|

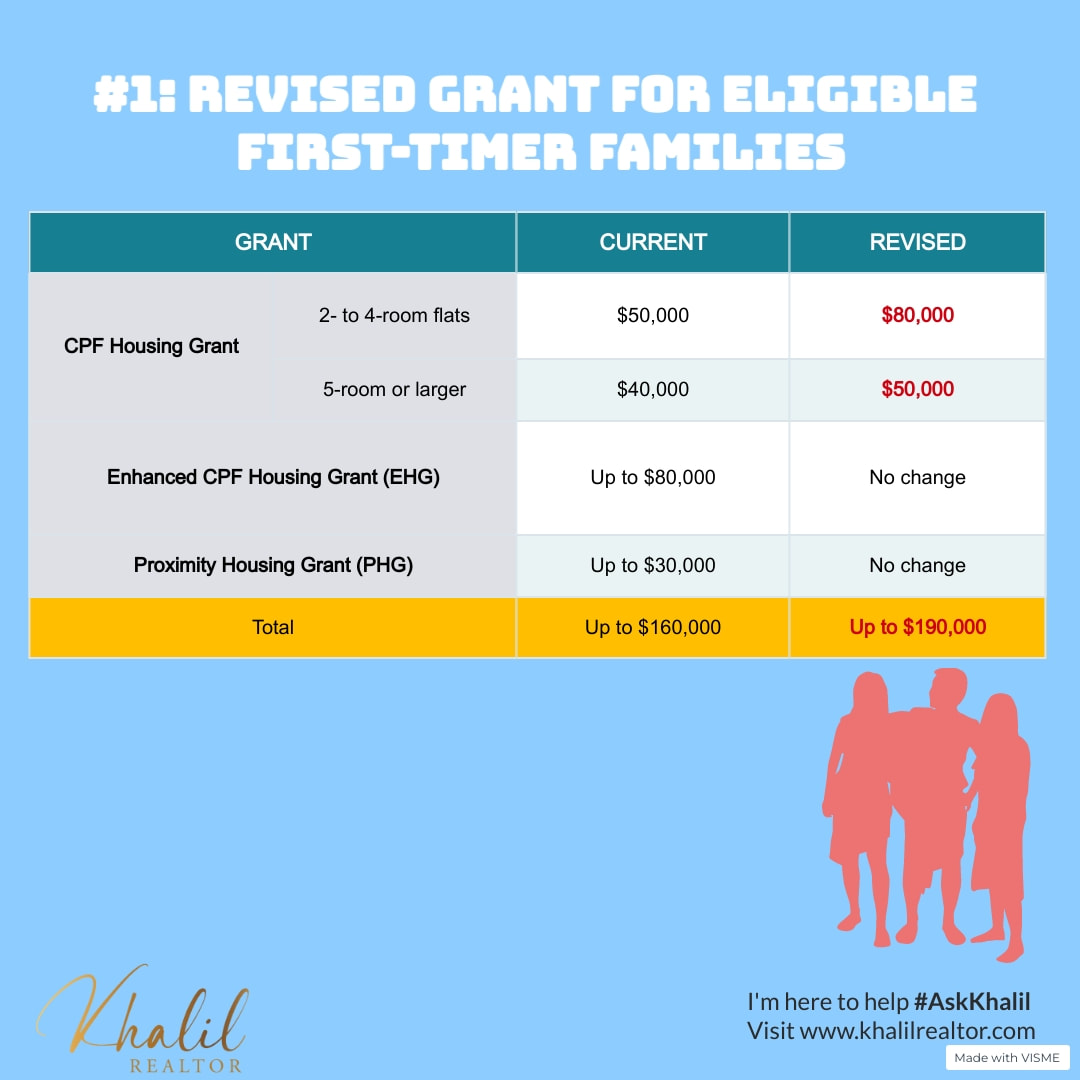

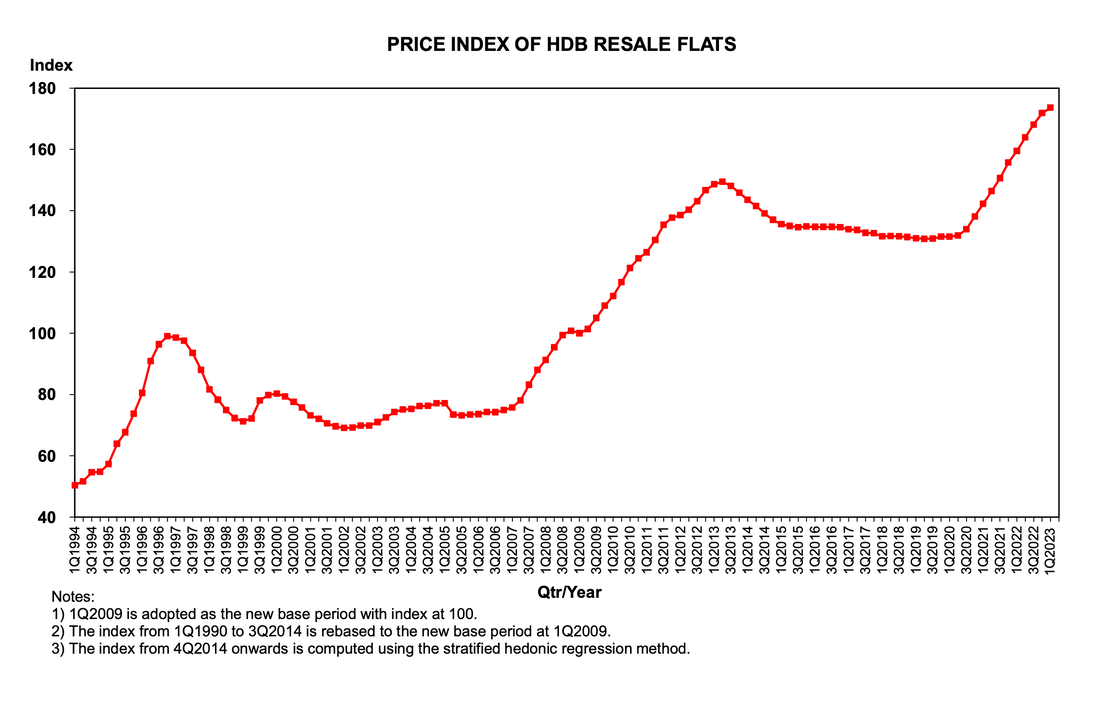

5/27/2023 From public rental flat to HDB part 2: How another family upgraded to a resale flat with my helpRead NowFinding a home within their means: Navigating the record high HDB resale market By Khalil Adis Imagine spending four long years in a cramped public rental flat, yearning for a bigger and better space to raise your child. That was the reality for Andy and Ruby (not their real names), a young couple determined to improve their living environment. With their aspirations set on a 4-room HDB flat, they sought my assistance in their quest. After three weeks of house hunting, we finally secured a resale flat in Sengkang without any cash-over-valuation (COV). Let me take you through the steps we followed. Step 1: Ensuring the basics: Intent to Buy and HDB Loan Eligibility (HLE) Our first priority was to ensure Andy and Ruby had registered their Intent to Buy and obtained the HDB Loan Eligibility (HLE) document. These two crucial documents were necessary for financial calculations and obtaining the Option to Purchase (OTP) from the seller's agent. Step 2: Crunching the numbers: Cash, CPF, and HDB loan We then worked together to determine the couple's available funds, including cash, CPF savings and the HDB loan. Their combined resources amounted to $58,000 in CPF, $2,000 in cash and a $364,000 HDB loan. Step 3: Exploring eligible grants To maximise their budget, we identified three grants they qualified for - the Family Grant ($80,000), Enhanced Housing Grant ($35,000), and Proximity Housing Grant ($20,000). These grants added up to an impressive $135,000 in CPF grants, providing a significant boost to their budget. Step 4: Determining the total housing budget Combining their available funds with the CPF Housing Grants, Andy and Ruby's total housing budget came to $557,000. This amount was more than enough to afford the 4-room HDB flats they had set their sights on in Hougang and Sengkang. Step 5: House hunting challenges and adaptation During the initial two weeks of viewings in Hougang, we faced fierce competition from other buyers. The units Andy and Ruby had selected were beautifully renovated, driving up the price with a cash-over-valuation (COV) of around $20,000—a cost they were not willing to bear. Step 6: A change in strategy and finding the perfect fit To overcome the challenges, I advised them to consider slightly older flats that may require some renovation but would not attract as much competition. We eventually found a 4-room flat in Sengkang with approximately 78 years of remaining lease. Based on recent transactions in the area, we made an offer of around $485,000. I also suggested increasing the deposit from $1,500 to $2,000 to secure the unit. Fortunately, this flat did not come with any COV, leading to substantial savings compared to their initial budget. Conclusion In conclusion, the resale HDB market still offers affordable flats, even in the face of record-high prices.

By leveraging CPF Housing Grants, low to middle-income families can significantly reduce their purchase costs. It takes a change in strategy, research, and negotiation skills, but upgrading from a public rental flat to owning your first home is within reach. If Andy and Ruby can do it, so can you.

0 Comments

|

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed