|

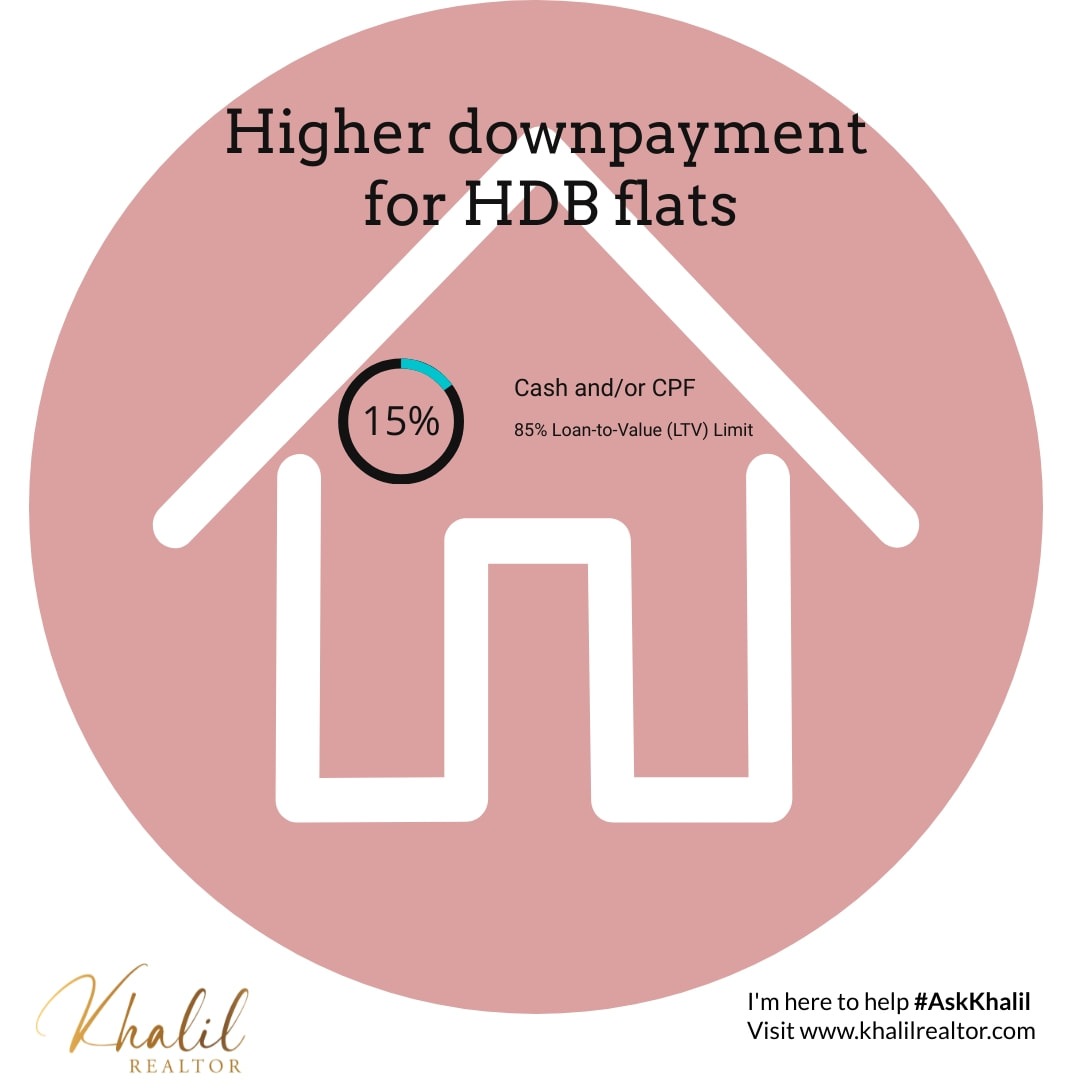

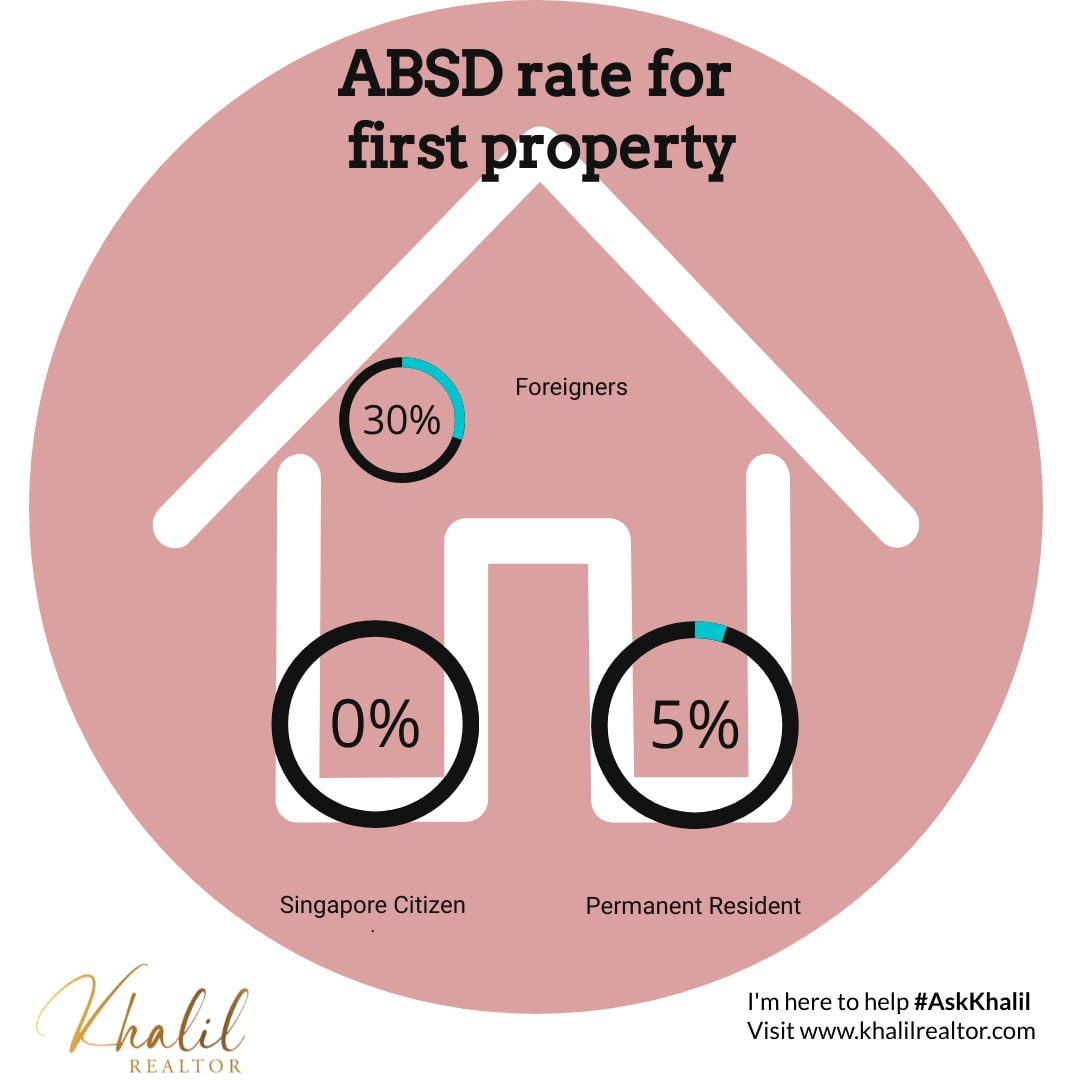

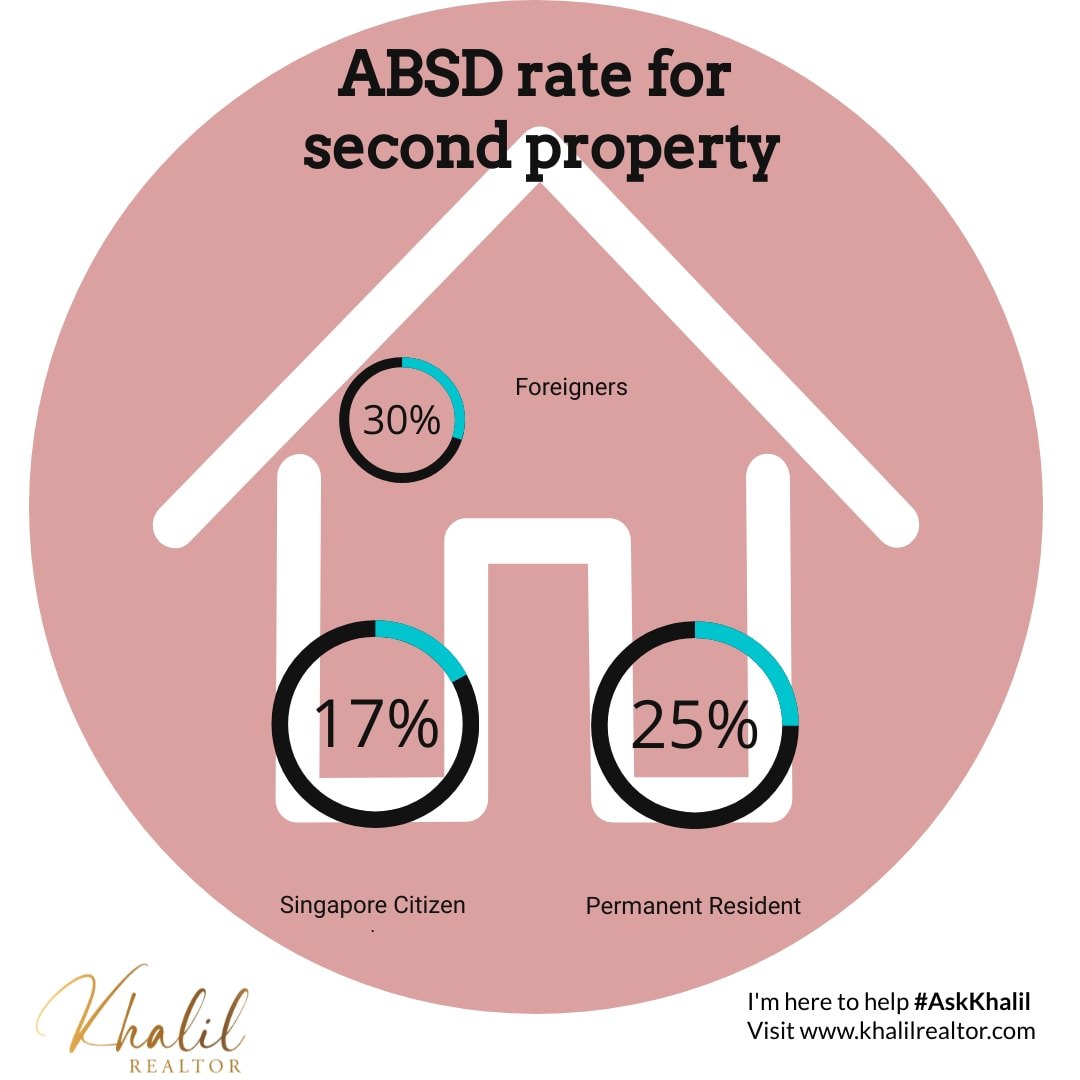

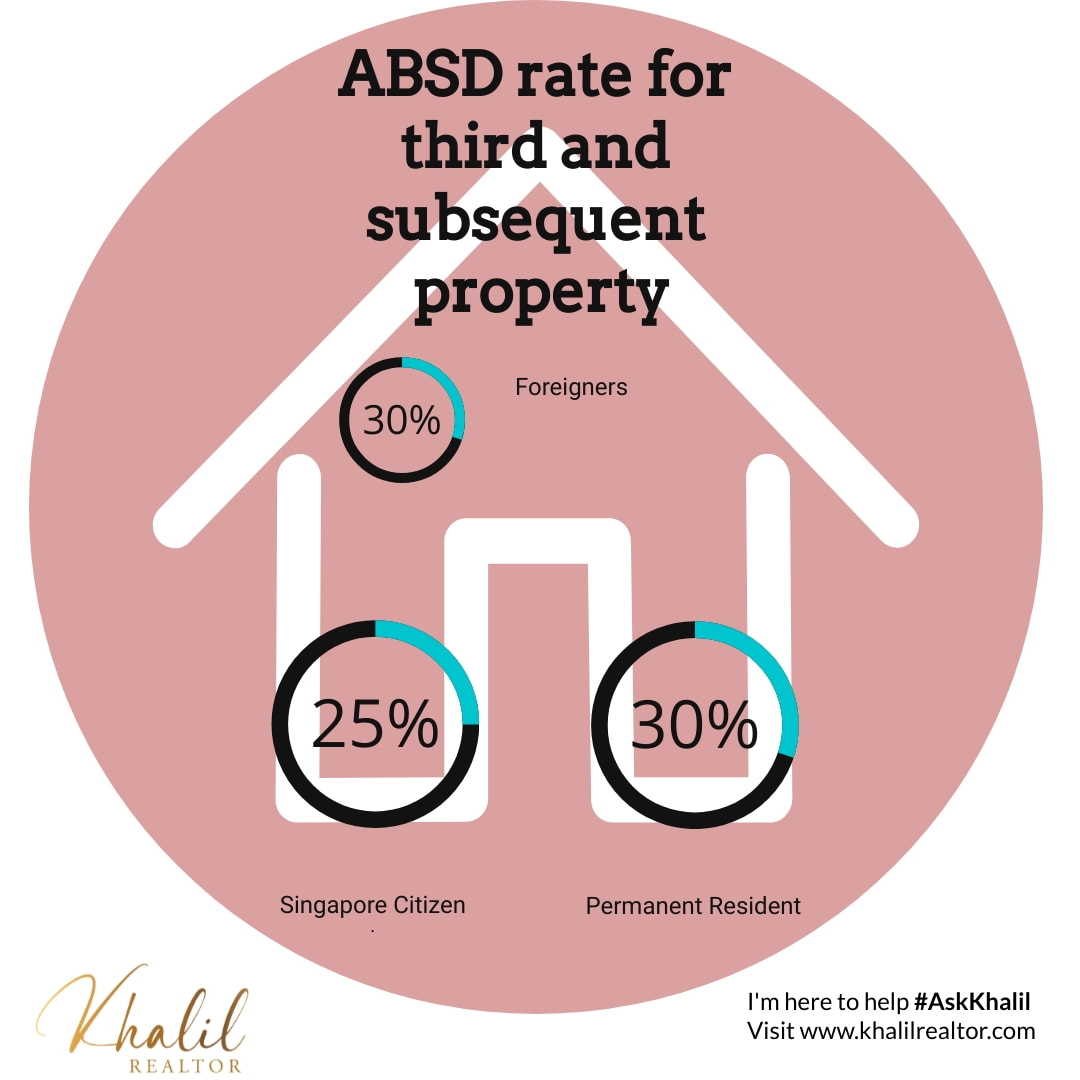

First-time homebuyers will see marginal impact while multiple property investors will have to pay a higher ABSD rate. By Khalil Realtor On 16 December 2021, the Ministry for National Development (MND) announced a slew of cooling measures in the property market. Targeted mainly towards multiple property owners and foreign purchases, the measures are aimed to moderate property prices in both the resale HDB and private property markets to ensure they are in tandem with wages. Therefore, first-time homebuyers are less likely to be impacted. We list down 5 ways the cooling measures may impact you #1: Higher downpayment for HDB flats If you are taking an HDB loan, do note that the Loan-to-Value (LTV) limit has been increased from 90 per cent to 85 per cent. This means you will need to prepare 15% in cash and/or CPF for your downpayment. However, if you are taking a bank loan, the LTV limit remains unchanged. You can still get up to 75 per cent financing with 5 per cent downpayment in cash and 20 per cent in cash and/or CPF. #2: No change for ABSD for first-time homebuyers If you are a first-time Singapore Citizen homebuyer, good news! The Additional Buyer’s Stamp Duty (ABSD) remains unchanged at 0 per cent. Likewise, for first-time Singapore Permanent Resident buyers, the ABSD remains unchanged at 5 per cent. However, for foreigners buying a residential property in Singapore, they will have to pay 30 per cent ABSD. #3: Higher ABSD rate for second-time homebuyers For Singapore Citizens buying their second property, the ABSD rate has now been increased from 12 per cent to 17 per cent. Likewise, for Singapore Permanent Residents buying their second property, the ABSD rate has now been increased from 15 per cent to 25 per cent. For foreigners buying any number of residential property in Singapore, they will have to pay 30 per cent ABSD. #4: Higher ABSD rate for third and subsequent homebuyers For Singapore Citizens buying their third and subsequent property, the ABSD rate has now been increased from 15 per cent to 25 per cent. Likewise, for Singapore Permanent Residents buying their third and subsequent property, the ABSD rate has now been increased from 15 per cent to 30 per cent. For foreigners buying any number of residential property in Singapore, they will have to pay 30 per cent ABSD. #5: Higher TDSR threshold at 55 per cent When purchasing a private property, you will be subjected to the Total Debt Service Ratio (TDSR). The TDSR has now been reduced from 60 per cent to 55 per cent. Your TDSR should be less than or equal to 55 per cent. The TDSR formula is as follows: (Borrower's total monthly debt obligations / Borrower's gross monthly income) x 100% Assuming you have a total mostly debt of $1,000, this is your TDSR: $1,000/$10,000 x 100% = 10% If you wish to purchase a private property, it will be wise to pare down your existing debt obligations to below 55 per cent so that you will not be overly leveraged. Moving forward #1: Decoupling If you are thinking of buying a second property but are concerned about paying a higher ABSD rate, you may consider decoupling. This frees up your spouse’s name to buy a property solely under their name. However, do note that decoupling is not allowed for HDB flats. The legal fees can be quite exorbitant (up to $10,000). A Buyer's Stamp Duty (BSD) of up to 4 per cent will apply for the shares that were sold to the other party. You may also be liable to pay for Seller's Stamp Duty (SSD). #2: Buying under a trust You may also consider buying a property under a trust arrangement.

This is a relatively expensive option that is common among the wealthy. A trust is an arrangement that authorises a trustee to hold assets on behalf of a beneficiary (or beneficiaries). The beneficiary shall have an equitable interest in the trust assets. The trustee has the responsibility to manage the trust assets for the benefit of the beneficiaries. You can buy a private property under trust and list your child as the beneficiary. However, the property must be paid for in cash. There is no ABSD payable

0 Comments

Leave a Reply. |

Details

Khalil RealtorA regular contributor for PropertyGuru Singapore's AskGuru column, Khalil has his fingers right on the pulse of Singapore's vibrant real estate market. Archives

May 2023

Categories

All

© 2021 KHALIL REALTOR. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed