|

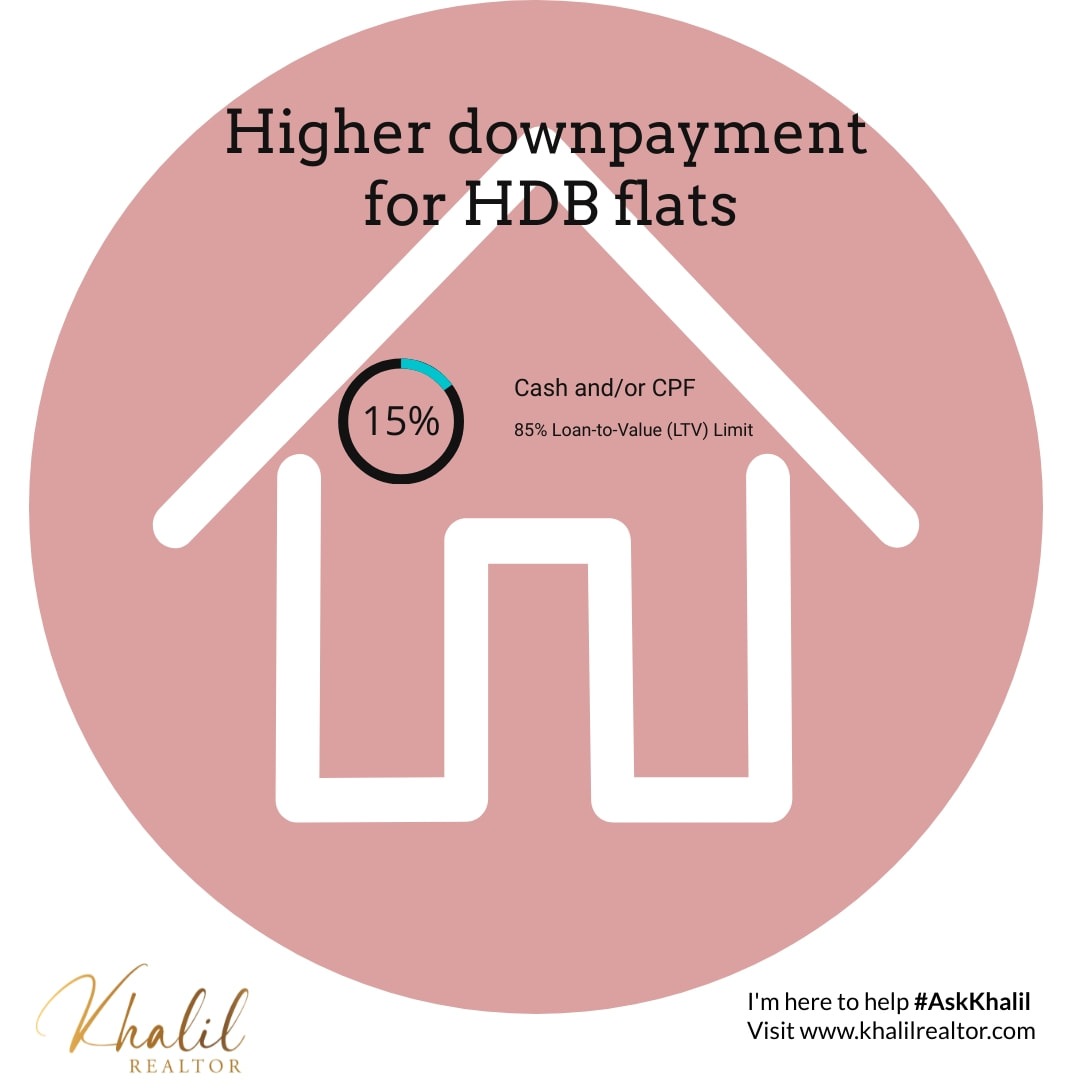

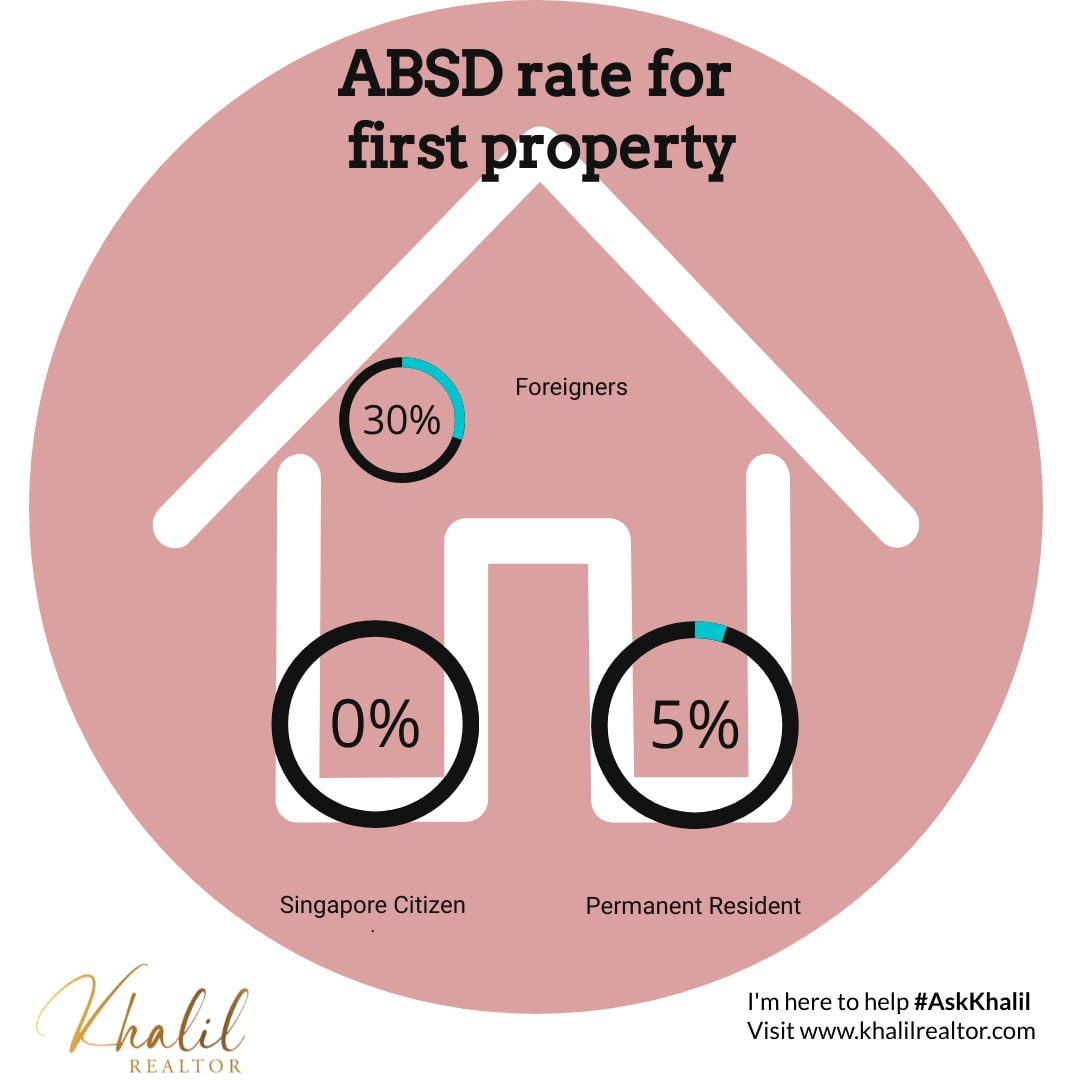

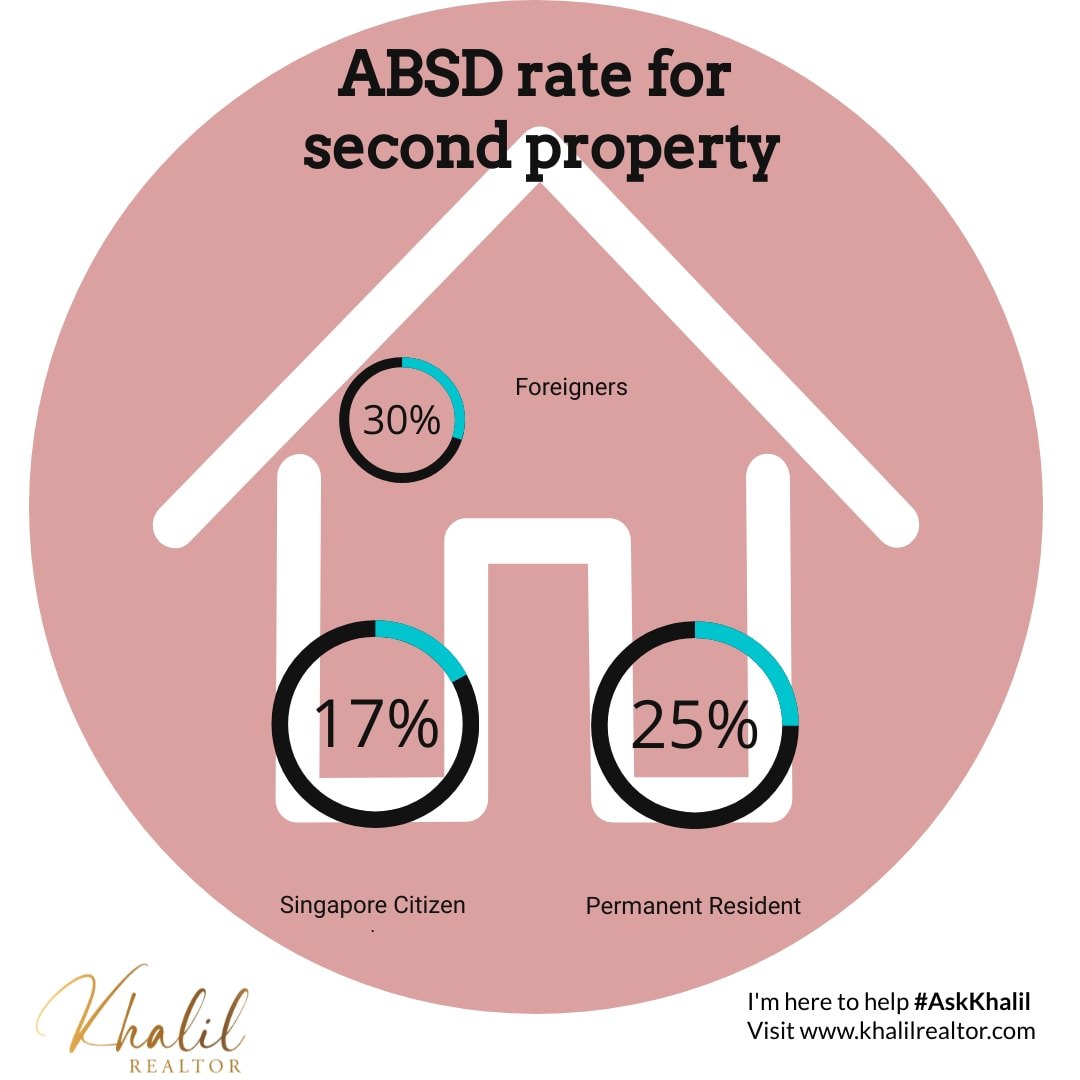

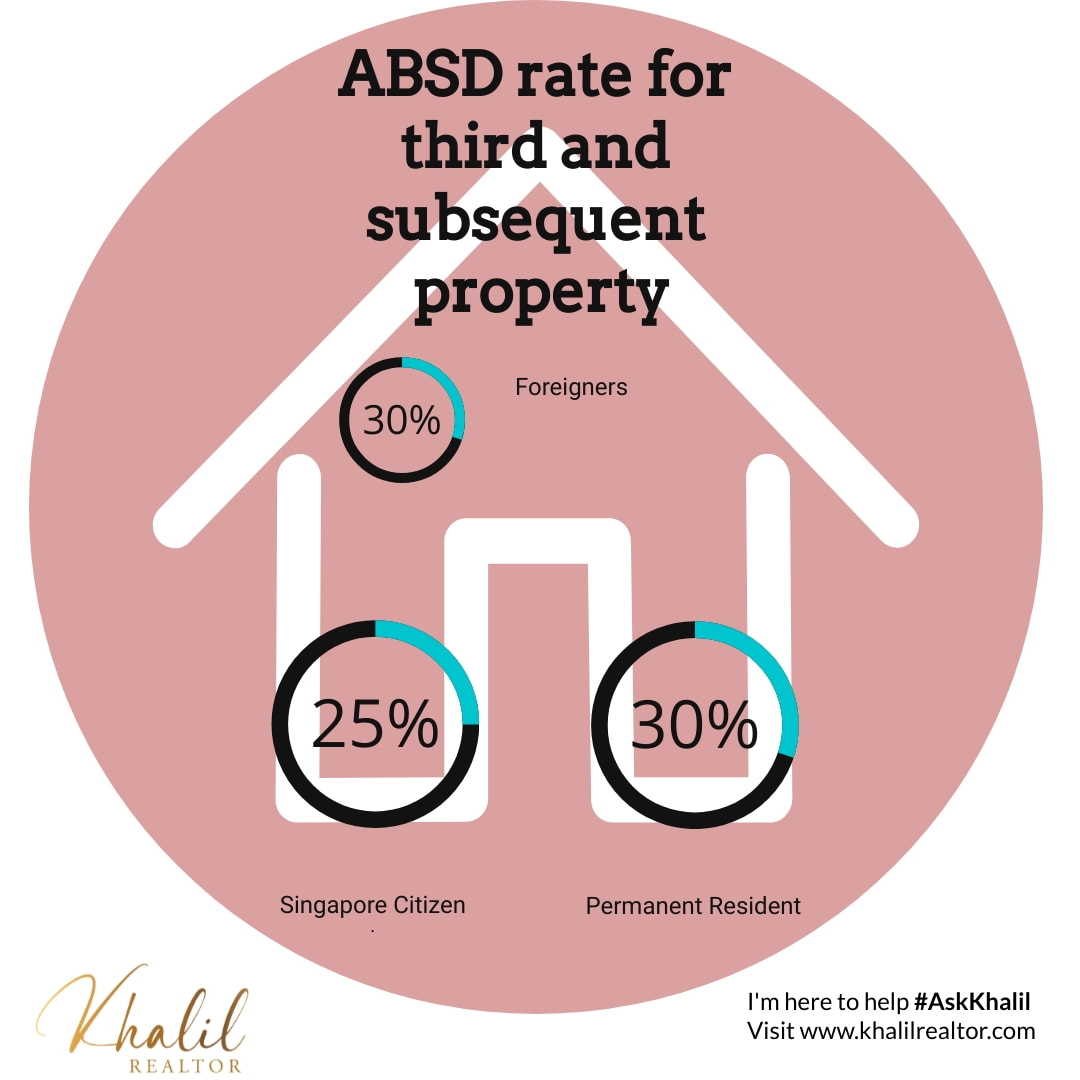

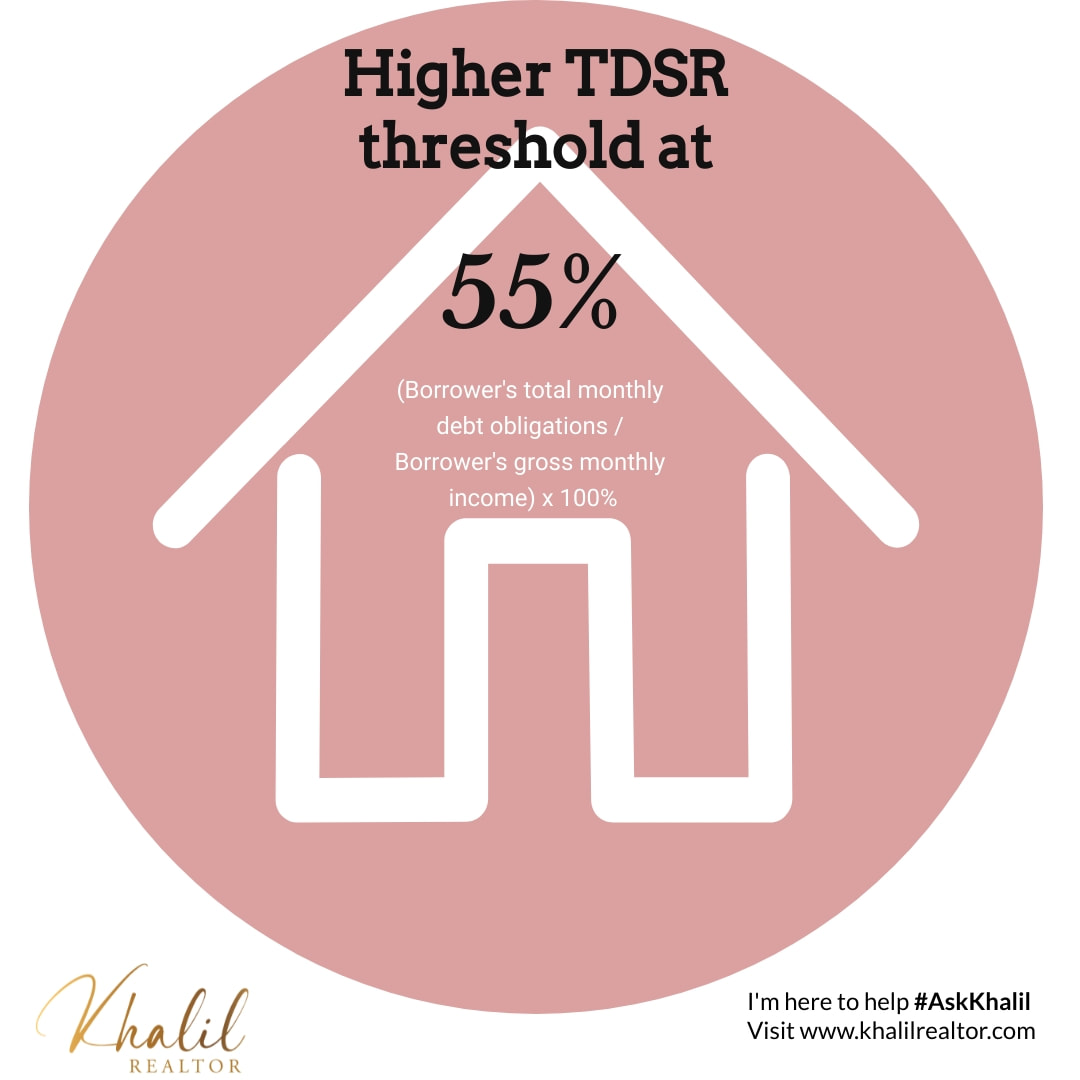

First-time homebuyers will see marginal impact while multiple property investors will have to pay a higher ABSD rate. By Khalil Realtor On 16 December 2021, the Ministry for National Development (MND) announced a slew of cooling measures in the property market. Targeted mainly towards multiple property owners and foreign purchases, the measures are aimed to moderate property prices in both the resale HDB and private property markets to ensure they are in tandem with wages. Therefore, first-time homebuyers are less likely to be impacted. We list down 5 ways the cooling measures may impact you #1: Higher downpayment for HDB flats If you are taking an HDB loan, do note that the Loan-to-Value (LTV) limit has been increased from 90 per cent to 85 per cent. This means you will need to prepare 15% in cash and/or CPF for your downpayment. However, if you are taking a bank loan, the LTV limit remains unchanged. You can still get up to 75 per cent financing with 5 per cent downpayment in cash and 20 per cent in cash and/or CPF. #2: No change for ABSD for first-time homebuyers If you are a first-time Singapore Citizen homebuyer, good news! The Additional Buyer’s Stamp Duty (ABSD) remains unchanged at 0 per cent. Likewise, for first-time Singapore Permanent Resident buyers, the ABSD remains unchanged at 5 per cent. However, for foreigners buying a residential property in Singapore, they will have to pay 30 per cent ABSD. #3: Higher ABSD rate for second-time homebuyers For Singapore Citizens buying their second property, the ABSD rate has now been increased from 12 per cent to 17 per cent. Likewise, for Singapore Permanent Residents buying their second property, the ABSD rate has now been increased from 15 per cent to 25 per cent. For foreigners buying any number of residential property in Singapore, they will have to pay 30 per cent ABSD. #4: Higher ABSD rate for third and subsequent homebuyers For Singapore Citizens buying their third and subsequent property, the ABSD rate has now been increased from 15 per cent to 25 per cent. Likewise, for Singapore Permanent Residents buying their third and subsequent property, the ABSD rate has now been increased from 15 per cent to 30 per cent. For foreigners buying any number of residential property in Singapore, they will have to pay 30 per cent ABSD. #5: Higher TDSR threshold at 55 per cent When purchasing a private property, you will be subjected to the Total Debt Service Ratio (TDSR). The TDSR has now been reduced from 60 per cent to 55 per cent. Your TDSR should be less than or equal to 55 per cent. The TDSR formula is as follows: (Borrower's total monthly debt obligations / Borrower's gross monthly income) x 100% Assuming you have a total mostly debt of $1,000, this is your TDSR: $1,000/$10,000 x 100% = 10% If you wish to purchase a private property, it will be wise to pare down your existing debt obligations to below 55 per cent so that you will not be overly leveraged. Moving forward #1: Decoupling If you are thinking of buying a second property but are concerned about paying a higher ABSD rate, you may consider decoupling. This frees up your spouse’s name to buy a property solely under their name. However, do note that decoupling is not allowed for HDB flats. The legal fees can be quite exorbitant (up to $10,000). A Buyer's Stamp Duty (BSD) of up to 4 per cent will apply for the shares that were sold to the other party. You may also be liable to pay for Seller's Stamp Duty (SSD). #2: Buying under a trust You may also consider buying a property under a trust arrangement.

This is a relatively expensive option that is common among the wealthy. A trust is an arrangement that authorises a trustee to hold assets on behalf of a beneficiary (or beneficiaries). The beneficiary shall have an equitable interest in the trust assets. The trustee has the responsibility to manage the trust assets for the benefit of the beneficiaries. You can buy a private property under trust and list your child as the beneficiary. However, the property must be paid for in cash. There is no ABSD payable

0 Comments

Punggol is one of the most sought after districts for HDB resale flats and private properties. Here are the lowdowns you should take note of when buying a property here. By Khalil Realtor Punggol has indeed come a long way from being an ‘ulu’ area. Once known as a rural settlement complete with kampungs and farms, Punggol has since 1998 transformed itself from a backwater area to a vibrant, modern yet green satellite district. Amid Punggol’s oasis of calm, you can see LRT trains whirring through the residential areas, passing by the ample lush natural landscape before taking you directly to the heart of the district, Punggol Central. While Punggol’s rustic charms may appeal to outdoor lovers, there are certain downsides about living here. Here are the pros and cons of buying a property in Punggol: The good: #1: It’s oh so quiet Punggol has an estimated population of 174,450 as of 2019 with a projected 96,000 housing units once the entire "Punggol 21-plus” master plan is completed. Despite its high density, Punggol is surprisingly very quiet at night save for the traffic whizzing by the Tampines Expressway (TPE). This is definitely good news for those wanting some peace and quiet but bad news if you want the buzz of city life. If you still want to move to Punggol, fret not as Waterway Point has all the modern conveniences and amenities for your city living. #2: Well landscaped parks and gardens Nature and outdoor lovers will revel in the many landscaped parks and gardens that Punggol has to offer, including the award-winning My Waterway@Punggol. From the Matilda District, you can enjoy a stroll or jog by the Punggol River before reaching Punggol Dam and Punggol Point. This is part of the comprehensive Park Connector Network (PCN) linking the entire island. The view is awe-inspiring and enough to make even the laziest couch potato get up and explore nature. #3: Properties here are in demand Being a relatively new township development with a young demographic, Punggol has proven to be popular among homebuyers as a few HDB housing projects are now eligible to be sold in the resale market. According to the third quarter of 2021 data from the HDB, the Resale Price Index (RPI) increased by 2.9 per cent, from 146.4 points in the second quarter to 150.6 points in the fourth quarter in 2021. On the overall, resale statistics from the HDB showed that the median prices of three, four and five-room flats were transacted at S$395,000, S$498,400 and S$600,000 respectively in the third quarter of 2021. In comparison, in the fourth quarter of 2018, they were transacted at S$343,000, S$455,000 and S$445,000 respectively. This shows a healthy demand and capital appreciation of HDB flats in Punggol. #4: Comprehensive public transport network Commuting in and around Punggol is very convenient as there is a comprehensive transport network comprising MRT, LRT and buses. In fact, the township has been planned such that each housing estate is located within 300 m away from any LRT station. An exception, however, is the new housing area at the Matilda district. #5: Punggol Digital District Come 2023, a new smart city is set to rise in Punggol called the Punggol Digital District. Housing technology firms involved in key growth fields as well as the new Singapore Institute of Technology Campus, Punggol Digital District will create around 28,000 jobs while providing residents with more lifestyle and dining options. In the pipeline includes the new Punggol Coast MRT Station which will be an extension of the North-East Line and the upgrading of the Punggol MRT station to an interchange station to connect to the Cross-Island Line (CRL). Punggol Digital District will also enjoy enhanced connectivity via the CRL which will link it to Jurong Lake District and Changi by around 2030. Collectively, they will act as property boosters for Punggol. The bad: #6: Lack of good hawker food Food. That’s our favourite national past time that defines if we love or hate or neighbourhood. Having lived in Taman Jurong, I must say I was spoilt for choice with various options of mouth-watering hawker fares such as the famous Boon Lay Power Nasi Lemak. However, the choices have become extremely limited in Punggol unless you are into fast food. While there are coffee shops serving local cuisines, they pale in comparison to the well-established hawker fares that you can find elsewhere. You are better off cooking your own meals. #7: Dust If you hate spring cleaning, be prepared for a rude shock. With many construction works going on, you will find yourself dusting up every single day. Windows, top of shelves, cupboards and other surfaces collect dust easily. This certainly isn’t good news if you are asthmatic or are prone to allergies. If so, you might want to invest in a good ioniser to keep your indoor air free of particles and other irritants. The ugly: #8: Get ready to jostle with the early morning crowd If you think Singaporeans are a kiasu lot, be prepared to see that word taken to new heights when you commute to work in the morning. In fact, many would play ‘musical chairs’ as they hustle for seats at on the MRT. Meanwhile, getting a Grab or taxi would be almost impossible. #9: That acrid smell in the air While Punggol may be planned as a green township development, be prepared for a strong burning smell that would emanate from time to time. Located just opposite the industrial area of Pasir Gudang, Johor, the smell has become increasingly acrid over the past few days that it will linger from night till dawn. In fact, it can get so bad that you might have to get up in the middle of the night to close the windows. #10: Noise pollution from aeroplanes Having lived in Punggol for almost four years, I would say my biggest gripe is the noise pollution every morning from the military aeroplanes and jet-fighters flying over the neighbourhood from Paya Lebar Airbase.

They would start as early as 8am at 5 minutes interval. This is enough to disrupt your sleep especially if you intend to sleep in on a weekday. This is something perhaps developers and HDB will not tell you. |

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed