3.95 per cent. This was followed by Riversound Residence where 28 units were transacted at a median price of $1,001.11 per sq ft (a capital appreciation of 4.07 per cent), and Jewel @ Buangkok (27 units at a median price of $1,326.11 per sq ft). Fifth in place is The Quartz and Rivervale Crest where 24 units each were transacted at a median price of $1,026.71 and $753.88 per sq ft in 2021. For The Quartz, this represents a price appreciation of 16.97 per cent over five years. For the entire Sengkang area, the median transacted price in 2021 is $1,070.91 per sq ft, representing a price appreciation of 10.88 per cent since 2016. By 2040, a new MRT station may be added to Sengkang which will improve its connectivity further to the rest of the island. According to Land Transport Master Plan 2040, there is a possibility that an eighth MRT line will run from Woodlands to the Greater Southern Waterfront with a station passing through Sengkang. Estimated to be about 30 km long, the line will potentially benefit 400,000 households, if the plan were to materialise. This could uplift property prices further. #4: Serangoon Though Serangoon is located closer to the city and is served by Serangoon MRT interchange station that connects to the Circle Line and North East Line, the private property sector lags behind those of Punggol, Sengkang and Hougang. In fact, it is the only area in District 19 that recorded negative growth. In 2016, a total of 20 units were sold at a median price of $1,113.48 per sq ft. Chiltern Park is the most popular project (seven units sold at a median price of $989 per sq ft), followed by Cardiff Residence (four units sold at a median price of $1,308.2 per sq ft), Casia Cambio and Chuan Park (three units each sold at a median price of $1,420.66 and $752.67 per sq ft respectively) and Casa Rosa (one unit sold at a median price of $837 per sq ft). In 2021, a total of 73 units were sold, comprising 27 units at Boathouse Residences (at a median price of $1,049.26 per sq ft), 12 units at Cardiff Residence (at a median price of $1,301.33 per sq ft), nine units at Chiltern Park (at a median price of $1,054.44 per sq ft), seven units each at Casa Cambio and Cherryhill (at a median price of $1,366.42 and $1,105.86 per sq ft respectively), five units at Amaranda Gardens (at a median price of $1,492 per sq ft), four units at Chuan Park (at a median price of $1,013.25 per sq ft) and two units at Casa Rosa (at a median price of $1,005.50 per sq ft). When compared to 2016, Cardiff Residence, Chiltern Park and Casa Cambio witnessed a price depreciation of 0.53, 30.24 and 3.97 per cent respectively. Meanwhile, Casa Rosa, Cherryhill and Chuan Park saw a price appreciation of 20.13, 11.82 and 34.62 per cent respectively. For the entire Serangoon area, the median transaction price in 2021 was $1,043.12 per sq ft, representing a capital depreciation of 6.75 per cent over 5 years. Under the URA Master Plan 2019, the URA envisages Serangoon Central to be “the heart of the North East region with excellent connectivity via the North-East Line, Circle Line, and Serangoon Bus Interchange.” However, there are no plans so far for Serangoon’s rejuvenation nor any new infrastructure developments under the master plan. This could be a dealbreaker for property investors looking for potential upsides. Summary Based on our analysis, it may be an opportune time to either sell your condominium or invest in one in Punggol. This is because there are potentially new upsides arising from the completion of the Punggol Digital District, Punggol Coast MRT station and the upgraded Punggol MRT interchange station to the CRL. The URA Draft Master Plan 2019 anticipates Punggol Digital District to be a new smart city by 2023 that will create around 28,000 jobs. The innovation hub is expected to house technology firms involved in key growth fields as well as the new Singapore Institute of Technology Campus. That’s not all. The LTA expects the new Punggol Coast MRT station to provide enhanced connectivity to the rest of the island via the CRL which will link Punggol Digital District to Jurong Lake District and Changi by around 2030. Collectively, all these infrastructure projects are expected to have a positive spillover impact for Punggol. Interested to sell your condominium or buy one in Punggol? I’m here to help. Contact me for a non-obligatory chat. |

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed